Buy ACME Solar Holdings Ltd for the Target Rs. 290 by Motilal Oswal Financial Services Ltd

Lower battery costs creating potential for IRR boost

* Decline in project costs creating potential for 4-5% equity IRR boost: A combination of lower battery/module prices and developers’ willingness to tweak original configurations of firm and dispatch able renewable energy (FDRE) projects is creating the potential for ACME Solar (and other independent power producers or IPPs) to boost equity IRRs on FDRE projects. We estimate that a decline in battery/module prices by ~20-25% during CY23- 25 could lead to ~15% capex savings on select FDRE projects for ACME, boosting equity IRR by ~4-5%.

* ACME most exposed to FDRE among peers with 2.6GW FDRE pipeline: Note that ACME has 53% FDRE projects (2.35GW) in its under-construction pipeline, for which letters of award (LoAs) were secured in CY23-24. These projects should benefit from cost deflation in battery/module prices. Overall, ACME stands out as the most exposed to FDRE projects among its peers, with 2.6GW (59% of its RE pipeline) under development, positioning it to benefit significantly from falling battery prices.

* IRR uplift from change in project configuration but challenges abound: Further, developers are also experimenting with changes in project configurations so as to take advantage of lower capex solar/storage. This can further boost IRR. However, as per our channel checks, this entails significant operational challenges (e.g., compliance with stringent capacity utilization factor (CUF) norms—minimum declared CUF of 40% and generation to be maintained within +10%/-15% of the declared value over the 25-year term of power purchase agreements), and the actual implementation will have to be watched out.

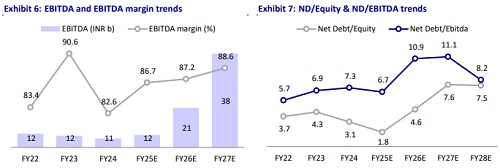

* Strong earnings outlook in coming quarters: We expect ACME to report a 29% QoQ increase in EBITDA in 4QFY25 and expect 1QFY26 to gain from the commissioning of 350MW of new capacity. With 53% of its pipeline PPAbacked and 100%/83% PPA coverage for FY26E/FY27E EBITDA, ACME offers strong earnings visibility. We maintain a BUY rating on ACME with a TP of INR290/share.

~25% decline in battery prices in CY23-25 re-shaping project economics

* The continued decline in battery prices has significantly enhanced the viability and competitiveness of battery energy storage system (BESS) projects. In CY23, average lithium-ion battery pack prices fell by 13% YoY to USD144/kWh, primarily driven by a reduction in raw material and component costs. This trend gained further momentum in CY24, with prices declining by another 20% YoY to USD 115/kWh—the steepest annual fall observed since CY17.

* Falling battery prices (down from over USD200/kWh in CY18 to ~USD115/kWh in CY24 to ~USD100/kWh now) are 1) leading to savings in capex, thus boosting project IRR; 2) giving developers the option to tweak predetermined combinations of solar/wind/storage so as to maximize returns

Improved battery economics aid right-sizing wind minimizing penalty risk

* In FDRE projects, developers face performance-linked penalties, typically 1.5x the PPA tariff, for non-compliance with the demand fulfilment ratio (DFR). Meeting DFR targets is especially challenging due to the variability of wind energy generation, unlike solar, which offers greater predictability.

* Wind capacity also exposes developers to penalty risk for under-generation and merchant risk for over-generation. Developers are exploring oversizing solar and battery storage, as solar + tracker systems are achieving plant load factors (PLFs) comparable to or marginally below the wind capacity. Additionally, land and RoW constraints make wind projects more prone to delays than solar.

We estimate ~4-5% rise in FDRE equity IRR for ACME’s projects

* For a 250MW FDRE project—comprising 350MW (AC) of solar, 90 MW of wind, and 700 MWh of battery storage— for which we assume LoA in CY23, we estimate battery costs have declined by ~25% and the capital cost associated with solar modules has also reduced meaningfully, driven by a decline in module prices. We estimate that together, this decline in battery/module costs should lead to 15% savings in project capex. We estimate a potential equity IRR improvement of ~400-500bp, assuming other variables remain constant.

* LoAs for ~2.4GW of FDRE projects were issued in FY24-25 at tariffs ranging from INR3.42 to INR4.73/kWh and given the cost deflation since then, we expect an equity IRR boost across these projects, thereby reinforcing the attractiveness of ACME’s 2.6GW FDRE pipeline.

Upsizing solar/storage to drive up IRR, but beset with challenges

* A decline in battery prices is enabling developers to re-evaluate whether wind capacity can be right-sized and solar/storage capacity can be upsized without compromising the energy output. We estimate that tweaking project configuration by lowering capex costs can increase equity IRR as the optimized project combination can lower overall project capex without compromising the total energy output.

* However, in reality, this is beset with challenges due to the existence of regulatory constraints mandating developers to

* Projects that require maintaining an annual CUF of not less than 40%; and

* Maintaining actual generation within a range of +10% to -15% of the declared CUF over the 25-year tenure of the PPA.

INR25b refinancing at 8.8% to cut interest costs

* On 3rd Apr’25, ACME announced the successful closure of a long-term project finance facility (extended by SBI and REC) of INR24.91b for a tenure of 18-20 years. This refinancing facility is aimed at replacing existing high-cost debt tied to its 490MW operational RE portfolio across Andhra Pradesh (160MW), Rajasthan (300MW), and Punjab (30MW) at a reduced weighted average interest rate of 8.8%.

* Structured under a co-obligor framework, the refinancing has improved credit ratings for the Andhra Pradesh and Punjab entities, backed by a strong operational track record (~9 years for AP & Punjab, ~3 years for Rajasthan).

Earnings momentum picking up over next few quarters

* We expect 4QFY25 EBITDA to jump 29% QoQ, driven by the full contribution from the 1,200MW of newly commissioned solar capacity. 1QFY26 will witness earnings contributions from the commissioning of an additional 350MW of capacity in 4QFY25. This includes a 300MW solar project and a 50MW wind project.

* The company is set to operationalize ~0.35GW/0.1GW/2.3GW projects in 4QFY25/FY26/FY27 (9MFY25-end operational: 2.5GW). We are modelling a stable EBITDA margin of 87%-89% over FY26-27E, in line with peers.

FY27 EBITDA visibility high; largely backed by PPA

* Overall ACME has 53% of its project pipeline backed by PPAs. Its 100%/83% of FY26/FY27 upcoming capacities are also backed by PPAs.

* Of the total under-construction projects, amounting to 4.43GW until FY29, the company has already signed PPAs for projects totaling 2.3GW. This implies that the entire FY26 revenue/EBITDA are ‘in the bag’ (i.e., backed by PPAs). With PPAs signed for 83% of the capacity coming up in FY27, a significant portion of the FY27 revenue/EBITDA is also ‘in the bag’.

* Additionally, LoAs have been granted for the other 1.8GW projects. A few of these projects could be converted into PPAs over 1HFY26 in our opinion, thus enhancing the visibility of FY27 earnings further. Additionally, ACME has grid connectivity in place for all its under-construction projects, with an additional ~2GW of connectivity (both applied and secured) available for future bids. This alleviates any concerns regarding grid availability.

Valuation and view

* In the last one month, ACME has outperformed NTPC Green, with ACME stock price up 14% compared to a 3% rise in NTPC Green’s share price.

* We maintain a BUY rating on ACME with a TP of INR290/share. We assign an EV/EBITDA multiple of 11x to FY28E EBITDA. Adjusting for net debt, we derive our TP of INR290, implying 35% potential upside.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412