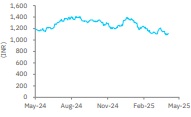

Buy Dr Reddy’s Laboratories Ltd For Target Rs. 1,588 By Elara Capital

Confident on post-Revlimid margin

Dr. Reddy’s Laboratories (DRRD IN) reported Q4FY25 slightly better than our estimates. Revenue and EBITDA came in 1-3% ahead of our estimates; PAT was 26% ahead, due to higher Other income and lower tax rate. Gross margin declined 300bp each QoQ and YoY, which suggests lower gRevlimid sales in the quarter. Strong performance continues in Russia and contract manufacturing businesses; organic growth in the India business was slightly weak at 6-7%. Management targets inorganic product addition in India, helping the business grow in the high teens in FY26. Management has guided for double-digit top-line growth and flat margin in FY26. Management reiterates 25% EBITDA margin outlook post gRevlimid. We lower our FY26E core EPS by 10% as we build in lower gRevlimid sales, but raise our FY27 core EPS by 4%, as we gain more confidence on margin. We retain Buy with a TP of INR 1,588.

Confident of 25% EBITDA margin post-gRevlimid: Management expects robust gRevlimid sales to wind down a few months before 31 January 2026 when the market freely opens up to all generic firms. It expects double-digit top-line growth in FY26 with EBITDA margin similar to FY25; this is in line with our expectations. Management reiterated sustaining ~25% EBITDA margin on an annual basis, even beyond the gRevlimid opportunity – something that the Street has yet to acknowledge, in our view. Increased visibility will be a key driver of stock price performance.

All set for Semaglutide opportunity: DRRD will be one of the first and largest players in the gSemaglutide market as it opens up in CY26. It is focused on key markets, such as Canada, India and Brazil. The company is vertically integrated in the product and has set up adequate capacity and expects regulatory approvals in time for first-wave launch. This could be a large opportunity, especially in Canada where only 2-3 firms may launch in the first wave. We conservatively estimate USD 100mn annual gSemaglutide sales for DRRD in Canada alone.

Biosimilar pipeline ramping up: DRRD’s bRituxan (rituximab) is close to being approved in the EU, and we expect US approval sooner than later. bProlia (denosumab) could see an FY26 launch. The most valuable product could be gOrencia wherein it could be among the first biosimilars to enter the US market. These are high-value products and have the potential to generate USD 40-100mn in revenue, as per our estimates.

India business to be led by inorganic product addition: Organic growth in the India business at ~7% in FY25 is not commendable. There could be slight improvement in FY26, but management says product acquisitions and in-licensing will take overall growth into high teens. Constant currency (CC) organic growth in Russia, the CIS, the PSAI and the RoW businesses remain in low double-digit percentage.

Retain Buy with a TP of INR 1,588: We lower our FY26E core EPS by 10% as we build in lower gRevlimid sales, but raise our FY27 core EPS by 4%, as we gain confidence on margin. We introduce FY28E. DRRD trades at 15.7x FY26E and 20.3x FY27E core earnings. We believe profit dip from sunset of the gRevlimid opportunity is already priced in valuation. We retain Buy with a TP of INR 1,588 on 28.7x FY27E core earnings plus cash per share. Increased price erosion in the US generics market and delay in key product approvals are key risks.

Please refer disclaimer at Report

SEBI Registration number is INH000000933