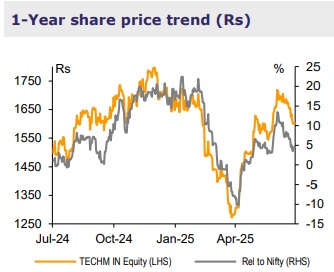

Reduce Tech Mahindra Ltd For Target Rs. 1,600 By Emkay Global Financial Services Ltd

Modest miss; margin roll-up continues in succession

TechM’s 1Q operating performance was slightly below expectations. Revenue grew 1.0% QoQ to USD1.56bn (down 1.4% CC), marginally missing estimates. With EBITM expanding by 60bps QoQ to 11.1%, TechM logged the 7th quarter of margin expansion, on disciplined execution and benefits accruing from Project Fortius, albeit a tad lower than estimated. Deal intake stayed strong for a 3rd straight quarter, with TCV of USD809mn driving 44% growth in deal intake on TTM basis. Revenue conversion was hit by a challenging macro environment, right-sizing field service business, reduced spending in Auto, and certain client run-offs leading to a slower start in FY26. However, the mgmt expects growth to improve Q2 onward, and certainly from H2, backed by deal wins and pipeline. The mgmt reiterated its 15% EBITM target for FY27, albeit suggesting risk from the prolonged period of an uncertain and tough macro environment. We cut FY26E-28E EPS by 2.4%-0.1%, factoring in the Q1 performance. Given the rich valuations, we retain REDUCE on TechM with TP of Rs1,600 at 20x Jun-27E EPS.

Results Summary

Revenue increased 1% QoQ (down 1.4% CC) to USD1.56bn, below our expectation of a 0.3% CC decline. Revenue for the IT Services and BPS segments was up 0.7% and 2.9% QoQ, respectively. Manufacturing (4.1% QoQ in USD terms), Communications (2.8%), Hi-Tech (1.4%), and HLS (0.8%) led the growth, whereas RTL (down 1.1%) and BFSI (down 0.5%) declined in Q1. Among geographies, Americas and Europe grew 2.7% and 3.3% QoQ in USD terms, while RoW declined 4.4%. EBITM expanded by 60bps QoQ as headwinds from the Comviva seasonality, higher visa costs, and lower utilization were offset by benefits from the offshore shift, G&A optimization including progress made on integration of portfolio companies, and savings from Project Fortius. Net-new deal wins improved sequentially to USD809mn. Total headcount declined 0.1% QoQ to 148,517, largely owing to fall in IT headcount. LTM attrition inched up to 12.6% (vs 11.8% in Q4). What we liked: strong deal intake, margin expansion. What we did not like: weak cash conversion (46% OCF/EBITDA), sequential softness in the BFSI and Retail verticals.

Earnings Call KTAs

1) Despite a tough macro backdrop and focus on profitable growth, the company sees steady improvement in large-deal momentum. With most run-offs behind, revenue conversion is expected to strengthen from Q2, supported by robust deal intake and the so far delayed large BPS deals now starting to contribute. 2) Hi-Tech was impacted by ongoing restructuring in the semiconductor industry, including steep budget cuts and workforce rationalization at a key client; gradual recovery is expected in H2FY26. 3) Communications is showing signs of stability, particularly in the APJ region, while India, the Middle East, and Africa have faced some volatility; however, new leadership has been appointed to drive improved performance in these markets. Europe is seeing a strong pipeline owing to consolidation opportunities and expansion of the Comviva suite. In the Americas, spending at key clients is showing signs of stabilization 4) BFSI remains one of the fastest growing verticals, with the company continuing to be optimistic about the vertical’s long-term potential across all geographies. 5) Manufacturing grew 4% QoQ in Q1, on the back of growth in Aero; however, the outlook remains challenging, impacted by the weakness in auto and the tariff uncertainties. The company continues to monitor its higher exposure to US auto OEMs, which may be affected by tariffs. 6) From the contracting and pricing perspective, the management has been prudent for large deals and is not focusing on ‘revenue at any cost’. 7) The company is focusing on three areas for driving tangible outcomes: i) scaling large clients through a ‘Turbocharge program’ – aiming at large accounts growing faster than the company average; ii) adding must-have accounts (added 15 new such accounts in Q1); iii) zeroing in on profitable large deals. 8) Going forward, it expects to drive margin via a) reduced subcontracting costs, b) greater shift to offshore delivery, c) integration-driven performance improvement in portfolio companies, and d) increased productivity in FPP. 9) The company anticipates outperforming in FY26 vs FY25, supported by the deal ramp-up. 10) The company has strengthened its senior leadership team with several appointments, including Amol Phadke as Chief Transformation Officer, and internal promotions for heads of telecom business in Americas and the India/Middle East/Africa businesses. 11) The company added 250 freshers in Q1.

Update on AI/Gen AI

1) The AI Delivered Right strategy has gained strong customer traction since its launch last quarter, having driven multiple deal-wins and recognition across its four core pillars – productivity delivered, transformation delivered, innovation delivered, and assurance delivered. 2) The company built >200 enterprise-grade AI agents across various industry segments, with several in use at scale with clients now. 3) TechM’s Advanced AI Consulting Practice and partner ecosystem are accelerating agentic AI adoption, enabling clients to validate ROI and prioritize use cases efficiently. 4) The management considers autonomous networks and network optimization using AI as significant opportunities in the telecom sector. 5) More than 77k employees have been trained in AI and Gen AI, with several having received advance training and certifications.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354