Buy PVR INOX Ltd For Target Rs. 1,380 By JM Financial Services

PVR Inox’s 1Q revenue growth (+23% YoY) was marginally ahead of JMFe: 20%. Underlying construct of their performance was far more encouraging though. Box office collection (BOC), up 21% YoY, was well distributed across language, genres and movie budgets. 10 movies crossed INR 1bn BOC in 1Q (None above INR 5bn). As we argued in An encore, 24 Aug 2023, skewness of BOC towards a few mega hits alongside a longer tail of flops is a possible impact of OTT. Conversely, equitable performance implies that OTT impact is waning. Sleeper hits such as “Tourist Family” are evidence that viewers are willing to visit Cinemas even for low budget movies apt for OTT viewing. That then restricts the reason for poor BOC of recent quarters to inconsistent content flow. That has already reversed. Q2 is off to a good start. Content pipeline for Q2/Q3 is looking even better. That is informing management’s confidence of exceeding FY24’s record admits (151mn) in FY26. 8%/11% higher ATP/SPH in FY26E (JMFe) and lower fixed cost mean revenue/EBITDA could be much higher. That coupled with 10x EV/EBITDA (pre Ind AS) – 1-SD below 10 year mean – make current levels attractive to play the seasonal and, hopefully, structural uptick. BUY.

* 1QFY26 – beats expectations: PVR Inox reported revenues of INR 14.7bn (23.4% YoY / 17.5% QoQ), beating JMFe (INR 14.3bn). Growth was broad-based across segments. Ticketing/F&B revenues grew 22.7%/22.4% YoY. Advertisement revenue grew 17% YoY to highest since pandemic. Other operating income (Movie distribution) grew 57% YoY led by movies such as Raid 2, Sitaare Zameen Par and Ballerina. Adjusted EBITDA (pre IndAS) came in at INR 953 Mn, in-line with JMFe (INR 971 Mn). PAT came in at -INR 545 Mn (vs JMFe: INR -341 Mn). PAT loss reduced considerably compared to 1QFY25 (INR -1,787 Mn). Net debt reduced further by INR 607mn (6.4%) sequentially to INR 8.9 bn.

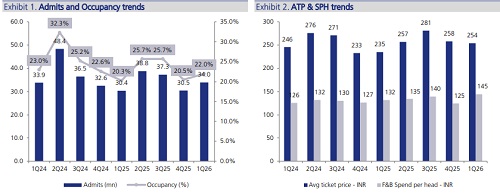

* Operational metrics: PVR’s GBOC grew 21%/10% YoY/QoQ to INR 8.6 bn. This was led by Hollywood (+72% YoY) and Bollywood (38% YoY) even as regional GBOC was stable (-4.2%). 10 films crossed INR 1bn (India GBOC) mark in the quarter with 3 crossing the INR 2bn mark. Admits in 1Q grew 11.8% YoY (11.5% QoQ) to 34.0mn. Footfall initiatives such as ‘Blockbuster Tuesdays’ (1mn admits), re-releases and live events (0.5mn admits) were successful in drawing admits. Occupancy at 22.0% was in-line with JMFe. ATP/SPH increased 8.1%/10.4% YoY (-1.6%/18% QoQ) driven by favourable mix drawing higher spending audience. PVR has signed 55/72 new screens under FOCO/Asset light model which are set to open in FY26-27. 20 screens were added in 1Q and 90-100 new screens are planned for FY26.

* Outlook- Promising line-up: PVR expects strong footfalls and occupancy in the coming quarters, supported by a pipeline that includes War2, Coolie, and Jolly LLB in Bollywood and Avatar and Conjuring in Hollywood. Q2 performance to date has been robust, aided by the success of Saiyaara, Superman and Jurassic. Management expressed confidence that FY26 occupancies and admits will surpass FY24 levels (151mn admits). Our FY26-28E EPS is up 3-4%, though confidence on these estimates are higher now. Our DCF based TP is broadly unchanged at INR 1,380. At 10x EV/EBITDA, valuations are attractive. BUY.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361