Buy Hindustan Unilever Ltd for the Target Rs. 3,050 by Motilal Oswal Financial Services Ltd

Macro drivers constructive; expectations rising for 2HFY26

* Hindustan Unilever’s (HUVR) 2QFY26 consolidated revenue rose 2% at INR162.5b (in line), with flat underlying volume growth (est. 2.5% and 4% in 1QFY26). Demand trends remained stable; however, the GST transition and prolonged monsoon weighed on performance during the quarter. The GST transition and trade pipeline adjustments impacted volume growth by ~2%. Nonetheless, management expects 2HFY26 to be better than 1HFY26.

* Home Care delivered mid-single-digit volume growth, while revenue declined 1% YoY, given price cuts taken in 1QFY26. Fabric Wash volumes grew in mid-single digits, driven by strong double-digit volume growth in liquids. EBIT margin contracted 30bp YoY to 19.1%.

* The Beauty & Wellbeing segment witnessed flattish volume growth, with revenue increasing 9%, driven by Skin Care and Health & Wellbeing. Channels of the Future maintained its competitive, double-digit growth trajectory. Skin Care and Colour Cosmetics grew in high single digits. EBIT margin contracted 440bp to 28.4% due to higher investments in brands and innovations.

* Personal Care posted flat YoY revenue growth, impacted by the GST rate transition during the quarter. Volumes declined to high single digits, supported by calibrated price hikes amid commodity inflation. Oral Care witnessed a marginal decline. EBIT margin expanded 340bp YoY to 20.3%, with EBIT rising 21%.

* Food & Refreshment (F&R) revenue grew 2%, with a low single-digit UVG. Beverages grew in double digits. Lifestyle Nutrition showed early green shoots with sustained UVG. However, sales were impacted by pricing actions taken in previous quarters to refine the pack-price architecture. Packaged Foods delivered a subdued performance amid the GST transition. However, EBIT declined 9% YoY.

* Under the new leadership, HUVR continues to remain focused on driving volume-led earnings growth, even if it comes at the expense of near-term margins. With various strategies underway, optimism is building for stronger operational performance in the coming quarters. We believe the new leadership is well-positioned to capitalize on its volume growth aspirations amid supportive macro drivers. We reiterate our BUY rating on the stock with a TP of INR3,050 (55x on Sep’27E EPS).

In-line performance; volume growth flat YoY

* Net sales grew 2.1% YoY to INR160.6b (est. INR160.6b), while UVG remained flat YoY (est. 2.5% and 4% in 1QFY26). Total revenue rose 2% YoY to INR162.5b (est. INR162.6b). Home Care revenue declined 1% YoY (with UVG up mid-single digit), Beauty and Wellbeing rose 9.1% YoY (UVG flat), Personal Care remained flat YoY (UVG up high-single digit decline), and Food & Refreshment sales grew 2% YoY (UVG up low-single digit).

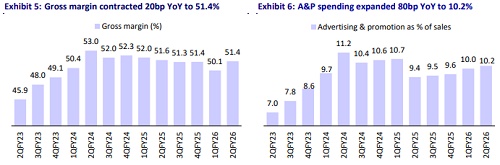

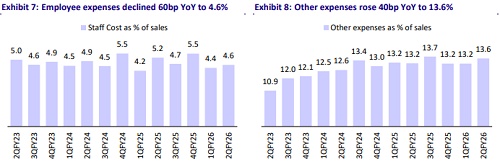

* Gross margins for the quarter contracted 20bp YoY to 51.4% (est. 50.7%). Employee expenses declined 9% YoY, while other expenses rose 5% YoY and ad spends rose 11% YoY. EBITDA margin contracted 80bp YoY to 23%. (est. 22.4%). The company expects EBITDA margin to remain at current levels in the near term.

* EBITDA declined 1% YoY to INR37.4b (est. INR36.5b), PBT declined 5% YoY to INR34b (est. INR34.2b), and PAT (bei) declined 4% YoY to INR25b (est. INR25.5b). Reported PAT rose 4.1% YoY to INR26.9b.

* An exceptional item of INR1,840m relates to the one-off positive impact from the resolution of prior-year tax matters between the UK and Indian tax authorities, along with restructuring expenses and acquisition- and disposalrelated costs.

* In 1HFY26, net sales, EBITDA, and APAT grew 4%, -1%, and 5%, respectively.

* HUVR has declared an interim dividend of INR19 per equity share, each with a face value of INR1.

Management conference call highlights

* HUL’s ~40% portfolio has transitioned to the 5% GST bracket, and the company has undertaken pricing and grammage revisions across more than 1,200 SKUs to reflect the changes.

* Management expects the combined impact of GST cuts, easing inflation, and a more accommodative monetary policy to drive a gradual recovery in consumption, particularly in rural markets.

* Volume impact of ~2% during the quarter was attributed to the GST transition and trade pipeline adjustments.

* E-commerce contributes 8% to total sales (12% in urban markets), while general trade forms 70% and modern trade about 20%, with all channels recording growth.

* The near-term EBITDA margin guidance remains in the 22-23% range, with 50- 60bp expansion expected following the demerger, as the low-margin Ice Cream business will be excluded.

Valuation and view

* We largely maintain our estimates for FY26-FY28. ? The company plans to focus aggressively on volume acceleration, alongside new launches and the reactivation of its value proposition, which is expected to drive further growth from 2HFY26 onwards.

* We expect supportive macroeconomic factors to act as a catalyst for boosting consumption sentiment. As a market leader in most staple categories, coupled with its strategic initiatives, HUVR is well-positioned to benefit the most.

* We model an 8%/8%/9% revenue, EBITDA, and APAT CAGR over FY25-28E. With various strategies underway, optimism is building for stronger operational performance in the coming quarters. We believe the new leadership is wellpositioned to capitalize on its volume growth aspirations amid supportive macro drivers. We reiterate our BUY rating on the stock with a TP of INR3,050 (55x on Sep’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412