Reduce Suprajit Engineering Ltd For Target Rs. 430 By Choice Broking Ltd

Margin Pressure amid Integration Cost

Operational Recovery Under Way amid Integration and Restructuring Efforts: SEL’s Q2FY26 performance reflects continued operational improvement and disciplined execution despite a challenging global backdrop. Excluding SCS, consolidated revenue and EBITDA grew 7.6% and 18.7% YoY, respectively, with margin at the upper end of the company’s guided range. The growth was driven by strong performance in the Suprajit Controls Division (SCD) and Domestic Cable Division (DCD). The Electronics Division also posted exceptional EBITDA expansion on the strength of customer diversification and improved product traction. However, we fear elevated corporate overheads, ongoing restructuring expenses and subdued export markets to continue to weigh on profitability.

Integration Progress Supports Long-term Turnaround: The integration of Stahlschmidt Cable Systems (SCS) progressed meaningfully, with EBITDA loss narrowing down to INR 67 Mn (INR 176 Mn in Q1FY26) and a clear roadmap towards breakeven by Q4FY26E. We expect near-term margin to remain under pressure due to restructuring cost in Germany and continued normalisation efforts across global operations. The Phoenix Lamps Division remained muted due to a weak export demand; however, new OEM inquiries can support medium-term recovery. We believe the company’s focus on technology-driven growth, cost-optimisation and operational synergies will support a stronger H2FY26E. However, short-term profitability may remain constrained by elevated integration and restructuring cost amid a volatile macro environment.

View and Valuation: We revise our FY26/27E EPS estimate by (2.4)%/2.4% and arrive at a target price of INR 430; valuing the company at 20x (maintained) on the average FY27/28E EPS. Considering near-term margin pressure due to integration cost, we maintain our ‘REDUCE' rating on the stock,

Q2FY26 Results Beat our Estimate Across the Board

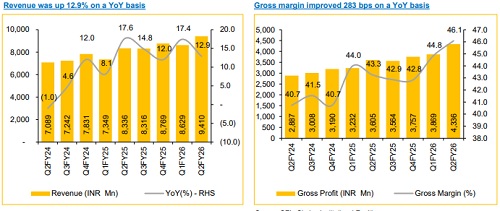

* Revenue was up 12.9% YoY and up 9.1% QoQ to INR 9,410 Mn (vs CIE est. at INR 9,170 Mn).

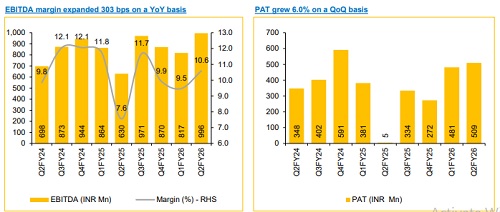

* EBITDA was up 58.1% YoY and up 21.8% QoQ to INR 996 Mn (vs CIE est. at INR 926 Mn). EBITDA margin was up 303 bps YoY and up 111 bps QoQ to 10.6% (vs CIE est. at 10.1%).

* APAT was up 6.0% QoQ to INR 509 Mn (vs CIE est. at INR 419 Mn).

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131