Buy Hero MotoCorp Ltd for the Target Rs. 6,500 by Motilal Oswal Financial Services Ltd

Steady quarter

Pickup in rural demand bodes well for HMCL

* Hero MotoCorp’s (HMCL) 2QFY26 PAT at INR13.9b came in slightly below our est. of INR14.4b, largely due to lower other income. Margins expanded on the back of revenue growth and operational efficiencies.

* We expect HMCL to deliver a volume CAGR of ~6% over FY26-28, driven by new launches and a ramp-up in exports. HMCL will also benefit from a gradual rural recovery, given strong brand equity in the economy and executive segments. We project a CAGR of ~8%/11%/12% in revenue/EBITDA/PAT over FY25-28. At ~22.5x/19.6x FY26E/27E EPS, the stock appears attractively valued. We reiterate our BUY rating with a TP of INR6,503 (based on 20x Sep’27E EPS + INR141/397 for Hero FinCorp/Ather post-20% Holdco discount).

Earnings in line with estimates

* Net revenue grew ~16% YoY to INR121.3b (in line with estimate).

* Net realization grew 4.2% YoY/2.4% QoQ to INR72k (vs. est. of INR70k).

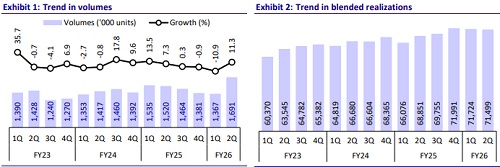

* Volumes were up 11.3% YoY and 23.7% QoQ, aided by a pickup in demand in rural regions. Festive season performance (Aug-Nov’25) was strong, with 16.2% growth in ICE Vahan registrations, outpacing industry growth of 14.7% and leading to a 40bp market share gain. Growth was driven by entry, deluxe, and scooter segments.

* Gross margins remained flat YoY at 33.3% (vs. est. 32.8%). Aluminum prices were up, whereas steel prices declined.

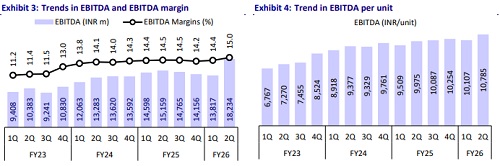

* EBITDA margins were up 50bp YoY at 15% (in line) on account of better operational efficiencies and improved volumes.

* EBITDA grew 20.3% YoY to INR18.2b, broadly in line with our estimate.

* However, lower-than-expected other income of INR2.3b led to adj. PAT of INR13.9b, slightly below our estimate of INR14.4b.

Highlights from the management commentary

* HMCL achieved nearly 1 million retail sales on Vahan in Oct’25, expanding its market share to 31.6% (+3.7% YoY). Management highlighted that demand has remained buoyant even after the festive season.

* Management expects the industry to post 8-10% growth in 2H. Further, it expects pickup in demand to last for 2-3 years, as seen during similar excise rate cuts in the past.

* Market share gains in EVs were particularly strong in urban and metro markets, with VIDA achieving a 20%+ market share in 49 towns, including in metros like Delhi and Mumbai. Further, HMCL is among the top 2 EV players in about 56 towns.

* Global business showcased one of its strongest performances in recent years, with dispatches growing 77% YoY, almost 3x the industry growth rate. This momentum is expected to continue in the coming quarters as per management.

Valuation and view

* We expect HMCL to deliver a volume CAGR of ~6% over FY26-28, driven by new launches and a ramp-up in exports. HMCL will also benefit from a gradual rural recovery, given strong brand equity in the economy and executive segments.

* We project a CAGR of ~8%/11%/12% in revenue/EBITDA/PAT over FY25-28. At ~22.5x/19.6x FY26E/27E EPS, the stock appears attractively valued. We reiterate our BUY rating with a TP of INR6,500 (based on 20x Sep’27E EPS + INR141/397 for Hero FinCorp/Ather after 20% Holdco discount).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412