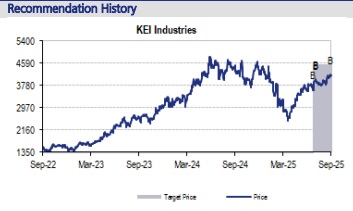

Buy KEI Industries Ltd For Target Rs. 4,775 By JM Financial Services Ltd

On course to achieve FY26 guidance and ramp up capacities

We recently met the management of KEI Industries. During our interaction, the company reiterated (1) its confidence in achieving 18-20% growth in revenue through FY26-28, and margin of 10.5-11% with 50bps improvement through FY28; (2) its Sanand plant capex is on track and operations in Phase 1 should commence by Oct’25; the entire plant is expected to commence operations from Sep’26; and (3) its strategy for the next round of capex in Bhiwadi (INR 5bn), wherein construction should begin around end-FY26/1QFY27, and commence operations within 2 years post that. While our estimates are unchanged, we rollforward to Sep’27E (from Jun’27E earlier). Our target price is now INR 4,775 (INR 4,550 earlier); we maintain BUY.

* Guidance unchanged at 18-20% revenue growth and ~10.5% EBITDA margin: The management reiterated its confidence in achieving 18-20% revenue growth over the next few years. EBITDA margin (including other income) should hover ~10.5-11%, and see a 50bps expansion through FY28 as the Sanand plant scales, economies of scale come in and newly added EHV capacities (inherently higher margin) scale up. Further, we understand that this guidance factors in any possible negativities including demand destocking, and input cost fluctuations, which the management views as activities in the normal course of business.

* Sanand capacity expansion on track: Total investment in Sanand will be ~INR 20bn, inclusive of all phases. This includes INR 7-8bn towards EHV capacities, and the rest towards other cable products (predominantly MV and HV cables). Until 1Q, we understand that KEI has incurred INR 10bn in capex here, and in the balance 9 months of FY26 it is likely to incur an incremental INR 6-7bn. The balance INR 3-4bn will be incurred in 1QFY27. Completion and commencement of operations in Phase 1 of the Sanand plant by Oct'25 is on track; the entire plant, including newly added EHV capacities, is expected to commence operations by Sept'26.

* Revenue potential from the Sanand capacity expansion: Asset turns for EHV capacities hover around 2x, hence, the INR 7bn-8bn of capex towards EHV could yield revenue of INR 12-13bn at its peak, while the balance INR 12-13bn directed towards other products, at ~4x asset turns, can drive incremental revenue of INR 48bn. Consequently, Sanand capacity expansion should drive incremental revenue of INR 55-60bn.

* Capex plans beyond Sanand: To avoid capacity constraints in future, the company has planned its next leg of capex in Bhiwadi. Here, KEI will undertake capex of INR ~5bn, of which INR 950mn on land acquisition has already been spent. Construction is slated to begin by end-FY26/1QFY27 and will take 2 years to ramp up, i.e., the facility should be fully operational by end-FY28. We understand that the Sanand facility, which will commence full operations by mid-FY27, should have achieved 60-70% utilisation by the time operations at the new Bhiwadi set-up begin.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361

.jpg)