Buy Bank of Baroda Ltd For Target Rs.270 by Prabhudas Liladhar Capital Ltd

Lower deposit cost to benefit NIM from Q3FY26

Quick Pointers:

* Weak quarter due to miss on NII/fees/opex and provisions.

* Cut in NIM to drive earnings downgrade; deposit cost a key monitorable.

BOB saw a weak quarter yet again as core PPoP adjusted for IT refund was 12.4% lower to PLe due to (1) miss on NIM by 8bps led by softer reported yields on loans and investments (2) weaker fee income and (3) higher opex led by other opex. Fall in reported NIM at 6-7bps QoQ was lower to peers (11-18bps decline). NIM may remain under pressure in Q2FY26 due to lead-lag impact of repo rate cut on loans/deposits. However, bank expects 70% of deposits to reprice within 1-2 quarters suggesting that NIM would start improving since Q3FY26. Loans de-grew by 2.0% QoQ due to 10% fall in corporate; however, BOB expects corporate growth of 8-10% YoY for FY26; we are factoring overall loan growth of 11% YoY in FY26. We trim NIM for FY26/27E by 5/3bps which may result in core earnings cut of 6.5%. We keep multiple at 0.9x on Mar’27 ABV but tweak TP to Rs270 from Rs275. Retain ‘BUY’.

* Weak quarter due to miss on NII/fees/opex and provisions: NII adjusted for IT refund was a miss at Rs110.6bn (PLe Rs113.9bn); NIM (calc.) was lower at 2.75% (PLe 2.83%); reported NIM fell by 7bps QoQ to 2.9% led by fall in loan yields by 12bps QoQ and increase in cash. Loan growth was in-line at 13.2% YoY. Deposit accretion was largely in-line at 9.1% YoY. CASA ratio fell to 33% (33.7% in Q4’25). Other income was a beat at Rs46.7bn (PLe Rs32.7bn) due to trading gains; fees were a 5.5% miss at Rs19.7bn. Opex at Rs78.7bn was 2.2% above PLe led by higher other opex. Core PPoP at Rs57.7bn was 12.5% below PLe. PPoP was Rs82.4bn. GNPA was more at 2.28% (PLe 2.24%) due to tad higher slippages. Hence, provisions were a drag at Rs19.7bn (PLe Rs18.3bn). Core PAT was 18% below PLe at Rs27.6bn; PAT was Rs45.4bn.

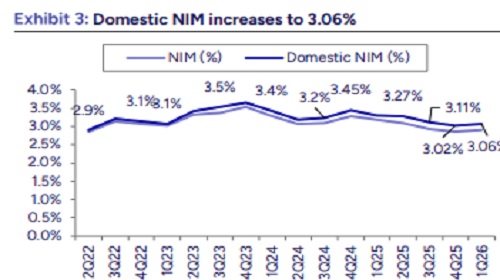

* NIM sees a QoQ reduction: Adjusted for IT refund overall NIM declined by 6- 7bps QoQ to 2.8% due to (1) 12bps QoQ fall in loan yields and (2) 19bps QoQ fall in investment yields. As per the bank, full benefit of repo has been passed in retail while 70% deposits would reprice within 1-2 quarters. This suggests that due to lead-lag impact NIM for Q2FY26 could slightly fall while it would start improving from Q3FY26 as majority of deposits would be repriced. Hence, we trim cut by 5bps/3bps in FY26/27E to 2.62%/2.72%. Bank has trimmed its NIM guidance for FY26 from 3.0% (in Q4’25) to 2.85-3.0%.

* Retail credit growth was broad based: Credit growth was -1.9% QoQ driven by a 10% QoQ fall in domestic corporate and 0.5% fall in SME; retail/agri increased by ~2.0% each. BOB is not facing any challenges in MSME and the book is mainly secured. Share of bulk deposits further fell from 17% to 16%. Slippages saw a blip QoQ due to 1) increase in legacy PL accounts amounting to Rs1bn and 2) one international account of Rs5.14bn slipped to NPA; bank is confident of recovering this exposure but has provided 40%. Standard asset provisions increased as Rs.5-6 Bn was additionally provided on the SMA 1/2 pool as internal weakness was observed and flagged by auditors.

Above views are of the author and not of the website kindly read disclaimer