Daily Derivatives Report 12th September 2025 by Axis Securities Ltd

The Day That Was:

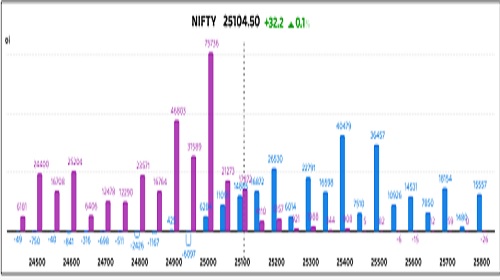

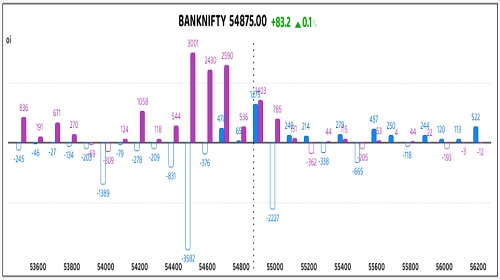

Nifty Futures: 25,104.5 (0.1%), Bank Nifty Futures: 54,875.0 (0.2%).

Nifty Futures saw a marginal increase of 32.2 points, with open interest decreasing by 1,05,525 shares, and Bank Nifty Futures rose by 83.2 points, with open interest decreasing by 1,03,390 shares, with both instances indicating short covering. The Nifty index closed above the 25,000 level after a volatile session, marking its seventh consecutive session of gains, while the Bank Nifty continued to lag behind the broader market. The Nifty futures premium narrowed to 99 points, while the Bank Nifty premium decreased significantly from 256 to 205 points. The positive momentum was driven by upbeat global markets and expectations of an interest rate cut by the US Federal Reserve next week, as well as hopes of easing diplomatic tensions between India and the U.S. There was a notable rotation in sectors, with Oil & gas, media, and PSU Banks advancing, while IT, consumer durables, and auto sectors faced declines. The Nifty Oil & Gas index led the charge, rising 1.08% to 11,084.10, bringing its two-day gains to 1.43%. The India VIX, a measure of market volatility, fell by 1.71% to 10.36, signalling a low-fear and stable market environment. In contrast to the positive equity market, the Indian Rupee weakened, dropping 36 paise to close at a new all-time low of 88.47 against the U.S. dollar, primarily due to pressure from US tariffs.

Global Movers:

US stocks continued their record-breaking run, on expectations of policy easing. The S&P rose 0.8% to finish at 6587, while the Nasdaq 100 climbed 0.6%. Meanwhile, data showed that US core CPI rose by the expected 0.3% m/m and jobless claims climbed to a four-year high. That keeps the view intact that two rates are coming before year-end, with the first happening at the FOMC meeting next week. Elsewhere, the ECB kept its key rate at 2% for a second straight meeting, as was expected, with traders ruling out any further cuts. In related markets, the VIX fell 4.2%, while the dollar index and the 10-year treasury yield continued their drop. Gold fell 0.2% on the day but is on track to end higher for the fourth straight week, while brent crude settled 1.7% down at $66.4 as the International Energy Agency warned of excess supply coming into the market.

Stock Futures:

Auropharma, BHEL, BSE Ltd., and Angel One were marked by considerable volatility, fueled by a surge in trading volume. This price action stemmed from a confluence of distinct, company-specific developments and a discernible shift in broader market sentiment.

Aurobindo Pharma (AUROPHARMA) surged yesterday, posting its highest single-day percentage price gain for the year amid a three-day rally. The stock's robust performance, which saw a 5.7% price gain and a 0.9% increase in open interest, defied a recent USFDA inspection at its Telangana-based Unit-XII facility. Market sentiment appears to have shrugged off the USFDA observations as procedural rather than critical, fueling a "Long Addition" of 335 contracts, bringing the total futures open interest to 36,606. The call-to-put option dynamic reflects this bullish momentum, with 3,132 new contracts added to the total call option open interest of 9,298, though new additions in put options were higher at 4,213, with total put open interest at 8,994, suggesting a mixed sentiment among options traders.

Bharat Heavy Electricals (BHEL) showcased a powerful rally, fueled by strategic portfolio diversification. The company's recent 10-year Memorandum of Understanding with a Singaporean firm to develop hydrogen fuel cell-based rolling stock for railways has positioned it to capitalise on India’s clean energy push. This momentum led to a 4% price gain and a 4.2% increase in open interest, with a "Long Addition" of 1,001 new contracts, bringing the total futures open interest to 24,714. While the futures premium to the spot price narrowed by 0.2 points to 0.82, the derivatives data signals a strong bullish conviction. The total open interest in call options stands at 8,702, with 1,062 new contracts added, while put options saw a greater addition of 1,327, bringing the total to 8,591, indicating a cautious optimism among traders.

BSE Ltd. (BSE) experienced a sharp correction, with its stock price plummeting 4.4% yesterday, capping a two-day decline of around 8%. This downturn was ignited by regulatory concerns over a potential SEBI proposal to shift from weekly to monthly F&O contracts, a move that threatens to undercut trading volumes and, consequently, the exchange's revenue model. The stock's decline was accompanied by a "Short Addition," as open interest surged 8.3%, with 2,703 new contracts bringing the total futures open interest to 35,234. The derivatives positioning paints a bearish picture, with a substantial addition of 10,873 new call option contracts and 7,088 new put option contracts, pushing the total open interest to 41,579 and 25,729, respectively, with the put-call ratio (PCR) holding steady at 0.62.

Angel One (ANGELONE) faced a significant sell-off, with its stock price dropping 5.5% amidst broader market concerns. The primary catalyst was a report suggesting that SEBI may phase out weekly F&O contracts in favour of a monthly expiry structure, a development that directly challenges the firm's retail-driven, high-frequency trading revenue model. The "Short Addition" in the stock was marked by a dramatic 20% increase in open interest, with 2,795 new contracts added, raising the total futures open interest to 16,744. The options market reflects this bearish sentiment, as the total call option open interest stands at 15,466 with 4,869 new contracts added, while total put open interest is at 10,983 with a smaller addition of 2,659 contracts. The put-call ratio (PCR) also declined to 0.71 from 0.79, signalling a greater inclination toward call buying or put writing.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) rose to 1.17 from 1.15 points, while the Bank Nifty PCR rose from 1.01 to 1.04 points.

Implied Volatility:

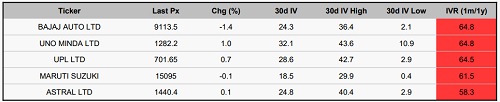

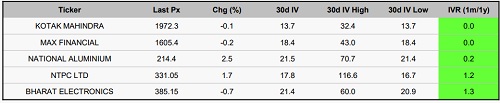

UPL Ltd and Bajaj Auto currently exhibit high implied volatility (IV), at 24% and 29% respectively, with IV rankings of 64% and 65%. These elevated figures suggest that options on these stocks are priced higher due to market uncertainty and the potential for significant price swings, presenting a higher risk for traders. Conversely, Kotak Bank and National Aluminium have the lowest implied volatility in the group, with IV rankings of 14% and 22%. This indicates more stable price movements and, consequently, more affordable options. In this market environment, simple directional strategies (buying calls or puts) are generally more profitable and also present a better risk profile for options sellers.

Options volume and Open Interest highlights:

LIC Housing Finance (LICHSGFIN) and Container Corporation (CONCOR) are exhibiting robust bullish momentum, underscored by a powerful call-to-put volume ratio of 5:1 for both, signaling dominant market optimism and a widespread expectation of continued price appreciation. However, this fervent demand for call options has inflated premiums, which could temper the appeal of new long positions. In a stark reversal of sentiment, Angel One (ANGELONE) and BSE Ltd. (BSE) are navigating a sea of bearish pressure, evidenced by their elevated put-to-call volume ratios. This imbalance indicates a negative market outlook, with the surge in put options suggesting these stocks may be nearing oversold conditions, a dynamic that could attract contrarian traders despite the prevailing negative trend. Elsewhere in the options market, Kaynes Technology and OFSS are witnessing significant open interest accumulation in both call and put options, reflecting a battleground of investor conviction. Meanwhile, Piramal Pharma is flashing a probable positive signal, with a sharp spike in call buying pointing to growing investor interest and a potential for upward momentum, while a simultaneous rise in put option volumes for Bharat Forge and RVNL suggests a defensive shift in market stance, potentially setting the stage for increased short-term volatility. (This data covers only stock options with at least 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

In the index futures segment, a notable shift in open interest was observed, with a total change of 3,340 contracts. This dynamic was primarily driven by a substantial increase of 3,340 contracts by Foreign Institutional Investors (FIIs), which was counterbalanced by a significant decrease of 3,018 contracts from proprietary traders and a modest reduction of 322 contracts from retail clients. Conversely, the stock futures market experienced a change of 39,052 contracts, showcasing a stark divergence in participant positioning. Here, retail clients demonstrated a strong bullish bias by adding 20,718 contracts, while proprietary traders also exhibited a positive outlook with an addition of 16,713 contracts. This was in direct contrast to FIIs, who liquidated a substantial 39,052 contracts, suggesting a bearish or profit-booking stance. The divergent positioning between FIIs and domestic participants across both index and stock futures highlights a notable contrast in market sentiment.

Nifty

Bank Nifty

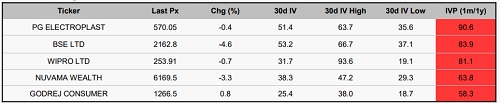

Stocks with High IVR:

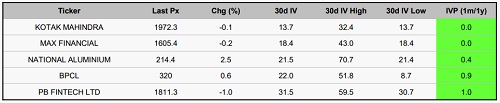

Stocks with Low IVR:

Stocks With High IVP:

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633