Weekly Derivatives Insights 17th December 2025 by Axis Securities

The Week That Was:

* Nifty futures closed at 26,145.4 on Friday, slipping 0.7% (187.8 points). Open interest rose 12.8%, with an addition of 20.59 lakh contracts, taking total OI to 181.95 lakh. The combination of rising OI and falling price clearly indicates a short build-up, keeping near-term sentiment cautious and mildly bearish.

* Bank Nifty futures settled at 59,657.8, declining 0.7% (397.8 points). Open interest rose 14.6%, with an addition of 2.45 lakh contracts, taking total OI to 19.41 lakh. The rise in OI alongside the price drop confirms a short build-up, keeping sentiment cautious with a bearish undertone.

* India VIX eased to 10.11 from 10.31, marking a 1.9% decline, reflecting continued low volatility expectations.

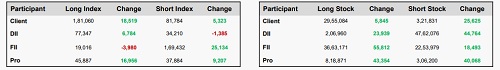

* The FII Long-Short ratio slipped to 0.11 from 0.16, indicating unwinding of index futures longs alongside a meaningful build-up in shorts. With short positions outpacing longs, the data reflects cautious undertones, even as broader sentiment retains a optimistic bias.

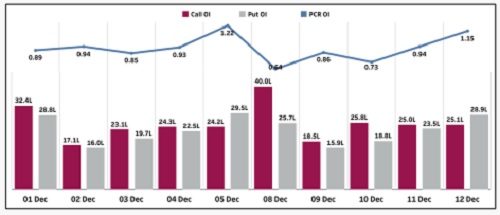

Nifty Open Interest Put-Call Ratio

* Nifty Put-Call Ratio (PCR) declined by 0.07 over the week, driven by a notable rise in Call option open interest and a simultaneous reduction in Put option open interest, with Call positions adding significantly more than Puts on a comparative basis. This shift indicates a mildly call-heavy trading sentiment.

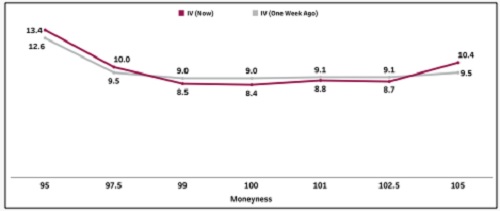

Volatility Analysis

* The decline in implied volatility across both out-of-the-money call and put options relative to last week indicates that the market anticipates steady price action and a reduced probability of significant, sudden fluctuations.

* Moreover, the flattening trend in the term structure reflects a lower perceived risk of future extreme events, resulting in diminished demand for hedging and leveraged directional positions.

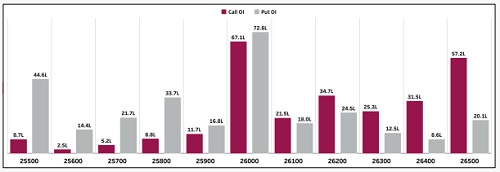

Nifty Open Interest Concentration (Monthly)

* The strike-concentration for the current monthly expiry has substantial open-interest buildup on the Call side at 27,000 and 26,000, while the Put side shows notable positioning at 26,000 and 25,000. A similar pattern was observed in the previous week, reflecting a largely unchanged positioning structure across week.

* Speaking of open interest changes, the 26,400-strike Call and 25,800 strike Put saw the maximum addition, alongside the 26,500 strike Call and 25,900 strike Put.

* Based on the data, we project the Nifty to trade between 25,800 and 26,500 in the week ahead.

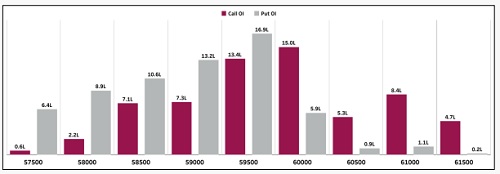

Bank Nifty Open Interest Concentration (Monthly)

* The strike-concentration for the current month’s expiry shows Bank Nifty open-interest buildup on the Call side at 60,000 and 59,500, while the Put side is concentrated at 59,500 and 59,000. The previous week reflected identical setup, with Call and Put anchored at the same strikes, underscoring a steady and unchanged open-interest structure across week.

* Speaking of open interest changes, the 59,500-strike Call and 57,500 strike Put saw the maximum addition, alongside the 59,600 strike Call and 58,800 strike Put.

* Based on the data, we project the Bank Nifty to trade between 58,500 and 60,000 in the coming week.

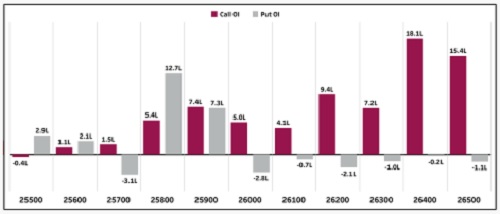

Nifty Change in Open Interest (Monthly)

* For Nifty in the current monthly expiration cycle, notable addition in calls was seen at the following strikes - 25,900 (7.4 Lc), 26,200 (9.4 Lc), and 26,400 (18.1 Lc), respectively. There was notable unwinding observed at 26,700 & 26,800 strike.

* Coming to puts, the 25,900 (7.3 Lc), 25,800 (12.7 Lc), and 25,500 strikes (2.9 Lc) saw considerable addition in open interest. There was notable Unwinding witnessed at 26,000 & 26,200 strike.

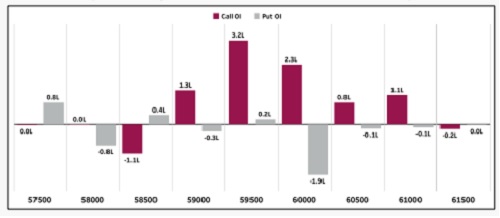

Bank Nifty Change in Open Interest (Monthly)

* For the Bank Nifty based on the current monthly expiration cycle - notable addition in calls was seen at the following strikes - 59,400 (1.7 Lc), 59,500 (3.2 Lc), and 60,000 (2.3 Lc), respectively. There was significant unwinding observed at 58,500 strike.

* Coming to puts, the 59,400 (0.5 Lc), 58,800 (0.6 Lc), and 57,800 strikes (0.6 Lc) saw considerable addition in open interest. There was significant unwinding observed at 60,000 & 59,800 strike.

Weekly Participant-wise Open Interest (contracts)

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633