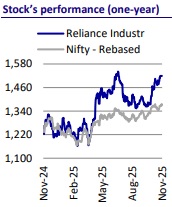

Buy Reliance Industries Ltd for the Target Rs. 1,765 by Motilal Oswal Financial Services Ltd

Battery venture set to scale up in FY27

* Reliance Industries (RIL) continues to progress on the 40GWh battery GIGA factory, which is set to commence operations in early CY26. We raise the New Energy business valuation for RIL to INR174/sh (earlier INR 116/sh) as we incorporate value for the battery manufacturing segment. We estimate the FY30 New Energy EBITDA at INR169b, ~7% of FY28 Consol. EBITDA, and believe New Energy can be a significant growth driver post FY30. According to our estimate, the actual India demand for BESS can far exceed CEA’s initial India FY32 BESS target of 236 GWh as battery costs decline and new use cases emerge (e.g., Green hydrogen, integration with thermal capacity). The Central government coming out with an approved list of battery manufacturers (similar to ALMM/ALCM) can be a significant growth driver for the sector.

* RIL’s key long-term competitive advantage in battery manufacturing (and across new energy) remains scale, ability to undertake technologically complex projects, and an integrated and unique new energy ecosystem.

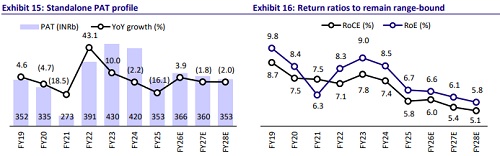

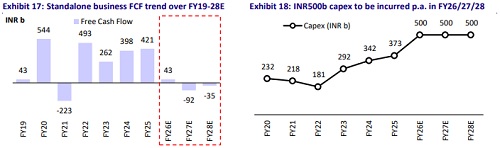

* We value the standalone business at 7.5x Dec’27E EV/EBITDA to arrive at a valuation of INR411/sh. We ascribe an equity valuation of INR585/sh to RJio and INR625/sh to Reliance Retail (factoring in the stake sale), as well as INR174/sh to the New Energy business.We reiterate our BUY rating on the stock with a TP of INR1,765.

Targets to build a 40GWh battery Giga factory; scalable up to 100GWh

* RIL is on track to commission its first battery giga-factory in Jamnagar, Gujarat, in early CY26. This initial factory will have a production capacity of 40GWh per annum for battery energy storage. It has achieved significant construction and engineering progress on-site for the 40GWh manufacturing capacity, and production line equipment is on track for installation.

* The complex will later scale up modularly to 100GWh capacity, as announced in the Annual General Meeting of the Company, held in Aug’25.

* For the next couple of years, production from the battery GIGA factory might be consumed for captive purposes, given RIL is also set to make progress on the plan to install 100GW of renewable power generation capacity.

India's total addressable market for battery storage

* According to the National Electricity Plan (2023) by the Central Electricity Authority (CEA), India’s energy storage capacity requirement is projected at 82.4GWh in FY27, comprising 47.7GWh from pumped storage (PSP) and 34.7GWh from battery energy storage systems (BESS) (link). This is expected to rise to 411.4GWh by FY32, including 175.2GWh from PSP and 236.2GWh from BESS. By 2047, the total requirement is projected to reach 2,380GWh, with 540GWh from PSP and 1,840GWh from BESS, driven by the expansion of renewable energy to meet India’s Net Zero 2070 targets.

* Beyond India’s 2030 vision of 500GW in renewable capacity, India may need to expand its installed capacity base by 50-60GW every year. Assuming 10%/30%/50% of this capacity needs battery backup, this implies an annual battery demand for 15-70GWhr.

* This estimate does not include the potential for 1) India to emerge as a key export hub for batteries, given India’s sizeable captive demand, and 2) potential from new use cases such as integrating BESS solutions with thermal/gas capacity.

* The Ministry of Power – Central Electricity Authority has issued an advisory wherein all Renewable Energy Implementation Agencies (REIAs) and state utilities are advised to incorporate a minimum of 2-hour co-located Energy Storage Systems, equivalent to 10% of the installed solar project capacity, in future solar tenders. The advisory further mentions that the distribution licensees may also consider mandating 2-hour storage with rooftop solar plants.

* Overall, we believe BESS demand has the potential to far exceed CEA’s initial estimated FY32 target of 236GWh.

We raise our New Energy valuation to INR174/sh; Revise our TP to INR1,765

* We were previously valuing only the integrated solar cell and module manufacturing business and attributed a value of INR116/share to this.

* Now we also incorporate value from the battery Giga factory as a part of our financial model and estimate a value of INR58/share for this business.

* This takes the cumulative value of the new energy business to INR174/share, i.e., ~10% of our TP. For the battery business, we assign an EV/EBITDA multiple of 15x to FY30 EBITDA and then discount the value back to FY28. In contrast, CATL (Contemporary Amperex Technology Co. Ltd) trades at CY27 EV/EBITDA of 11.2x currently.

* For both the integrated solar cell and module manufacturing business and the battery business, we assume only captive consumption until FY27 and assume 25%/75%/100% of sales in FY28/29/30 are to external customers.

Valuation and view

* We value the standalone business at 7.5x Dec’27E EV/EBITDA to arrive at a valuation of INR411/sh. We ascribe an equity valuation of INR585/sh to RJio and INR625/sh to Reliance Retail (factoring in the stake sale), as well as INR174/sh to the New Energy business. We reiterate our BUY rating on the stock with a TP of INR1,765.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412