Buy GHCL Ltd For Target Rs. 900 By Emkay Global Financial Services Ltd

Resilient performance amid challenging environment

GHCL’s Q4 EBITDA at Rs2.2bn (+18% YoY/-5% QoQ) was above our estimates largely on the back of improvement in operational efficiencies leading to better margins vs our expectations (volume, realization was largely flat QoQ). The company reported 9% YoY volume growth in FY25 (pricing down ~17%). The management highlighted that domestic demand in India is strong and will continue to grow organically, by 200ktpa, with import duty on solar glass adding incremental demand. GHCL expects a muted demand environment in soda ash in CY25, owing to macro uncertainty and slower pick-up in demand from lithium carbonate and solar glass production, while container/flat glass demand is steady. GHCL’s plan for forward integration into bromine, vacuum salt, and backward integration into salt remains on track, improving revenue growth visibility from H2FY26E. We retain BUY with unchanged estimates and TP of Rs900 and assign 8x EV/EBITDA on Mar-27 estimates.

GHCL continues to report better margins, led by operational excellence

GHCL reported Q4FY25 revenue of Rs7.8bn (-5% YoY/flat QoQ), while EBITDA came in at Rs2.2bn (+18% YoY/ -5% QoQ), led by volume expansion, improvement in gross margins, and savings in power cost & other overheads. Q4FY25 accounted for better cost control measures (3% savings in power cost YoY), while volumes improved marginally. We expect the company’s proven cost reduction activities to aid margin improvement in FY26, along with backward integration. Other overheads were higher in Q4 vs Q3, due to volume increase, CSR expense, and some one-off gains taken in Q3FY25.

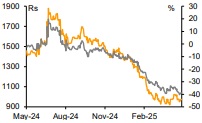

Pricing to remain under pressure amid muted demand environment

India market demand grew 5% YoY in FY25 and will see continued growth, of 200ktpa, primarily led by demand from solar glass manufacturers. Recent minimum import price (MIP) restriction by the government provided buffer to domestic pricing, with the industry not seeing any major benefit. The industry will seek extension post-expiry in Jun-25 due to weaker global demand. China is experiencing muted demand for solar glass and lithium carbonate due to geopolitical tensions and the recent tariff situation. This has led to supply spillover from the Inner Mongolia capacity addition to Southeast Asian and Middle eastern countries. In FY26, ~2mmt of capacities will be added (China: 1.1mmt and RoW: 0.9mmt); also, certain players have postponed commissioning. We expect China’s demand slowdown to keep prices rangebound in FY26.

Company on track with vacuum salt, bromine, and Zara Zumara projects

GHCL’s vacuum salt and bromine projects are expected to be commissioned in Q3FY26; this should aid revenue growth in FY26E. The salt production from Zara Zumara land should start FY26-27 onward, aiding gross margin benefit from captive consumption in its existing soda ash plant in the interim. The company has budgeted a capex of Rs42bn in phase 1 of the soda ash plant (550kt) and Rs26bn for phase 2 (550kt).

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354