Accumulate Coromandel International Ltd For Target Rs. 2,103 By Elara Capital Ltd

Growth to be broad-based in all divisions

Coromandel International (CRIN IN) reported better-than-expected Q3 across all parameters. Topline outperformance was led by 13% higher-than-expected volume growth in the P&K fertilizer segment at 1.13mn tonnes. Non-subsidy business grew 13% YoY. EBITDA grew 102% YoY to INR 7.2bn, led by 2.8x growth in EBITDA from subsidy business to INR 5bn. Profitability was bolstered by higher volume growth and spiked production of phosphoric acid and sulphuric acid (led by resumption at Ennore plant and higher acid prices). EBITDA per tonne rose 209% YoY for the subsidy business (all fertilizers except urea considered for calculation). We remain structurally positive on CRIN on the back of aggressive investment plans across business segments, increasing profitability in the core fertilizer business and rising free cashflow (after meeting capex requirement). We revise CRIN to Accumulate from Buy with TP raised to INR 2,103 (from INR 2,041), on 22x (unchanged) FY27E EPS of INR 95.6.

Better volumes and higher EBITDA per tonne to drive FY26 profitability:

Given healthy liquidation in P&K fertilizer in Q3 as also in January, we expect decent volume growth in the fertilizer business in FY26 as well. CRIN will secure additional volumes through debottlenecking of existing capacity as well as recommencement of granulation unit at Ennore. On the profitability front, growth in EBITDA per tonne will be led by higher rock phosphate volume from Senegal, increased production of phosphoric acid (as a result of debottlenecking) and better feedstock prices.

Capacity expansion plans on track:

Expansion is progressing as expected – Fertilizer capacity of 0.75 mn tonnes in NPK granulation units, phosphoric acid capacity of 0.2 mn tonnes and 0.6 mn tonnes of sulphuric acid. Acid plants are expected to start from Q4FY26. CRIN does not anticipate any problem in securing more rock phosphate, required for new capacity. For granulation capex, CRIN is in final stages of collaborating with a technology partner and expects to commence the plant by Q4FY27. For these investments in fertilizer capacity, CRIN has applied for incentives from the state government (which is being considered). CRIN is also expanding capacity of crop protection (In technical) to expand its presence in the segment.

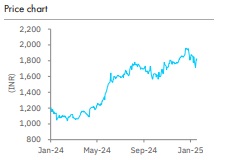

Revise to Accumulate with a higher TP of INR 2,103:

Post elevation of Mr. Sankarasubramanian at the helm of affairs, growth visibility across all business segments and sub-segments has improved significantly, driven by management’s plan to scale up those segments. These growth plans are likely to improve profitability for all the divisions and increase their contribution in the overall profit pool. While CRIN continues on the path to achieve these growth targets, cash accumulation will also increase as annual cash generation will outweigh deployments in expansion projects. Due to 13% run up in stock price since the last result update (25th October 2024), we revise CRIN to Accumulate from Buy with a higher TP of INR 2,103 (INR 2,041 earlier) on 22x (unchanged) FY27E EPS of INR 94.8. We have increased TP marginally to factor in lower interest cost and higher other income led by burgeoning surplus cash.

Please refer disclaimer at Report

SEBI Registration number is INH000000933