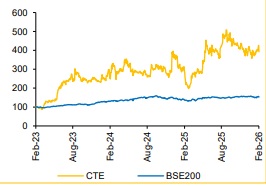

Buy Centum Electronics Ltd for the Target Rs.3,000 by Choice Institutional Equity Limited

Execution Stabilising; Strategic Positioning Intact

CTE delivered a measured quarter; we expect near-term growth to remain moderate. The underlying order book of INR 17,001 Mn (~1.5x FY25 revenue) provides a healthy revenue visibility. We expect the Builtto-Spec (BTS) segment to continue to be anchored by domestic defence and space programmes, while the EMS business offers stability through shorter execution cycles. We believe that the increasing mix of strategic programmes will enhance earnings quality and improve margin in the medium term

We believe that CTE is strategically deepening its presence in missioncritical defence, space and aerospace electronics, accelerating its evolution from a component supplier to a higher-value system-level partner. Continued participation in advanced ISRO programmes and collaborations with leading domestic defence players strengthen its positioning in complex, high-entry-barrier segments.

We believe that the India-EU engagement will support rationalisation of overseas subsidiaries, reducing earnings drag and improving capital efficiency, thereby sharpening mgmt. focus on the structurally stronger India defence and space opportunity. With rising exposure to EW payloads, space systems and naval electronics, margin quality and earnings visibility are set to strengthen in the medium term.

Strong Operating Performance; Exceptional Losses Weigh on PAT

* Revenue for Q3FY26 up by 21.8% YoY and up by 19.3% QoQ at INR 3,332 Mn (vs CIE est. INR 3,205 Mn)

* EBIDTA for Q3FY26 up by 22.3% YoY and up by 47.7% QoQ at INR 333 Mn (vs CIE est. INR 234 Mn). The EBITDA margin stood at 10.3%, increased by 8 bps YoY (vs CIE est. of 7.4%)

* PAT for Q3FY26 came at INR -618 Mn (vs CIE est. INR 55 Mn)

* Reported PAT reflects negative adjustments totaling INR 871 Mn, comprising exceptional items of INR 573 Mn (impairment charges in European subsidiaries) and losses of INR 298 Mn from discontinued Canadian operations

View & Valuation: We maintain our positive stance on CTE and reiterate our BUY rating. We value the stock at PE of 35x multiple, implying a target price of INR 3,000.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131