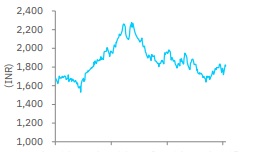

Buy ICICI Lombard General Insurance Ltd For Target Rs. 1,960 By Elara Capital

Underwriting offset by lower investment yield

ICICI Lombard (ICICIGI IN) reported gross direct premium income (GDPI) of INR 62.1bn and PAT of INR 5.1bn in Q4FY25. Due to the implementation of the new 1/n reporting format from 1 October 2024, YoY and QoQ comparisons are not meaningful, especially given the seasonal nature of various business segments. The combined ratio stood at 102.5% in Q4FY25, with an improvement in the expense ratio, primarily driven by lower operating costs. Consequently, the cost of float (underwriting losses / average AuM) stood at 1.6%.

However, the investment yield came in lower at 6.3% compared with the 8.5-8.7% runrate in the past three quarters, leading to a net yield after cost of float of 4.7%. The decline in investment yield was largely due to the absence of realized gains during the quarter. Furthermore, investment leverage declined to 3.8x, resulting in a Q4 RoE of 14.5%. We expect RoE to range within 17-18% in FY26E-27E. We maintain a positive outlook on ICICIGI, though we believe most positives are priced in. We retain ACCUMULATE, valuing the stock at 31x FY27E EPS.

Industry loss ratios elevated, ICICIGI continues to fare better: The industry’s combined ratio remained elevated at 113.2% in 9MFY25, driven by higher loss ratios. The motor loss ratio increased for the industry at 123.8% in 9MFY25 versus 118.2% in 9MFY24. In contrast, ICICIGI continues to maintain underwriting discipline, faring much better leading to lower cost of float than the industry.

Motor segment – Growth outlook tepid: Softness in rural demand (2W, tractors), muted CV sales, and pricing pressure weigh on near-term growth. We expect ICICIGI motor segment GDPI growth to be -single-digit in FY26E. The company may look to tactically increase premium through higher reinsurance accepted.

Reiterate Accumulate with a TP of INR 1,960: ICICIGI has one of the best franchises in the general insurance industry with management focusing on profitable growth. Recent investments in retail health are paying dividends as the company has gained market share in the health segment coupled with strong underwriting. We expect a 12% GDPI CAGR and a PAT CAGR of 12% in FY25-27E, driven by CoR improvement to 101.6% by FY27E, translating into an ROE in the range of 17-18%. We Reiterate Accumulate with a TP of INR 1,960, based on 31x FY27E EPS of ~INR 63.1.

Please refer disclaimer at Report

SEBI Registration number is INH000000933