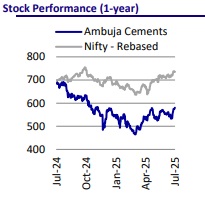

Buy Ambuja Cements Ltd for the Target Rs. 700 by Motilal Oswal Financial Services Ltd

Accelerating transformation; growth drivers in place

We attended the plant visit event organized by ACEM at its Marwar Mundwa plant in Rajasthan, where we interacted with the senior management team, followed by a tour of the plant. Key highlights of the interaction are as follows: 1) the company’s market share increased from 11-12% to 14.5%, with a target of ~17-18%/+20% by FY28E/FY30E; 2) increasing its premium cement share remains a key focus area, which is currently accounts for ~24% of its trade volume, with ~INR400/t higher profitability; 3) capacity expansion is on track and company is confident of achieving targeted capacity of 140mtpa by FY28; and 4) it has reiterated its EBITDA/t target of INR1,500/t by FY28E, led by cost savings and an increasing share of premium cement.

Key takeaways from the management meeting

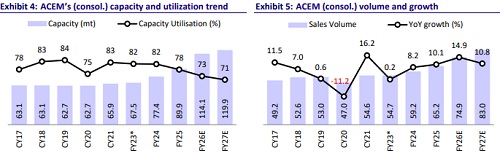

* The company has reiterated its capacity target of 140mtpa by FY28E. After acquiring Holcim’s stake in ACC and ACEM, the Group’s capacity increased from 68mtpa in Sep’22 to 102.8mtpa currently. Acquisitions of Sanghi Industries (6.1mtpa), Asian Cement (1.5mtpa), Penna Cement (10mtpa), and Orient Cement (8.5mtpa) have supported progress toward the 140mtpa capacity target. In FY26, installed capacity will increase by ~19mtpa to ~118mtpa, and further to 140mtpa by FY28E.

* Capex cost/t for greenfield projects will be USD75-80/t, and the company aims to remain net debt free in this phase of capacity expansion.

* Adani Cement has increased its market share to 14.5% (vs 11-12% a few years ago) and plans to grow it by 1pp in FY26E. It aims to achieve a market share of ~17-18% by FY28E and over 20% by FY30E.

* Following recent acquisitions in the last few years and plans to merge some of the acquired capacities (the merger of Sanghi Industries, Penna Cement, and Adani Cement expected to be completed within two quarters), management chose to hold off on merging ACC with ACEM to better control capital market activities. The goal remains to have one company per business, and the ACC-ACEM merger will be initiated at an appropriate time.

* The company holds the highest premium cement share in the industry and plans to increase it further. Trade sales account for ~74% of total volumes, with premium cement constituting ~26% of trade volumes. Premium cement is ~INR400/t more profitable than regular grey cement. The company aims to continue increasing the share of premium products (can reach ~50% at maximum), driven by the rising consumption/demand trend for premium products.

* Cement demand is expected to grow at a CAGR of ~7% over FY25-30, outpacing capacity addition at ~6% CAGR, which will support higher industry capacity utilization and pricing power. Demand growth will be led by the infrastructure and industrial segments, with shares projected to increase modestly by FY30. In FY26, demand growth is estimated at ~7% (vs ~4% in FY25), although capacity additions are expected to be significantly higher at ~50-70mtpa.

* The company targets EBITDA/t of INR1,500 by FY28E and plans to reduce cost by INR500-600/t by FY28E through: a) saving INR200-300/t in energy costs by increasing the share of green energy (376MW of green power capacity commissioned; targeting 1,000MW by Jun’26 and a TSR of 27% by FY28); b) saving INR100/t in logistics costs by increasing the share of sea transport and reducing lead distance, targeting to reach 5-8% sea-based transportation by FY28, which is ~60% cheaper than road transport and ~40% cheaper than rail transport; direct dispatches now at ~75% vs 50% two years ago, with a target of reaching ~85%); c) saving INR100/t in RM costs by leveraging group synergies; and d) saving INR50-100/t in admin and other overheads. These cost savings are expected to improve profitability, with EBITDA/t reaching INR1,500/t by FY28E.

View and valuation

* ACEM has reiterated its capacity target of 140mtpa and EBITDA/t target of INR1,500 by FY28. So far, capacity growth has been largely driven by the inorganic route. However, in FY26, expansion will primarily be organic, with multiple projects underway across various locations. The company is also expected to prioritize integrating acquired assets. Profitability improvement will be driven by ongoing cost savings and a higher share of premium products.

* We estimate the company’s consolidated revenue/EBITDA/PAT CAGR at ~17%/35%/36% over FY25-27, albeit on a low base. We estimate EBITDA/t to increase to INR960/INR1090 in FY26/FY27 vs. INR768 in FY25. ACEM (consol.) trades at 21x/17x FY26E/FY27E EV/EBITDA and USD154/USD147 EV/t. We reiterate our BUY rating with a TP of INR700 (valuing the stock at 20x FY27E EV/EBITDA).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412