Buy Kotak Mahindra Bank Ltd For Target Rs.2,350 by Prabhudas Liladhar Capital Ltd

Recovery is slower than expected

Quick Pointers:

* Soft quarter with miss on core PAT due to higher provisions and lower fees.

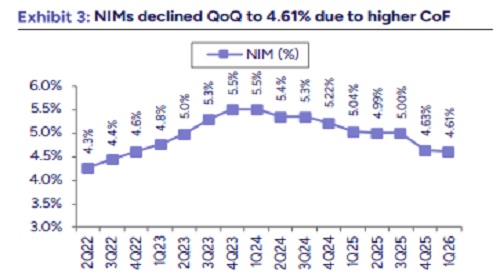

* We trim loan growth by 100bps to 16% and cut NIM by 9/7bps for FY26/27.

KMB saw a weak quarter as miss on provisions, fees and NII led to 13.7% lower core PAT. While NII was cushioned as cash was utilized to pay-off borrowings, Q2FY26 would see impact of normal liquidity and 50bps repo cut suggesting NIM decline QoQ. However, H2FY26 NIM could improve due to CRR cut and deposit repricing. While loan growth was healthy at 4.2% QoQ, it was led by SME and mid-market. Barring housing, retail growth was sluggish due to weak demand while unsecured recovery is slower. Hence, we trim loan growth by 100bps for FY26/27E to 16% YoY. Asset quality worsened QoQ due to higher net slippages/provisions led by MFI stress and slower corporate recovery. We cut NIM & fees, increase provisions but reduce opex; net cut in core PAT for FY26/27E is avg. 4.2% We tweak multiple to 2.3x from 2.4x on Mar’27 core ABV and slightly reduce TP to Rs2,350 from Rs2,400. Retain ‘BUY’.

* Soft quarter due to weaker fees and higher slippages/provisions: NII was a tad lower at Rs72.6bn (PLe Rs74.2bn); NIM (calc.) was largely in-line at 4.61% (PLe 4.63%); higher cost of funds was offset by better yields. Credit/deposit growth as expected were 14.1%/14.6 YoY. CASA ratio fell to 40.9% (43% in Q4’25). LDR increased to 86.7% (85.5% QoQ). Other income was higher at Rs30.8bn (PLe Rs29.9bn); fees were a miss at Rs.22.5bn (PLe at Rs25.6bn). Opex at Rs47.8bn was 7.3% below PLe led by lower staff cost and other opex. Core PPoP at Rs47.3bn was 2% lower to PLe; PPoP was Rs55.6bn. Asset quality worsened as GNPA was higher at 1.48% (PLe 1.41%) owing to higher net slippages. Hence, provisions were a drag at Rs12.1bn (PLe Rs7.3bn). Core PAT was 13.7% below PLe at Rs26.6bn while PAT was Rs32.8bn.

* Sequential loan growth led by SME mid-market: Credit growth was strong at 4.2% QoQ mainly led by SME and mid-market. While corporate growth looks optically higher at +10.8% QoQ, select SMEs were migrated to corporate so that they are appropriately served. There are no challenges in SME and this portfolio is completely secured; growth is healthy due to strong WC demand by small companies. PL/CC/MFI fell QoQ by 1.8%/3.7%/12.2%. Credit flow was intact in PL but CC saw slower offtake due to one-time clean-up of blocked accounts. CV growth was sluggish due to subdued economic activity in goods segment while CE de-growth was driven by tighter cash flows and early monsoons. We trim YoY loan growth for FY26/27E by 100bps to 16%.

* Asset quality was weak; provisions remain elevated: Net slippages were higher at Rs12.6bn (PLe Rs9.1bn) driven by MFI, retail CV and seasonal stress in agri; PL/CC stress has stabilized. Credit costs jumped to 115bps from 80bps in Q4’25 due to slower recovery from legacy corporate loans. MFI credit cost was a key contributor to stress; it may start reducing from H2FY26. Unsecured recovery has been slower than expected and hence we raise provisions for FY26E by 15bps to 79bps; for FY27 we are factoring provisions of 62bps.

Above views are of the author and not of the website kindly read disclaimer