Buy J.B. Chemicals & Pharmaceuticals Ltd For Target Rs.2,030 by Prabhudas Liladhar Capital Ltd

Margin surprise

Quick Pointers:

* Reiterate EBITDA margin guidance of 27-29% in FY26E.

* Guided for 12–14% growth in CDMO with 3-4 new launches in FY26

J.B. Chemicals & Pharmaceuticals (JBCP) Q1FY26 adjusted EBITDA growth of 13% YoY for one offs and ESOP was 3% above our estimates. Revenue growth across key segments (domestic and CDMO) was healthy during the quarter. We believe JBCP growth momentum to continue driven by 1) geographical expansion of legacy brands 2) improvement in MR productivity 3) scale up in acquired brands 4) launch of new products & therapies 5) scaling up contract manufacturing business and 6) strong FCF generation. Further margins will continue to improve beyond FY27 with grant of perpetual license of acquired opthal portfolio. Our FY26E/27E EPS remains unchanged. We expect EPS CAGR of 22% over FY25-27E. At CMP, the stock is trading at 28x FY27E EPS. We maintain ‘BUY’ rating with TP of Rs2,030/share, valuing at 32x FY27E EPS.

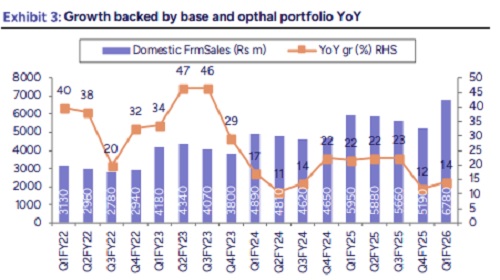

* Domestic business (incl opthal) aided growth YoY: JBCP revenues grew by 9% YoY to Rs11bn, in line with our estimates. Domestic formulation delivered double digit growth of 14% YoY to Rs 6.8bn. Opthal portfolio from Novartis delivered Rs 570mn in revenues. Export formulations remained muted down 2% YoY to Rs 2.83bn. Russia, US & South Africa remained flat for the quarter. CDMO business registered growth of 8% YoY. API sales at Rs 180mn; up 38% YoY

* Adj OPM at 30.2% adj for ESOP & one-off: Reported EBITDA came in at Rs 3bn up 7% YoY. Margins stood at 27.5%; up 50 bps YoY. Adjusted for ESOP (Rs140mn) & acquisition related one off cost (Rs150mn), EBITDA was Rs3.3bn with OPM of 30.2%; 3% above our estimate. GM’s increased 210bps both YoY and QoQ to 68.2%. PAT came in at Rs2bn up 14% YoY, in line with our est.

Above views are of the author and not of the website kindly read disclaimer