Sell Samvardhana Motherson Ltd for Target Rs. 129 by Elara Capitals

Margins disappoint; organic growth weak

Organic revenue growth for Samvardhana Motherson International (MOTHERSO IN) was flat YoY, even as consolidated revenue grew by 8.3% YoY to INR 293bn, largely driven by inorganic revenues. EBITDA margin came in below estimates at 9.0%, down 183bps QoQ (Elara estimates: 10.5%), largely driven by lower margins for the modules and polymer segment (6.5%, down 426bps QoQ).

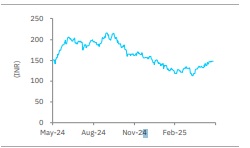

As discussed in our thematic, ‘China energizing seismic shifts’, MOTHERSO’s key European clients seem the most vulnerable currently, which should have a ripple effect on suppliers such as MOTHERSO. This is also visible in the group’s restructuring activities in the EU. Also, production of global light vehicles is expected to drop by ~3% YoY in FY26E, after declining by ~1% in FY25, thus limiting organic revenue growth in FY26 despite ramp-up in the non-auto segment. We largely retain our FY26E-27E estimates – The downgrade in core EPS is likely to be offset by the addition of Atsumitec acquisition. The consumer electronics business should ramp-up, but current valuations factor in related upside, even as there seems a downside to the core auto segment’s financials and multiples. Given the recent rally in the share price, we revise MOTHERSO to Sell from Reduce with TP unchanged at INR 129, on 18x (unchanged), still at >100% premium versus global ancillary peers (on June ’27E P/E).

Non-Auto drives growth for FY25: Non-automotive revenue in FY25 reached INR 31.86bn, up by 108% YoY, now contributing 2.4% to gross revenue versus 1.3% in FY24. This was mainly driven by the Aerospace division (FY25 revenue at INR 17.5bn), for which revenue surged by ~400% YoY, and EBITDA by ~80% YoY. MOTHERSO’s booked business for the non-automotive business is USD 2.7bn, of which Aerospace orderbook is USD 1.3bn. Total orderbook (booked business) is USD 88.1bn, of which 24% is from EVs.

FY30 gross revenue target of USD 108bn versus USD 26bn in FY25: While MOTHERSO has guided for gross revenue target of USD 108bn for FY30 (details expected in investor meet in October/ November 2025), versus FY25 gross revenue of USD 26bn, we note that net revenue in FY25 stood at only ~USD 13bn. Further, we believe, the inorganic expansion in autos in this cycle is fraught with risks as there are structural market share pressures for legacy OEMs globally. In consumer electronics, MOTHERSO has already operationalized a facility (Plant 1), with capacity of up to 15-17mn units by end-FY26. The plant is expected to start operations from Q2FY26, while the greenfield facility will commence operations from Q3FY27.

Revise to Sell; TP unchanged at INR 129: Our FY26E/ FY27E consolidated EPS estimates are 2-12% below Bloomberg consensus. We revise MOTHERSO to Sell (from Reduce), with TP unchanged at INR 129. The consumer electronics business is expected to ramp-up, but current valuations factor in related upside, even as there seems a downside to the financials and multiples of the core auto segment.

Please refer disclaimer at Report

SEBI Registration number is INH000000933