Buy AU Small Finance Bank Ltd For Target Rs. 772 by Centrum Broking Ltd

Poised to deliver historical high RoA levels

AUBANK’s results exceeded our expectations, driven by strong cost control and a sequential improvement of over 600bps in provision coverage. Looking ahead, we expect AUBANK to deliver robust book value growth of 18% CAGR over FY25–FY27E, alongside an attractive return profile with RoA expected to reach 1.85% by FY27. Our positive outlook is supported by multiple factors: (1) Merger synergies: The integration of Fincare is already translating into tangible benefits, as reflected in the disciplined growth of operating expenses; (2) Cross-sell potential: Management has articulated a clear long-term strategy to leverage cross-selling opportunities arising from the merger; (3) Asset quality improvement: The pressure from the unsecured portfolio is easing, with early signs of a recovery in the MFI cycle (turnaround expected from 2QFY26) and the CGFMU cover providing a buffer against future MFI-related credit costs. Moreover, the scaling down of the credit card portfolio has further reduced asset quality risks. We reiterate our BUY rating on AUBANK with a revised target price of Rs772 (earlier Rs748).

Stable performance in tough macro environment

NII for the quarter stood at Rs20.9bn, marginally ahead of our estimate of Rs20.3bn (a beat of 2.8%), largely driven by lower interest expenses. Opex came in at Rs15.6bn, slightly better than our estimate of Rs15.8 billion. CTI ratio was marginally higher sequentially at 54.7% compared to 54.4% in 3QFY25, but better than our expectation of 57%. As a result, PPOP at Rs12.9bn exceeded our projection of Rs11.9bn. Credit costs were elevated at Rs6.35bn versus our estimate of Rs5.69bn, leading to sequential improvement in provision coverage by over 600bps. PAT for the quarter came in at Rs5.0bn, ahead of our expectation of Rs4.7bn.

Lower CTI came as a pleasant surprise

CTI for FY25 improved to 56.3% vs 63.6% in FY24, primarily driven by reduced employee costs resulting from merger synergies. Additionally, cross-selling opportunities within the existing infrastructure are expected to enhance synergies and support further improvement in CTI over the medium term. Over the next two years, the management has guided for clocking CTI below 55% levels.

Strengthening Balance Sheet driven by improved slippages and robust provisioning

The bank’s slippages improved sequentially across both secured and unsecured portfolios, with slippages print at 3.62% in Q4FY25 from 4.06% in Q3FY25. However, there was a surge in credit costs to Rs6.35bn vs. Rs5.01bn in 3QFY25. Non-OD CE improved to 99.2% in March (99.4% ex Karnataka) - strong number for MFI book which has declined QoQ. Resultantly, in MFI, slippages are expected to stabilize in the medium term. However, credit cost in MFI is anticipated to remain elevated in near term. Overall credit cost guidance, stands at 75-85bps on total average assets as long term average.

Reiterate BUY with TP of Rs772

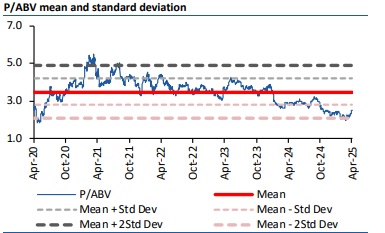

Over the last five years, AUBANK stock has traded at a mean P/ABV multiple of ~4x on a oneyear forward basis. However, it has delivered negligible returns, primarily due to a significant de-rating of multiples. Further, the bank delivered 20% BV CAGR during the same period. Currently, the stock is trading at a deeply discounted level of mean minus 2SD, reflecting overly pessimistic market sentiment. We reiterate AUBANK to BUY with a revised target of Rs772, based on 2.5x FY27E P/ABV (average of mean -1 and -2 SD). The bank is well-positioned to deliver sustainable 18% BV CAGR, making it an attractive investment.

Valuation

Over the last five years, AUBANK stock has traded at a mean P/ABV multiple of ~4x on a one-year forward basis. However, it has delivered negligible returns, primarily due to a significant de-rating of multiples. Further, the bank delivered 20% BV CAGR during the same period. Currently, the stock is trading at a deeply discounted level of mean minus 2SD, reflecting overly pessimistic market sentiment. We reiterate AUBANK to BUY with a revised target of Rs772, based on 2.5x FY27E P/ABV (average of mean -1 and -2 SD)

For More Centrum Broking Disclaimer https://www.centrumbroking.com/disclaimer/

SEBI Registration No.:- INZ000205331