Neutral Blue Star Ltd for the Target Rs. 1,950 by Motilal Oswal Financial Services Ltd

Crafting perfect climates!

Profitable growth driven by backward integration and scale

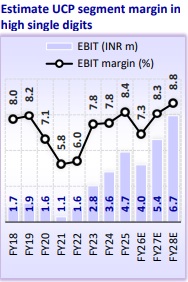

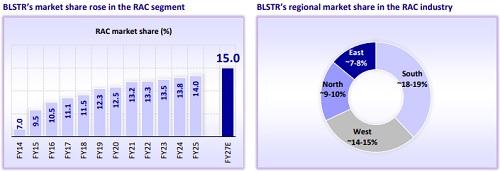

* Leading player in commercial refrigeration with steady market share gainsin RAC: Blue Star (BLSTR) is steadily gaining market share in the Indian RAC segment. Its share improved to ~14% in FY25 from ~7% in FY14. The company is now targeting ~15% share by FY27E. BLSTR retains a strong leadership position in the commercial refrigeration business, holding over 31% share in deep freezers and modular cold rooms. We estimate that its unitary cooling product (UCP) revenue would decline ~3% YoY in FY26, primarily due to a weak summer season. However, we project revenue growth of ~19%/18% YoY in FY27/FY28, fueled by a recovery in demand. We estimate that the EBIT margin will be in high-single digits and gradually improve as BLSTR achieves a higher scale of operations and increasesindigenization.

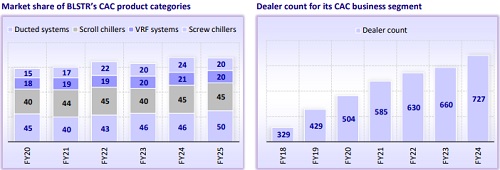

* Leading integrated MEP service provider shifting focus to high-value segments; retains leadership in CAC: BLSTR is a leading integrated MEP (Mechanical, Electrical and Plumbing) service provider with eight decades of experience in providing solutions to the infrastructure, building, and industrial domains. BLSTR has shifted its focus to data centers, factories, and select infrastructure projects, having better profitability and cash flow generation. BLSTR’s commercial air conditioning (CAC) business offers a full range of energy-efficient packaged, ducted, VRF systems and chillers catering to B2B customers. It holds leadership positions in ducted air conditioners and scroll chillers (45-50% market share) and ranks second in VRF and screw chillers (~20% share). We estimate a revenue CAGR of ~15% over FY26-28, led by its healthy order book and a segment margin of 8.6%/8.9% in FY27/FY28.

* PEIS, a value-added play: The professional electronics and industrial systems (PEIS) segment contributed ~4%/8% of revenue/EBIT over FY21-25, though its margin contracted to ~9% in FY25 from ~15% in FY21. The MedTech and data security businesses faced regulatory and demand challenges, while its industrial solution business is gaining traction. We estimate a recovery in PEIS will be driven by improving private capex and demand in healthcare and data security. We estimate a ~10% revenue CAGR over FY26-28 and margin expansion to ~11-13%.

* Fairly valued at current levels: For BLSTR, we estimate a CAGR of ~16%/23%/28% in revenue/EBITDA/PAT over FY26-28, fueled by continued healthy growth in the MEP and CAC businesses and a recovery in the UCP business. We project OPM to expand by ~40-50bp in FY27E/FY28E (each), led by positive operating leverage and cost-saving initiatives. BLSTR trades at 48x/38x FY27E/FY28E EPS (vs. average of 46x in the last 10 years), and we believe that the stock is fairly valued at current levels given the strong rerating in its valuation multiples in the last few years.

* Initiate coverage with a Neutral rating: We initiate coverage on the stock with a Neutral rating and an SoTP-based TP of INR1,950 (valued at 50x Dec’27E EPS for UCP, 40x Dec’27E EPS for MEP & CAC, and 25x Dec’27E EPS for PEIS).

Weak summer in CY25 weighs on RAC demand; long-term story intact

* The RAC industry experienced a sharp YoY decline in 1HFY26 sales due to a weak summer season, prolonged rains, and deferred consumer purchases following the GST-rate cut announcement. RAC volumes grew ~29% YoY in FY25, led by a robust seasonal demand and energy-efficient product uptake. However, FY26 volumes are estimated to dip ~8% YoY, given the weak 1H.

* The RAC segment dominates India’s AC market with ~84% share and clocked a ~16% CAGR during FY20-25, reaching a value of INR300b by FY25. Demand is expected to recover, supported by low penetration (~12% of households) and long-term growth drivers like rising heat, incomes, and urbanization. Over FY26- 30, the RAC industry is estimated to clock ~16% value CAGR to INR498b and 14% volume CAGR to 21.2m units.

* BLSTR has steadily gained market share in RAC, rising from ~7% in FY14 to ~14% in FY25, with a target of ~15% by FY27E. In 2020, the company repositioned itself as a mass premium brand, along with expanded offerings across categories of inverter, fixed-speed, and window ACs. The company has an installed capacity of over 2.5m units of RAC, and these products are available across 9,500 outlets in more than 1,000 locations. It has ~25-30% backward integration in the RAC business.

Demand tailwinds offer strong growth visibility in MEP and CAC

* The Indian MEP services market is likely to clock ~11% CAGR, propelled by infrastructure push, urbanization, and government initiatives such as PM Gati Shakti and PLI. BLSTR, a leading integrated MEP player, is currently focusing on high-margin segments such as data centers, factories, and select infrastructure projects. As of Sep’25, its MEP order book stood at INR48.4b. Despite a near-term slowdown in the order inflow, it expects ~10% CAGR in project business over the medium to long term.

* The Indian CAC market is valued at ~INR50b and is likely to clock ~16% CAGR over FY26-30, fueled by rising commercial real estate activity across sectors like offices, malls, hospitals, and hotels. BLSTR offers a full range of energy-efficient CAC solutions, including packaged, ducted, VRF systems, and chillers. It is a leader in ducted ACs and scroll chillers (45-50% market share), with strong positioning in VRF and screw chillers (20%+ share).

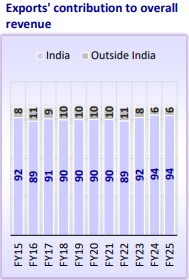

* BLSTR also exports HVAC&R products to more than 18 countries, with a B2Bfocused international business supported by subsidiaries in the US, Europe, and Japan, and JVs in Qatar and Malaysia. While RAC and commercial refrigeration exports remain limited and opportunistic, the company is targeting high-value, energy-efficient technologies such as VRFs, VFDs, and heat pumps for global OEMs.

Estimate CAGR of ~16%/23%/28% in revenue/EBITDA/PAT over FY26-28

* We estimate BLSTR to report ~16% revenue CAGR over FY26-28. The revenue CAGR across its segments is estimated as follows: UCP (~18%), MEP & CAC (~15%), and PES (~10%).

* We estimate BLSTR to report ~23% EBITDA CAGR over FY26-28. We project its EBITDA margin at 7.5% in FY26 and an improvement of 40-50bp in FY27/FY28 (each) to 8.0%/8.4%, led by positive operating leverage and cost-saving initiatives.

* We expect BLSTR to clock ~28% EPS CAGR over FY26-28, driven by EBITDA CAGR of ~23%. We estimate a PAT margin of 4.6%/5.1%/5.5% in FY26/27/28 vs. 4.9% in FY25 (average 3.5% over FY21-25).

Valuation and view: Fairly valued; initiate coverage with Neutral rating

* BLSTR is among the top performers in the consumer durables space, outperforming HAVL, VOLT, and the BSE Sensex by 181%, 127%, and 161%, respectively, over the last three years. This was fueled by market share gains and margin expansion in the UCP segment, along with strong growth in the MEP business. BLSTR trades at 48x/38x FY27/28E EPS (vs. an average of 46x in the last 10 years), and we believe that the stock is fairly valued at the current levels given the strong rerating in its valuation multiples seen in the last few years.

* We initiate coverage on the stock with a Neutral rating and an SoTP-based TP of INR1,950 (valued at 50x Dec’27E EPS for UCP, 40x Dec’27E EPS for MEP & CAC, and 25x Dec’27E EPS for PEIS).

* Key risks: 1) climate-driven disruption; 2) import dependency; and 3) intensifying competition.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)