Buy JSW Energy Ltd For the Target Of Rs. 565 By the Axis securites

JSW Energy Ltd (JSWE) operates across the entire power sector value chain, with diversified assets across 11 states. The company is engaged in power generation, transmission, and emerging segments such as energy storage systems (ESS) and Green Hydrogen, positioning itself as a key player in the transition to sustainable energy solutions.

Investment Rationale

A. Pick-up in power demand and increase in power price: Over FY13-F23, the power demand in India grew at a CAGR of ~4.3% and the peak demand by 4.7%. Feb’25 saw a pick-up in the power demand. Peak demand in Feb’25 reached 243 GW (up 9.5% YoY). For the Month of March, the energy consumption is picking up, with consumption to date being 57 BU, a 9.4% increase on a YoY basis. The demand is expected to improve further in the upcoming summer. Further, the Day-Ahead Market (DAM) prices on IEX have been improving, with Prices in March reaching up to Rs ~5 per unit. The company has ~28% of its portfolio available for sale in merchant markets and is expected to benefit with the increase in DAM Prices.

B. Capacity Expansion: The company added 377 MW of capacity in Q3FY25, taking its installed capacity to 8,117 MW as of Dec’24. With recent wind project acquisitions and the completion of the KSK Mahanadi Power Company Limited, the company’s operational capacity has reached 10,200 MW, surpassing its 10 GW milestone for FY25. The company’s consolidated installed capacity is expected to be 14 GW by Jun’25. Its locked-in capacity has increased to 28.3 GW and is on track to achieve its target of 20 GW of installed capacity before the initial guidance of 2030.

C. Acquisitions of KSK Mahanadi: On 13th February 2025, the NCLT approved the Resolution Plan submitted by the company for the corporate insolvency resolution process of KSK Mahanadi Power Company Limited. The Competition Commission of India, vide order dated 4 th March 2025 (CCI Approval Order), approved the acquisition of KSK Mahanadi Power Company Limited by the Company. With the approvals, the acquisition of the KSK Mahanadi is now complete, with a resolution amount of Rs 16,084 Cr being paid. The company now holds 74% equity shares in the company. KSK Mahanadi’s 1,800 MW is fully operational and tied up, while for the balance of 1.8 GW, a significant part is done for the first unit, and work is underway for other units

D. Other Acquisitions: On 27th Dec’24, the company announced the acquisition of O2 power, a leading renewable platform with a capacity of 4,696 MW, at a valuation of Rs 12,468 Cr. 2.3 GW of the O2 power assets are to be operationalised by Jun’25, and the balance of 2.4 GW is at various stages of completion, which would require a Capex of Rs 13,000 to 14,000 Cr. The O2 power assets have a blended tariff of Rs 3.37 with high-quality off-takers like SECI, SJVN, and NTPC. On 10th Jan’25, the company also acquired 125 MW of wind projects from Hetero Labs and Hetero Drugs Ltd at an enterprise value of Rs 630 Cr. This portfolio has a blended tariff of Rs 5.22 per unit.

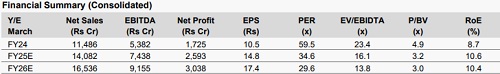

E. Recommendation: We believe that with the recent price corrections and expected pick-up in demand in the summer, the current CMP provides a good entry point. We recommend a BUY rating on the stock with a target price of Rs 565/share, implying an upside of 10% from the CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633