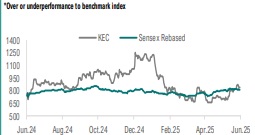

Accumulate KEC International Ltd For Target Rs. 998 By Geojit Financial Services Ltd

T&D to aid execution; margins remain the key

KEC International Ltd. (KEC) is a global infrastructure Engineering, Procurement and Construction major. It has presence in the verticals of Power T&D (Transmission & Distribution), Cables, Railways and Water & Renewable.

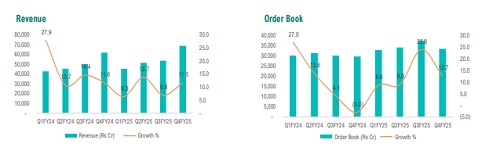

• KEC’s Q4FY25 revenue grew by 11.5% YoY, which is below our estimate due to slower execution in Railway, Civil & Water segments. However, key segments like T&D (36% YoY), Cable (29% YoY), and Renewables (121% YoY) registered robust growth.

• EBITDA margin during the quarter improved by 155bps YoY to 7.8%, aided by an increasing mix of high margin T&D orders. The company expects margins to improve to 8-8.5% in FY26 on the back of T&D orders and higher execution in Railway, Civil & Water segments.

• FY25 order book grew by 13% YoY to Rs 33,398cr, led by a strong inflow of Rs 24,689cr (36% YoY). We expect a pickup in order inflows driven by a healthy order pipeline of Rs 1.8tn, largely from domestic and international T&D.

• The share of T&D orders expanded to 72% in FY25, compared to 61% in FY24, which is expected to drive profitability in the coming quarters.

Outlook & Valuation

A turnaround in margins remains a key monitorable and we expect an increasing mix of T&D orders (10%+ margin) and an improvement in non-T&D execution to aid margins in the coming quarters. We expect revenue to grow at a CAGR of 15% over FY25-FY27E owing to strong order inflows in FY25. We maintain our Accumulate rating and value the stock at a P/E of 20x on FY27 EPS with a TP of Rs. 998.

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH20000034