Accumulate Hero Motocorp Ltd For Target Rs.6,190 by Prabhudas Liladhar Capital Ltd

Hits accelerator on EVs, exports & entry segment

Quick Pointers:

* First-time 2W buyers’ ratio increased to 81% this festive season, against an average of 72% seen so far.

* The management expects the 2W industry to grow by 8-10% in H2FY26 (5- 6% for FY26), and HMCL to outperform.

HMCL reported its highest-ever quarterly standalone revenue and PAT in Q2FY26, modestly beating street estimates on most P&L line items. It is seeing sustained retail momentum even after the festivities, and with the marriage season on, HMCL expects Scooters to grow strongly and 100cc Bikes to bounce back with aspirational and replacement demand in H2FY26. HMCL is stepping up promotional campaigns and capacities to meet the rise in demand. We tweak volume, realization and margin estimates translating to revenue/EBITDA/PAT CAGR of 9.5%/10.5%/9.9% over FY25-28E and retain ‘Accumulate’ rating with TP of Rs6,190 (previous Rs6,049). We value the core business at 20x P/E Sep’27E and Rs66 for Hero’s financing arm.

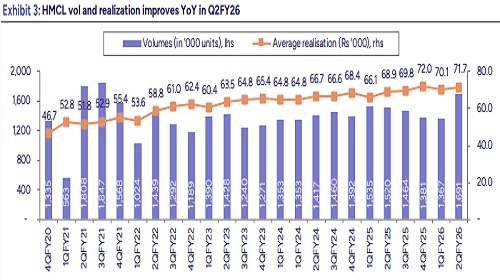

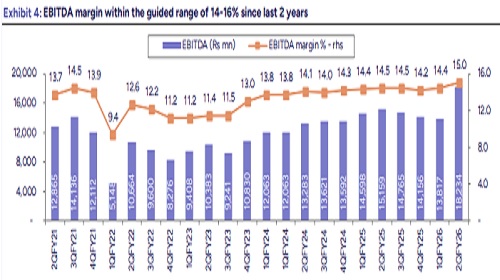

Standalone revenue grows 15.9% YoY to Rs121.3bn: Realization was Rs71.7k (+4.2% YoY, +2.4% QoQ), beating BBGe by 2.0% (met PLe). Gross margin was flattish at 33.3%, while EBITDA margin grew by ~55bps YoY to 15.0% (30bps/40bps above BBGe/PLe) owing to lower other expenses. EBITDA stood at Rs18.2bn (+20.3% YoY), while PAT was Rs13.9bn (met BBGe/PLe). In H1FY26, standalone revenue was Rs217.1bn (+5.3% YoY); EBITDA, Rs32.1bn (+7.7% YoY); EBITDA margin, 14.8% (+30bps YoY); and PAT, Rs25.2bn (+8.3% YoY). Volumes were flat, and realization grew +5.2% YoY.

EV contribution margin improving QoQ: With upcoming launches, higher volumes and cost controls, EV contribution margin should reach close to breakeven. The company recorded its highest-ever quarterly EV market share at 11.7% (+680bps YoY) in Q2FY26. ICE margin was 17.7% (+120bps YoY) due to lower RM cost, cost savings program, and better mix. Advertisement spending in H1FY26 increased by 10% YoY, one of the highest post-festive spendings on advertisements compared to peers, as HMCL continues focusing on brand-building.

International business up by 77% YoY (led by Bangladesh, Nepal, Sri Lanka & Colombia): The business grew 3x of industry’s pace. HMCL had 12% market share in the top 10 markets (#1 in some) and has been gaining share in the top 7 markets. Premium product mix was 40%. HMCL wants to continue expanding margins via higher volumes and an improved mix.

Conference Call Highlights:

* In the past, post excise rate cuts, 2W industry had seen double-digit growth for a couple of years. With GST 2.0 reforms, the management expects the trend to continue.

* Rural market saw slower growth in the early part of the quarter with some damage due to heavy monsoons but is now recovering as per trends seen in Oct-Nov’25.

* HMCL saw 1mn VAHAN registrations during the Oct’25 festive period, with market share of 31.6% (+370bps vs previous year festivities), gaining share across all key segments.

* For the full festive season (23Aug’25-12Nov’25), ICE VAHAN registrations grew by 16.2% (led by Entry, Deluxe and Scooters) over comparable period last year against industry growth of 14.7%, aiding 40bps market share gain for HMCL.

* Entry segment share in overall 2W industry expanded by 3% in Q2 and by 5% in H1FY26.

* Operating cash in H1FY26 was Rs41.11bn.

* HMCL saw the lowest inventory and receivables level in Q2, along with highest-ever collections during the festive period. Receivables were close to 12days in Q2 vs. 30days in the same period last year.

* PAM (parts, accessories, merchandise) revenue was Rs15.33bn in Q2FY26 (>+5% YoY).

* EBITDA margin guidance was maintained at 14-16%.

* Inflationary pressure was seen in Q2, and commodity costs are expected to remain rangebound in Q3FY26 (increase by 1-2%).

* Discounts were lower YoY, but HMCL is spending more on customer acquisition now.

* Q2 saw the launch of 12 new models. HMCL now has presence across all segments in 2Ws

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271