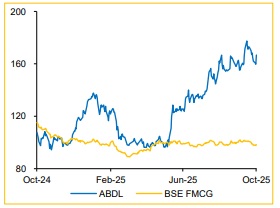

Add Allied Blenders and Distillers Ltd for the Target Rs.590 by Choice Broking Ltd

Key Takeaways from Management Interaction at the Plant:

1. The plant was constructed at a cost of INR 1,150 Mn. The company further plans to get approvals for linking the PET plant with a conveyor belt to existing bottling facilities.

2. The PET plant has a capacity of 600 Mn bottles p.a. and will meet a significant portion of Rangapur Bottling Plant's packaging needs.

3. All PET bottles produced in the plant are consumed in Telangana and AP bottling facilities, saving logistical as well as outsourcing costs.

4. With the opening of the new PET plant, Management is on track for its larger 3-year strategy involving a capex of INR 5,270Mn.

5. The backward integration strategy consists of a PET Plant, Malt Plant and ENA capacity expansion at its Meenakshi Distillery in Aurangabad.

6. Upon the execution of the entire strategy, Management expects EBITDA margin to increase by ~300bps.

Rangapur Integrated Manufacturing Facility – ENA, Bottling and PET at one location

Rangapur is the largest facility with 60 Mn LPA ENA, 600 Mn p.a PET bottle manufacturing and 10 Mn p.a. bottling capacity. The facility benefits from an uninterrupted water source from nearby Krishna river. The distillery uses broken rice for production of ENA, majority of which is sourced locally. With 1 Tonne of broken rice, roughly 400—500 bulk litres of ENA can be produced. The rest is by-product of DDGS and DDWS (cattle/animal feed). Filling and sealing of the bottles from large tanks is automatic, while QC is manual. The plant pushes out 0.7—0.8 Mn cases of alcoholic beverages every month. The plant is used for production of Officer’s Choice Whiskey, Officer’s Choice, ICONIQ White, Sterling Reserve B7 among other brands in mass premium and P&A categories

Malt Plant expected to go live in Q4FY26E, completing integration

We also visited the under-construction site for the upcoming 4 MLPA Malt plant. The plant is expected to provide for the company’s majority malt requirements. Additionally, we noted efforts towards development of a home-grown single malt. Single malt whiskeys need malt liquids which have been aged for at least 3-years. Hence, an in-house single malt is only expected to be developed by FY29E.

Valuation – Maintain BUY rating with a TP of INR 590

We have already baked in the margin improvement from the commissioning of the PET Plant. We estimate these savings to be INR ~300 Mn per year. Projecting a ~15% revenue CAGR over FY25— FY28E, we conservatively estimate that backward integration will grow EBITDA margin to 14.9%, thus arriving at a Net Income CAGR of ~32%. Therefore, we maintain our “ADD” rating on the stock, with a TP of INR 590 using a DCF approach. Our TP implies a PE of 48.3x / ~37x over FY27E / FY28E EPS, respectively.

Key Risks

* New launches gaining slower-than-expected traction

* Possible delay in commissioning of vertically integrated plants

* Working capital issues.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131