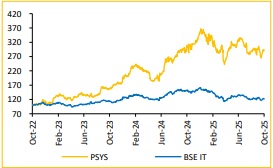

Add Persistent Systems Ltd for the Target Rs. 6,050 by Choice Institutional Equities

View and Valuation:

PSYS has achieved a robust 28% CAGR over the past 4 years, outperforming several peers even before the AI surge. The company focuses on its top 100 clients, representing over 82% of revenue, aiming to capture significant AI-related market share backed by its AI powered digital engineering platform SASVA. Successful wins against Tier-1 competitors, in Q2FY26, including a major financial services consolidation deal, highlight its strategic strength. Additionally, the company plans to implement contractual clauses to secure price increases for experienced resources, ensuring steady margin growth. Given this outlook, we expect Revenue/EBIT/PAT to expand at a CAGR of 18.2%/24.2%/23.9%, respectively, over FY25–FY28E and maintain our ADD rating with a target price of INR 6,050.

Strong Q2 for 22nd Consecutive Quarter despite Macro-headwinds

* Reported Revenue for Q2FY26 stood at USD 406.2Mn up 4.2% QoQ (vs CIE est. at USD 403.0Mn). In INR terms, revenue stood at INR 35.8Bn, up 7.4% QoQ.

* EBIT for Q2FY26 came in at INR 5.8Bn, up 12.7% QoQ (vs CIE est. at INR 5.4Bn). EBIT margin was up 75 bps QoQ to 16.3% (vs CIE est. at 15.5%).

* PAT came in at INR 4.7Bn, up 11.0% QoQ (vs CIE est. at INR 4.2Bn).

Sustained Growth Momentum driven by BFSI, Software & Hi-tech Deal Wins:

PSYS delivered strong Q2FY26 revenues at USD 406.2Mn (up 4.2% QoQ), marking its 22nd consecutive growth quarter. Its annualised run rate crossed USD 1.6Bn, keeping it on track to achieve USD 2Bn by FY27. TCV stood at USD 609.2Mn, with USD 350.8Mn from new bookings. BFSI leads growth, backed by consolidation wins, strong execution and robust pipeline. Software, Hi-Tech and Emerging Industries continue to gain momentum, supported by large deal wins. Healthcare and Life Sciences (HLS) is stabilising and set to rebound, as clients adapt to regulatory and macro shifts. PSYS sees this as an opportunity to deepen focus in its HLS subsegments rather than diversifying into new verticals. Despite macro challenges, the pipeline remains strong and broad-based, especially in BFSI and Hi-Tech. We expect PSYS to achieve sustainable growth across regions, driven by improving demand visibility in key verticals, a healthy pipeline and strong conversion to TCV and revenue.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131