Add Hindustan Unilever Ltd for the Target Rs. 2,695 by JM Financial Services Ltd

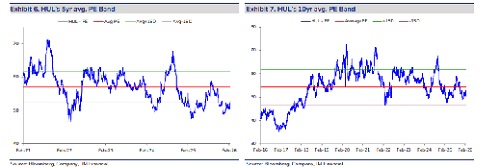

HUL’s 3QFY26 Consol. Net sales of INR 162bn (+5.7% YoY; LTL sales growth of 5% YoY with a UVG of 4% YoY) and gross margins were inline however EBITDA (adj for labor code impact) was c.3-4% ahead of ours/consensus est. as impact of higher staff cost (+12.5% YoY) was offset by lower than expected A&P spends (+2.4% YoY). The sales performance can be considered normal as destocking in October was offset by restocking in later half of the quarter. On the outlook, management maintained its guidance of 2HFY26/FY27E being better than 1HFY26/FY26 led by improving macro and internal initiatives. However, it refrained from quantifying the extent of acceleration in sales growth. On the margin front; commodity basket is likely to remain stable to inflationary (but manageable); guidance on EBITDA margin (ex-icecream business) remains unchanged at 22.5-23.5%. Going ahead focus will be on prioritising growth over margins. 9MFY26 margins already at top end of guidance suggest margin expansion is unlikely and earnings growth in FY27 will be driven by revenue performance. We stay constructive and expect execution to improve under new CEO (we estimate c.8% Sales/EBITDA CAGR over FY26- 28E vs low single digit CAGR over FY24-26E). We cut our estimates by c.2-3% to factor in icecream business demerger; maintain ADD with revised TP of INR 2,695 (earlier INR 2,770). Pace of acceleration in sales growth will be key for rerating from current levels.

? Revenue performance largely inline, margin delivery ahead of expectations: During the quarter, Ice-cream business operations have been demerged. Reported consol. sales grew c.6% YoY to INR 162.4bn (inline). On LTL basis (excl Minimalist/ice-cream business) sales increased by 5% YoY with UVG of 4% YoY. Gross margins stood at 50.8% (inline), improving c.30bps YoY primarily due to a positive portfolio mix. Staff cost (excluding labor code impact) and other expenses increased 12.5% and 7.6% YoY respectively, while A&P spend rose 2.4% YoY (lower due to phasing issue). Consequently, EBITDA grew 5.7% YoY to INR 39bn (c.4% beat vs. our est.) with margin remaining stable at 24%. PBT (bei) increased 3.5% YoY to INR 36.2bn due to lower other income (-40% YoY). PAT (bei) from continuing operations increased by 0.7% YoY to INR 25.6bn. Reported PAT (from continuing operations) declined 30% YoY to INR 21.2bn, primarily on account of fair valuation impact of financial liabilities linked to restructuring expenses and acquisition/disposal related costs. Reported PAT surged c.121% YoY to INR 66bn, largely driven by one-time exceptional gain following ice-cream business demerger.

? Segmental performance: 1) Home care's sales grew 3% YoY led by mid-single digit UVG as price cuts continued to weigh on growth. Household care sustained double-digit UVG (led by Vim), while Fabric Wash delivered mid-single digit UVG. Liquids portfolio posted double-digit growth. 2) Beauty & wellbeing delivered USG of 6% YoY with low-single-digit UVG, led by volume-led double digit growth in hair care (outperformance in Dove and TRESemme). Skin Care and Colour Cosmetics saw a strong performance in light moisturisers and winter portfolio offset by subdued performance in the non-winter portfolio. Reported growth was 10.5% YoY as Health & wellbeing (led by Oziva) saw high double digit growth. 3) Personal care grew 6% led by double digit growth in premium skin cleansing (Pears & Dove) and oral care (much better vs. Colgate’s sales growth of 1%) – led by outperformance in Closeup. 4) Foods' USG grew 6% YoY, driven by high-single digit UVG with broad based growth across categories. Tea growth (lwo single digit sales growth with mid-single digit UVG) remained subdued due to price cuts in a deflationary commodity environment, while Coffee sustained strong double digit growth. Lifestyle Nutrition and Packaged Foods grew in high-single digits. Kissan masterbrand was extended into new demand spaces with the introduction of the Great Indian Chutneys range

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361