Neutral Barbeque Nation Hospitality Ltd for the Target Rs.325 by Motilal Oswal Financial Services Ltd

Muted quarter; recovery delay persists

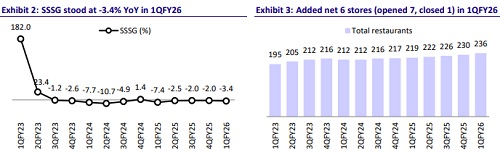

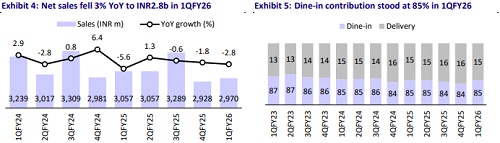

* Barbeque Nation Hospitality (BBQN)’s consolidated revenue declined 3% YoY to INR3.0b (in line), hit by competition in South India and sluggish demand. The same-store sales growth (SSSG) remained weak and dipped 3% YoY in 1QFY26 on a base of -7%. Dine-in revenue declined 3% YoY to INR2.5b, and delivery was down 1% to INR0.4b during the quarter.

* BBQ India’s revenue declined 7% YoY to INR2.3b, led by negative SSSG and low store expansion. Same-store sales declined 5.2%. GP margin compressed 40bp YoY to 66.1%. GP down 8% YoY. RoM (Pre-Ind-AS) margin compressed 230bp YoY to 9.6% due to operating deleverage. Its RoM dipped 25% YoY. BBQ India added two net stores to 193 in 1QFY26.

* BBQ International’s revenue was up 10% YoY to INR263m, supported by strong SSSG. The SSSG was at 8.5%. GP margin declined 190bp YoY to 72.6%. GP was up 7% YoY. RoM (Pre-Ind-AS) margin contracted 270bp YoY to 22.4%. RoM down 2% YoY. Mature stores delivered over 27% margins. It added two stores during the quarter, taking the total count to 11 stores.

* Premium Casual Dining Restaurant’s (CDR) revenue up 19% YoY to INR431m, led by store additions. The same-store sales rose 1.6% YoY. GP margin contracted 170bp YoY to 73.5%. GP up 16% YoY. RoM (Pre-Ind AS) margin contracted 430bp YoY to 14.4% lower due to new restaurant additions. RoM declined 9% YoY at INR59m. The matured portfolio (restaurants older than two years) delivered over 20% Pre-IND-AS RoM.

* Consolidated GM contracted 40bp YoY to 67.7%. EBITDA margin contracted by 120bp YoY to 15.5% (est. 17.8%). EBITDA Pre-Ind AS margin down 240bp YoY to 4.6%. RoM (Pre Ind) contracted 230bp YoY to 11.5%.

* The company plans to open 20–25 BBQ India outlets annually, 4–6 new international stores across the Middle East and Southeast Asia in the near term, and 12–15 Premium CDR restaurants in FY26 as part of its calibrated expansion strategy. BBQN’s current valuations at 13x FY26E and 10x FY26E pre-Ind AS EV/EBITDA are comfortably positioned. However, we are watchful of BBQN’s demand recovery. We reiterate our Neutral rating on the stock as we still await clarity on its earnings recovery. Our TP of INR325 is based on 10x Jun’27E Pre-Ind-AS EV/EBITDA (low valuation due to weak RoCE profile and uncertainty in earnings recovery).

Weakness persists; SSSG declines 3.4%

* Muted trajectory continues: BBQN reported a sales decline of 3% YoY at INR3.0b (est. INR 3.0b) in 1QFY26. Same-store sales were down 3.4% in 1QFY26 (est. -3%). Dine-in channel (85% of sales) declined 3% YoY to INR2.5b. Delivery channel (15% of sales) declined 1% YoY to INR0.4b.

* Digital KPIs: Cumulative app downloads were 7.9m in 1QFY26 vs. 6.8m in 1QFY25. Own digital asset contribution was at 30.8% vs. 29.6% in 1QFY25.

* Store additions continue: The company added seven stores and closed one store, which led to a total of 236 stores. Out of 236 stores, BBQN has 193 stores, 11 international BBQN stores, and 32 Toscano and Salt stores. Total metro and tier-1 accounted for 185 stores, and tier 2/3 accounted for 51 stores in 1QFY26.

* Contraction in margins: Gross margin dipped 340bp YoY to 67.7%. (est. 68.5%). EBITDA declined 10% YoY to INR460m (est. INR538m). EBITDA margin contracted 120bp YoY to 15.5% (est. 17.8%). Pre-Ind AS EBITDA dipped 36% YoY to INR136m in 1QFY26, and the margin contracted 240bp YoY to 4.6%. RoM (Pre-Ind-AS) was down 20% YoY, and the margin contracted 230p YoY to 11.5%.

* BBQN recorded a loss after tax of INR164m in 1QFY26 vs. a loss of INR48m in 1QFY25.

Highlights from the management commentary

* Demand challenges were led by weak dine-out trends, price competition (especially in South India), and softer corporate footfalls in cities like Bangalore and Chennai.

* Despite pressure on SSSG in BBQ India, profitability impact remains limited, with only 3–4 stores currently loss-making.

* The company plans to open 20–25 BBQ India restaurants annually. Plans to open 4–6 additional outlets across the Middle East and Southeast Asia in the near term. Premium CDR is being scaled with a plan to add 12–15 new stores in FY26.

* The company continued to focus on the dine-in segment (~85% of revenue). The delivery business (15% of revenue) is improving, with Dum Safar Biryani posting positive SSSG.

Valuation and view

* We broadly maintain our EBITDA estimates for FY26 and FY27. ? BBQN’s PBT margin profile is weaker than that of QSR players. Hence, despite a comfortable position on valuation, we are watchful of its operating margin delivery. A mid-single-digit RoCE profile is weak considering the fine dine-in format.

* BBQN’s current valuations at 13x FY26E and 10x FY26E pre-Ind AS EV/EBITDA are comfortably positioned. However, we are watchful of BBQN’s demand recovery. We reiterate our Neutral rating on the stock as we still await clarity on earnings recovery. We have a TP of INR325, based on 10x Jun’27E Pre-IndAS EV/EBITDA.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)

.jpg)