Market Strategy Note 2026 by Geojit Investments Ltd

What Went Right & Wrong in CY2025..?

* We began CY2025 with a cautiously optimistic outlook, recommending a diversified multi-asset strategy emphasizing large-cap equities, select sectors, precious metals, and debt.

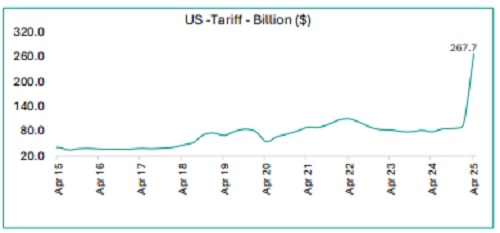

* Caution stemmed from India’s premium valuation, downgrade in domestic earnings and rising uncertainty around ‘TRUMPONOMICS’ as negotiation tactics intensified, pushing India from a favorable position to the highest tariff during the year. Optimism, however, was anchored in the absence of recessionary risk.

* Later geo-political risks escalated due to Indo-Pak and Israel-Hamas conflicts.

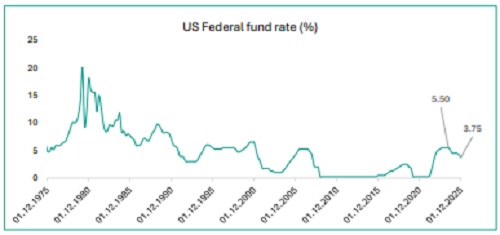

* Gold and silver emerged as the top-performing assets in CY25, driven by USD depreciation after tariff hikes and the Fed’s halt of quantitative tightening (QT).

* FIIs shifted to other EMs amid India’s premium valuations and lack of AI opportunities, triggering record INR depreciation due to heavy outflows and a widening trade deficit by the later part of the year.

* India’s performance stayed stable, supported by strong domestic buying and better earnings by Q2FY26 as inflation eased.

* Optimism was largely driven by large caps and select sectors such as PSUs, Auto, Metals, and Financials.

* As the year closes, key risks for 2026 include the US-India trade deal, elevated Fed rates, the Russia-Ukraine conflict, potential reversal of the yen carry trade, and persistently high valuations.

Elevated External Headwinds with Trade Tensions & Policy Response

* U.S. tariffs have depressed output, particularly in manufacturingintensive nations, and triggered supply chain reallocations, hurting both U.S. and global growth.

* Mexico's 50% tariff on Indian imports adds a new layer of trade complexity.

* Further, trade war has led to the blocking of critical minerals by China, which is adding further strain to the global supply chain.

* This turbulence tightens global liquidity and amplifies volatility, which often leads to capital shifting away from emerging markets.

* With US midterm elections nearing, the US government may fast-track trade negotiations to reduce risks.

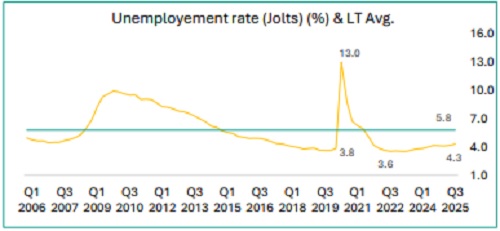

* The unemployment rate is on an upward trend, signaling potential stress in labor market.

* This could lead to further rate cuts, coupled with easing tariff tensions, to support economic growth, though it would be largely dependent on the US economy data like inflation, job and yield.

Global Risk Can Moderate in 2026

* Ongoing geopolitical tensions and a tariff-heavy trade backdrop continue to keep a safety premium embedded in gold.

* Further, robust purchases by global central banks while gold has now shifted from a traditional hedging asset to risk-off asset globally.

* Gold could have peaked in the medium term, while easing geopolitical and trade tensions in CY26 can lead to a prolonged consolidation rather than further upside, which could be positive for equity given the reverse relationship.

* Global economic activity has seen moderation, including major economies like the US and China. The IMF estimates global growth to moderate to 3.2% in CY25 & 3.1% in CY26 versus 3.3% in CY24.

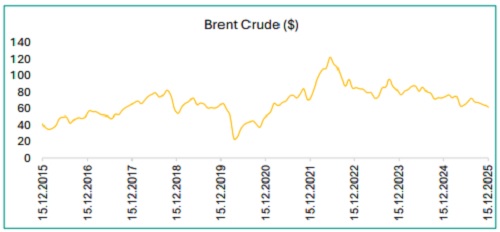

* Higher output from OPEC+, US shale, inventory build-up, seasonality and energy transition is driving oil prices on a downward trajectory, which is positive for containing global inflation and India.

* A potential end to the Russia-Ukraine conflict in the upcoming fiscal year could further reduce prices by stabilizing global supply chains.

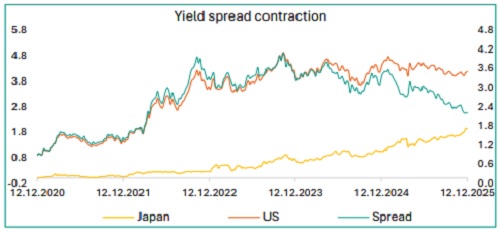

* Rising JGB yields and narrowing Japan-US 10-yr yield spread are increasing the risk of reverse carry trades.

* This shift in global funding continues to pressure EM currencies and market, including the INR and continued FII withdrawals.

* A reversal in FII outflows will largely depend on global rate easing, a weakening U.S. dollar and a reduction in trade concerns.

AI’s EXPONENTIAL RISE

Fundamentals vs. Bubble Fears

* The global AI industry is accelerating rapidly, with the industry expected to grow at a 30.6% CAGR in CY25-33E to reach a revenue size of USD 34.9 trillion (Grandview Research).

* AI adoption is accelerating across major industries, including technology, financial services, and healthcare, driving rapid deployment of AI-centric technologies and strengthening their commercial relevance across enterprise operations.

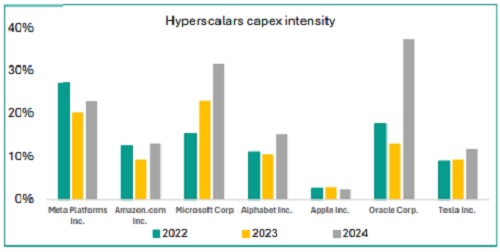

* Hyperscalers are rapidly increasing capital-expenditure intensity, with firms like Microsoft, Oracle, and Meta directing a growing share of revenue toward AI infrastructure, compute, and data-center investments.

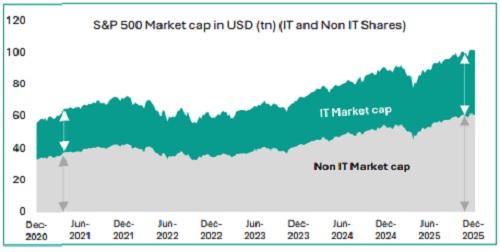

* In S&P 500 Index, IT constitute 70 stocks. AI’s influence has lifted the sector’s share of the total market cap from 27% in 2020 to 33% of its $60tn, fueling fears of AI bubble.

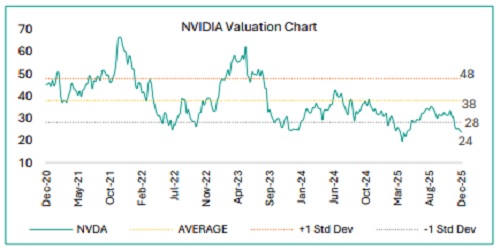

* However, valuations seem justified, as exemplified by NVIDIA, one of the major beneficiaries of AI industry momentum, which trades at 24x 1-year forward PE, a 37% discount to its 5-year average, while its earnings are expected to grow at 57% CAGR between CY25–27E.

* With expanding use-cases, rising enterprise adoption, and strong earnings visibility for the industry, AI’s long-term fundamentals remain robust, supporting the next phase of growth even as markets stay alert to bubble-like narratives.

STABLE GDP

While Low Inflation Brings Stagnation in Short-term

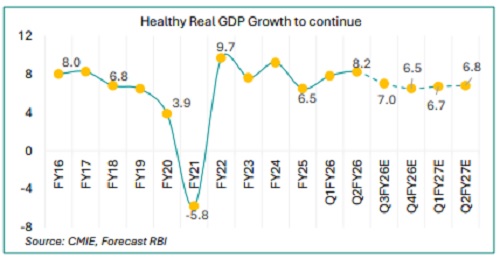

* India is expected to record steady GDP growth over the coming year, underpinned by resilient domestic demand and a benign inflation environment.

* Despite 8% real GDP growth, nominal GDP growth was soft at 8.8% in H1FY26, well below the 10.1% budget assumption for FY26, reflecting broad price stagnation across commodities and manufacturing.

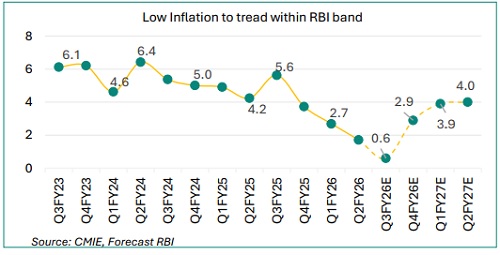

* Inflation is expected to edge higher during 2026 and remain within the RBI’s target range, supported by subdued oil prices and adequate food stocks.

* The government has shifted its policy emphasis toward supporting the demand side through proactive fiscal measures, after having focused predominantly on supply-side support in earlier periods.

* Income tax cuts, GST rationalization and the upcoming 8th Pay Commission will boost household disposable incomes, spur consumption and stimulate demand.

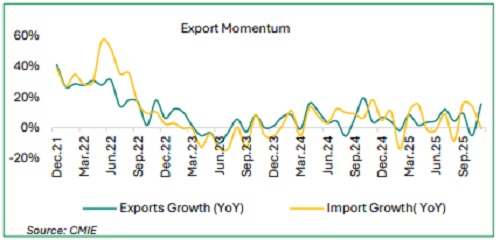

* Merchandise exports have witnessed notable volatility on a MoM basis, bringing uncertainty in the short-term, while broadly remaining resilient despite tariff challenges. Services exports continue steady growth, which, combined with subdued oil prices, will act as a cushion for the current account deficit.

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH20000034

.jpg)