Buy Ajanta Pharma Ltd for the Target Rs. 3,200 By Prabhudas Liladhar Capital Ltd

Leveraging BGx franchise to accelerate growth

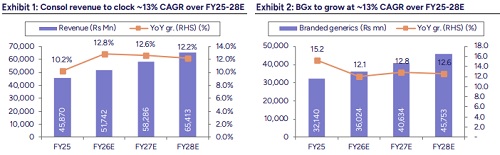

We initiate coverage on AJP with ‘BUY’ rating and TP of Rs3,200/share, 25% upside from current levels. AJP’s play on high growth branded generics (BGx) market spread across India, Asia and Africa contributed 74% to total revenue in FY25 and delivered 12.5% CAGR over FY22-25. We expect AJP to clock 13% revenue CAGR over FY25-28E driven by increased focus on branded formulations, penetration into newer therapies and scaleup in US generics.

Overall, we expect EBITDA/PAT CAGR of 17%/ 16% over FY25-28E with healthy RoE/RoCE of 28.5%/35.6% in FY27E. At CMP, AJP is trading at 24x P/E and 17x EV/EBITDA as of Sep FY27E. We value AJP at 30x P/E on Sep FY27E EPS based on its ability to generate higher RoE/RoCE compared to peers and strong exposure to BGx markets. Initiate with ‘BUY.

Play on branded generic (BGx) business: AJP’s BGx business enjoys healthy OPM of 30%. BGx business contributed ~74% of overall revenue in FY25 and delivered 12.5% CAGR in revenue over FY22-25. We believe the momentum will continue on the back of new launches, geographic expansion, new therapeutic addition and volume growth. We have factored ~13% of CAGR revenue over FY25-28E for the BGx business.

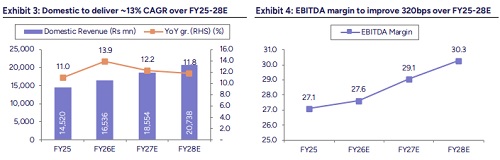

Strong hold in domestic markets: Domestic formulations constituted 32% of the total turnover in FY25. AJP is focused on 4 high-growth specialty therapies: cardiac, ophthal, derma and pain management. Thus, the portfolio is driven by chronic therapies with ~65% contribution, which is very sticky. Over the last 3 years, AJP has outperformed IPM by ~200-300bps. During FY25, the company entered 2 new therapies – nephrology and gynecology – and acquired 3 brands in pain management. New therapeutic additions, market share gain and new launches will help domestic business register ~13% revenue CAGR over FY25-28E.

Niche franchise in Asia and Africa, first-mover advantage: BGx business in Asia and Africa contributed 42% to total revenue in FY25 and clocked 11.5% CAGR over FY22-25. The company has presence in 30 countries across Asia and Africa with 2,040 MRs and has been a pioneer in introducing field force in some of these markets. The company has been strategically strengthening this business through increased investments in both products and people, thus driving growth along with further therapeutic diversification. We factor in ~13%/~11% revenue CAGR over FY25-28E from BGx business across Asia/Africa.

Best-in-class return metrics: AJP has managed to maintain its OPM at 26-27% over the past few years. We see moderate improvement in margins in FY26E as the full impact of opex related to new therapeutic additions will be reflected during the year. We expect 320bps margin improvement over FY25-28E led by its focus toward BGx business. AJP continues to generate strong FCF of Rs7-10bn annually, majority of which is distributed through dividends and share buybacks. However, AJP is also open to explore any M&A across branded generic markets. With improving utilization and asset turnover, we expect strong FCF generation of ~Rs25bn and RoCE expansion of ~800bps to 38% over FY25-28E.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271