Buy Sun Pharmaceutical Industries Ltd For Target Rs.1,875 by Prabhudas Liladhar Capital Ltd

Strong quarter aided by specialty and domestic formulation

Quick Pointers:

* Guided for 25% tax rate in FY26 and going forward.

* Reiterate its $100mn expenses towards new launches of specialty in FY26.

Sun Pharma (SUNP) Q1FY26 EBIDTA (+11% YoY) was 7% above our estimates aided by higher specialty sales and lower opex. Over last few years SUNP dependency on US generics has reduced and company’s growth is more functional on specialty, RoW and domestic pharma that has strong growth visibility. Though FY26 expenses (an additional $100mn spend) is likely to remain elevated given company are in investment phase to ramp up specialty pipeline; successful launch of Leqselvi and Unloxcyt along with progress of other pipelines will be key. Our FY26/FY27E EPS stands reduced by 6-7% as we factor in higher tax. We maintain ‘BUY’ rating with revised TP of Rs.1,875 based on 32x FY27E EPS. SUNP remains our top pick in large cap space.

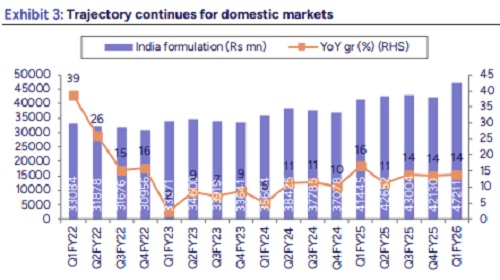

Higher domestic & US specialty supports YoY: Revenues came in at Rs 138.5bn up 9.5% YoY vs our estimate of Rs 135bn. Domestic formulation growth was strong at 14% YoY. US sales came to $473mn ($465mn in Q4FY25). In line with estimates. Global specialty sales were up 17% YoY and 5% QoQ to $311mn. RoW markets remained healthy up 18% YoY while EMs growth stood at 7% YoY. API sales were up 9% YoY.

EBITDA beat; higher tax led to PAT miss: Reported EBIDTA came in at Rs 40.7bn. up 11% YoY against our estimate of Rs 38bn. 7% beat to our estimate. OPM came in at 29.4% up 50bps YoY and 300bps QoQ. GMs came in at 79.6%, up 20bps QoQ and 100bps YoY. Other expenses ex R&D was up 6% YoY and down 9% QoQ. R&D spend came in at Rs 9bn (6.5% of revenues) up 14% YoY. Tax came in higher at 26%. Forex gain stood at Rs 2.2bn. There were certain one offs related to impairment and litigation settlement charges. Adj for forex gain and one offs; PAT came in at Rs 28bn below our estimate of Rs 29.5bn led by higher tax.

Above views are of the author and not of the website kindly read disclaimer