Buy Astra Microwave Products Ltd For Target Rs. 768 By Geojit Financial Services Ltd

Margin to expand...order pipeline to improve

Astra Microwave Products Ltd. (AMPL) is a leading designer and manufacturer of a wide array of radio frequency systems, microwave chips, and microwave-based components and subsystems for defence, telecom, and space.

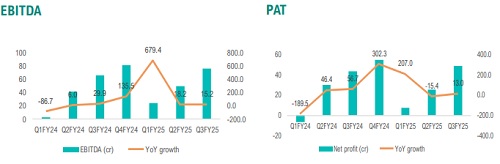

* In Q3FY25, AMPL reported a 12% increase in revenue, driven by healthy order execution, which was marginally lower than our estimates.

* EBITDA grew by 15% YoY, while margins were stable at 29.5%. Reported PAT increased by 9% YoY.

* 9MFY25 order inflow was at Rs.674cr, with ~70% of these orders are from domestic defence orders, which is expected support margins expansion.

* The current order backlog is at Rs.1,960cr, which is ~1.4x FY25E projected sales. Anticipate Rs.350cr of orders in Q4FY25.

* The order pipeline looks promising, with potential opportunities amounting to Rs.8,000cr within AMPL's total addressable market of Rs.39,000cr by FY28.

* Considering a shift in order execution mix towards domestic orders (~86% mix), we anticipate EBITDA margin in the range of ~25% for the next 2-3 years.

Outlook & Valuation

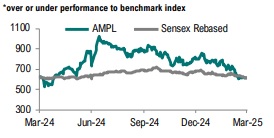

We maintain a positive outlook on AMPL as the order book is anticipated to improve going ahead, led by ongoing defence modernization. While AMPL's higher domestic order execution bodes well for margin expansion and earnings. We anticipate earnings to grow by 32% CAGR over FY25E-26E. AMPL is trading at a one-year forward P/E of ~30x (long-term average) post recent sharp correction. We value AMPL at P/E 30x as we roll forward to FY27E and maintain a BUY rating with a target price of Rs.768.

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345