Buy Suprajit Engineering Ltd For Target Rs. 520 By JM Financial Services Ltd

In 2QFY26, Suprajit Engineering Ltd. (SEL) reported a consolidated EBITDA margin of 10.6%, 80bps above JMFe, primarily driven by stronger-than-expected performance in the DCD and SCS businesses. Excluding SCS, the consolidated EBITDA margin expanded by 140bps YoY to 14.0%. Management indicated that the SCD segment is expected to perform well in 2HFY26, despite postponement of certain vehicle launches and the shelving of a few programs, supported by a strong order pipeline. The ongoing restructuring, expected to be completed by Dec’25, continues to enhance operating profitability, contributing to a 330bps YoY EBITDA margin expansion in 2Q. DCD is estimated to witness robust growth in 2HFY26, driven by a surge in automotive demand following GST rationalisation. With the GST rate cut (SEL’s products now taxed at 18% versus 28% earlier), SEL anticipates gaining market share in the aftermarket and winning business from unorganised players. Although PLD’s performance is expected to improve in 2HFY26, led by domestic business and new enquiries following a global competitor’s bankruptcy filing, export headwinds from the Middle East are likely to persist. For SED, ramp-up of orders from new customers and additional wins from multiple EW and E3W players are expected to support performance in the second half. Regarding SCS, management reiterated its guidance to turn EBITDA positive and begin delivering benefits from 4QFY26, driving margin improvement into FY27. SEL expects to outperform the global auto industry by 5–10%, with a margin guidance of 12–14% (excluding SCS). We roll forward and ascribe a 20x PE to the average EPS for FY27/28E, arriving at a target price (TP) of INR 520. Maintain BUY.

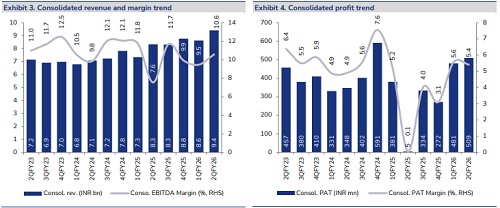

* 2QFY26 – Margin above estimates: Organic biz. performance: Consol. revenue (excluding SCS) stood at INR 8.3bn (+7.6% YoY and QoQ). EBITDA stood at INR 1,161mn (+18.9% YoY, +17% QoQ). EBITDA margin stood at 14.0% (+140bps YoY, +120bps QoQ). SCS performance: SCS reported operating revenue of INR 1.1bn with an EBITDA loss of INR 67mn. Reported performance: SEL’s consol. net sales stood at INR 9.4bn (+12.9% YoY, +9.1% QoQ), 6.8% above JMFe. EBITDA stood at INR 996mn (+58.1% YoY, +21.8% QoQ). EBIDTA margin stood at 10.6% (+300bps YoY, +110bps QoQ), 80bps above JMFe, primarily driven by a stronger-thanexpected performance in DCD and SCS businesses. Reported PAT came in at INR 509mn vs. 5mn YoY (+6% QoQ), 20.6% above JMFe due to higher-than-expected other income. Gross debt increased by INR 649mn QoQ to INR 7,384mn.

* Suprajit controls division (SCD): Revenue for 2Q grew by 7.1% YoY to INR 3.6bn (-7% QoQ), led by new programs. EBITDA margin improved 330bps YoY to 11.6% (-20bps QoQ), primarily led by operational improvements and restructuring initiatives. Regarding the US tariff, SEL highlighted that majority of the tariff related costs are being passed on the customer and the balance is absorbed. Further, it is working on mitigating the tariff impact via alternate delivery solutions and proposals for its US OEMs. Despite uncertainties with postponenment / delay in a few program launches, the company expects SCD to perform well in 2H. Additonally, the restructuring activities are on track with completion expected by Dec’25.

* Domestic cable division (DCD): Revenue for 2Q stood at INR 3.4bn (+10.3% YoY; +24.5% QoQ). EBITDA margin contracted by 40bps YoY to 16.8% (+190bps QoQ). Aftermarket growth remained robust and beyond cables projects continued to receive healthy traction. Capacity addition catering to PV segment has been completed at Chakan. Looking ahead, SEL expects a strong performance in 2H, led by better automotive sector growth due to GST reforms and continued momentum across the aftermarket and beyond cables product lines. Further, with the GST rate cut (SEL’s products now taxed at 18% versus 28% earlier), SEL anticipates gaining market share in the aftermarket and winning business from unorganised players.

* Phoenix lamps division (PLD): Revenue declined 7.2% YoY at INR 941mn (+8.9% QoQ) due to sharp reduction in export to the Middle East (both Trifa brand and direct sales). EBITDA margin contracted 240bps YoY to 12.6% (-20bps QoQ). The company expects 2H to be better than 1H, led by domestic business and new enquiries owing to bankruptcy filing by a global competitor, while headwinds from Middle East may persist.

* Suprajit Electronics Division and Technology Centre (SED & STC): Revenue for the segment grew 35.9% YoY to INR 411mn (+35.2% QoQ) and EBITDA margins expanded 840bps YoY to 13.6% (+670bps QoQ). Volume reduction from a major EV customer was more than offset by new order execution from other customers. Looking ahead, ramp-up of orders from new customers and additional order wins from multiple EW and E3W players are expected to support performance in 2H. STC has collaborated for sunroof cables. Further, it has been working with Blubrake for the development of an ABS product, with two customer requirements under validation. This could be a growth trigger given mandatory implementation of ABS across all 2Ws starting from Jan’26 (final notification is awaited though).

* Other Highlights: 1) SEL expects to outperform the global auto industry by 5-10%, with 12- 14% margin guidance (excluding SCS). 2) Revenue contribution from Automotive / 2W / Aftermarket / Non-Automotive stood at 44% / 26% / 15% / 15% for 1HFY26 (vs. 39% / 28% / 17% / 15% in FY25). 3) SCS: Revenue for the quarter (first full quarter post-integration of all assets) stood at INR 1.9bn (vs. INR 897mn in 1QFY26). EBITDA margin improved significantly from -19.6% in 1QFY26 to -6.1% in 2QFY26, and the company expects it to turn EBITDA positive by 4QFY26.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361