Commodity Morning Insights 31th December 2025 - Axis Securities

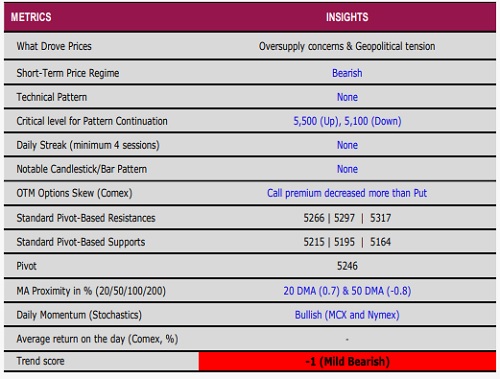

* Comex Gold traded with volatility in the last session and settled largely flat near the $4,330 level. Safe-haven demand remained supported amid rising geopolitical tensions, as peace talks between Russia and Ukraine have been thrown into further doubt after reports suggested that President Putin informed President Trump that Moscow would reassess its stance in negotiations following alleged strikes on Putin’s residence. In addition, Trump warned of further strikes on Iran if nuclear rebuilding continues, and announced US strikes on a drug-related facility in Venezuela, lending support to gold prices near the lower levels

* Silver prices recovered more than 5% after posting their biggest single-day sell-off in more than 5 years. Geopolitical risks remained in focus, with tensions in the Russia–Ukraine conflict lingering following reports of a suspected Ukrainian drone incident near President Putin’s residence, even as negotiations continued with key issues unresolved

* Nymex Crude Oil extended its winning streak for a second consecutive session. Heightened geopolitical tensions, stemming from unresolved issues between Russia and Ukraine, and recent US strikes on a drug-related facility in Venezuela, supported prices and boosted the appeal of black gold. However, the near-term trend remains sideways for prices

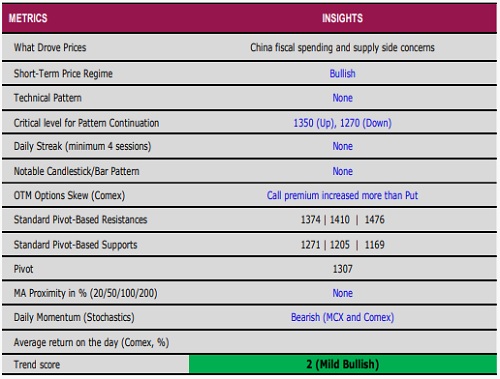

* Comex Copper rebounded over 3% in the last trading session after sliding nearly 5% in the previous day session. Supply disruption and strong demand have underpinned prices in 2025, and we expect copper to trend higher in 2026 as long as supply-side issues are not addressed.

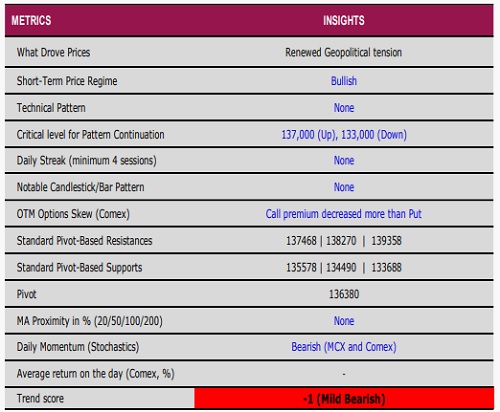

Gold

Silver

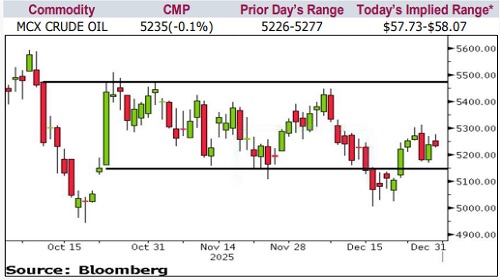

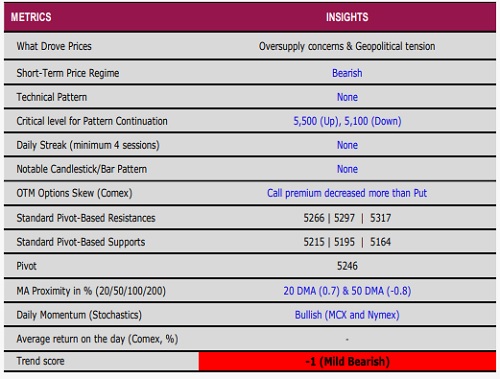

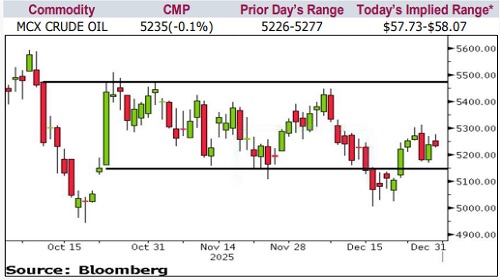

Crude Oil

Copper

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633