Accumulate Finolex Industries Ltd for the Target Rs. 228 By Prabhudas Liladhar Capital Ltd

ADD on PVC resin to drive volume growth, margin improvement

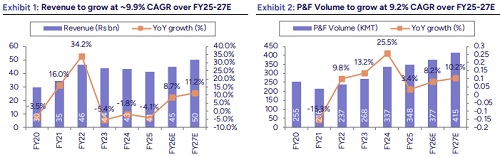

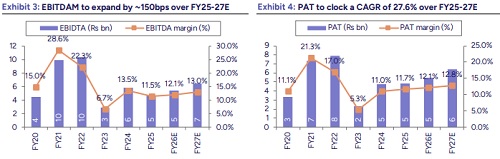

We upward revise our FY26E/FY27E earnings estimate by 7.1%/5.7% and maintain ‘Accumulate’ rating with revised TP of Rs228 (Rs217 earlier), based on 20x FY27E earnings plus valued stake in the group listed entity Finolex Cables at 50% discount to consensus target market value. We recently met the management of Finolex Industries (FNXP) to gauge volume growth outlook, market share dynamics, PVC resin availability, and price trends post DGTR’s final findings on ADD on PVC resin. The company reiterated its 10% volume growth guidance in Pipes & Fittings (P&F) for FY26 and expects margin improvement ahead. We believe FNXP stands to benefit from 1) imposition of ADD on PVC resin given its backward integration, 2) GST rate revision on agri pipes, 3) expanding dealer/distribution network, and 4) gradual expansion in P&F capacity. We estimate revenue/EBITDA/PAT CAGR of 9.9%/16.9%/27.6% for FY25-27E with P&F volume CAGR of 9.2% and EBITDA margin of 13.0% by FY27E. Maintain ‘Accumulate’.

Key Takeaways:

* Industry growth and size: The industry is expected to reach Rs1,000bn by 2030, attracting new entrants and fresh PVC resin capacities, with Adani likely to scale up significantly over the next 2–3 years. Recent imposition of ADD on PVC resin and the upcoming BIS implementation (Dec’25) should reduce trading volumes and weed out smaller, non-compliant players, who remain vulnerable to rising resin costs and regulatory requirements. While disruptive product technology is unlikely, the rise of organized players could meaningfully alter the distribution landscape.

* FNXP’s P&F volume growth: The management reiterated its 10% P&F volume growth guidance for FY26. The industry is expected to benefit from the imposition of ADD on PVC resin, with inventory restocking likely to begin soon. This should ultimately support higher organized market share, as smaller P&F players struggle amid rising resin costs. After a subdued Q1FY26, performance improved sharply in Jul’25, aided by a low base and deferred sales from Jun’25. As a result, YTD growth stands in high single digits, and with ADD on PVC resin in place, the management is confident of meeting its guidance.

* Levy of ADD on PVC resin: PVC prices are likely to increase by Rs7–8/kg following ADD implementation, which is expected within 1–2 months (deferment unlikely). Players without value-chain integration will face margin pressure, while Chinese producers, lacking alternate large export markets, may attempt to offset ADD through lower production costs or government incentives. In the near term, smaller players’ costs are expected to rise; over time, Reliance and Adani, with their large upcoming capacities, are likely to gain pricing power in PVC resin, impacting the P&F market. In the agri pipe segment, however, high price elasticity remains a concern, as higher PVC prices could curb demand, posing a risk for FNXP.

* Proposed GST rate cut on P&F: Currently, plastic P&F attract 18% GST. According to the management, introducing differential GST rates by usage (agri, infra, plumbing) is not feasible, as product substitution/swapping across segments is easy.

* VCM supply concerns for FNXP: The industry remains heavily dependent on the VCM–PVC route for PVC resin manufacturing, with limited alternatives available. FNXP produces 125k MT of its total 272k MT PVC resin capacity through this route. While the company may face supply issues from its existing vendor, it is exploring sourcing options from other geographies. The management indicated that supply continuity should not be a challenge, though logistics and related costs may increase.

* Outsourcing constraints: The company is unlikely to pursue outsourcing partnerships for expansion, given the fragmented market with numerous small manufacturers. Establishing a large facility also requires substantial land (~30 acres for a 100k MT plant), which is difficult to secure, making the availability of large outsourcing partners limited. FNXP operates with an outsourced capacity of 36k MT.

* Capacity expansion plan: FNXP has increased its capacity to 520k MT from 470k MT in Mar’25, with utilization expected at 70–75% and targeting ~10% growth in FY26. The company is also evaluating further capacity expansion opportunities; while no specifics were shared, the management indicated that a greenfield project could be considered in the future to drive growth.

* CPVC business: The business contributes to ~7% of revenue, with a target to reach 10% in the next 2 years. The business leverages the common distribution network (no separate channel) and is adopting a penetrative pricing strategy to drive market share gains.

* Management oversight: The leadership team, led by promoter Mr. Prakash Chhabria, remains actively engaged in the business through regular interactions from London, while his daughter is increasingly involved in operations. In addition, Mr. Udipt Agarwal has been appointed as Additional Director/Whole-time Director effective 5th Sep’25, and will take charge as the Managing Director from 1st Nov’25. He currently serves as the Chief Commercial Officer at Alkyl Amines Chemicals Ltd.

Above views are of the author and not of the website kindly read disclaimer

.jpg)

.jpg)