Buy Oil and Natural Gas Corporation Ltd For Target Rs. 327 By Elara Capital Ltd

Production growth triggers in place

For the past three months, ONGC (ONGC IN) performance was similar to the benchmark Nifty Index (down 1-4%), as volatile crude oil price impact was offset by rising visibility on oil & gas production for the next three years. Standalone production performance during QoQ was encouraging and its recent plan to increase reserve recovery by 60% from the flagship Mumbai High field would bring much-needed production growth prospects beyond FY27. Additionally, administered price mechanism (APM) gas prices would increase by USD 0.25/mmbtu each year until FY27 as per the Kirit Parekh Committee report. Therefore, we reiterate Buy with a SOTP-based TP of INR 327.

EBITDA up 11% YoY, led by higher production, realization and INR weakening:

Q3 EBITDA at INR 190bn vs our estimates of INR 184bn, was up 11% YoY, because of fall in statutory levies, which resulted in 2% crude oil realization growth. Oil & gas production (ex of JV) up 3-4% YoY and the USD-INR rate weakened by 1% YoY. However, PAT at INR 82.4bn vs our estimates of INR 107.5bn fell 17% YoY due to the jump in depletion cost to INR 49bn, up 31%, with commissioning of the KG field and other income of INR 18bn, down 47%. QoQ production growth was up 5% each for crude oil and natural gas.

Rerating trigger #1 -- KG field ramp-up in CY25:

Current KG-98/2 field oil production is at 35,000bpd and ONGC expects it to ramp up to 45,000bpd and gas production to reach 10mmscmd from the current ~3mmscmd in CY25. Therefore, ONGC has set a target of oil & gas production of 44.5mn tonne, up 7% YoY, and 45.6mn tonne, up 2.5% YoY, of oil equivalent for FY26 and FY27, respectively.

Rerating trigger #2 -- enhancing Mumbai High reserve recovery by 60%:

Post collaboration with technical service provider (TSP), indicated incremental production by TSP in Mumbai High (MH) field from baseline production level is 60% over a period of 10 years, which we estimate will increase MH oil & gas output by ~40% from the current level of ~11mn ton oil equivalent by FY28. We believe successful implementation of MH output increase by TSP will lead to ~5% oil & gas production CAGR during FY24-28E. Enhanced gas production from KG and MH would attract premium pricing of 12% of crude oil price.

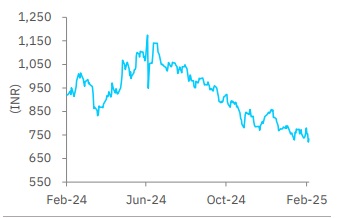

Price chart

We reiterate Buy with a TP at INR 327:

We expect ~5% oil & gas production CAGR during FY24-28E and higher natural gas realization from new wells & fields of nominated blocks. We cut our consolidated EPS by 19% for FY26E and by 11% for FY27E, due to reduced profitability estimates of subsidiaries and lower international crude oil prices. But we keep our TP unchanged at INR 327 as we ascribe a higher FY27E EV/EBITDA at 4.8x (from 4.5x) due to production growth visibility. We believe valuation multiple will further increase with the rise in oil & gas production of KG and MH fields. Our SOTPbased TP assumes crude oil realization at USD 75/bbl, gas realization at USD 7.3 per mmbtu for FY26E and USD 7.6 per mmbtu for FY27E, ONGC Videsh oil & gas reserves based on EV/boe at USD 3.5x (from USD 2.6/boe) and investments in listed entities at a 50% discount to the CMP.

Please refer disclaimer at Report

SEBI Registration number is INH000000933