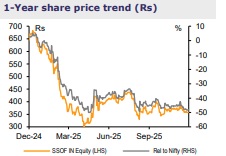

Buy Sonata Software Ltd for the Target Rs.400 By Emkay Global Financial Services Ltd

We hosted Sonata Software’s CFO Jagannathan CN as well as Deputy CFO Shilpa Kolhatkar, for NDR in Mumbai. Key takeaways: 1) In the IITS business, Sonata is facing three major headwinds—continued softness in a large TMT client, ramp down in a large BFSI client due to budget constraints, and weakness in RMD due to impact of tariffs and inflation; these are partly negated by healthy deal wins and traction in data, cloud, and AI opportunities. 2) BFS remains soft due to budget constraints at a large client and is likely to stay weak through Q3. TMT is gaining traction beyond big tech, though the top client remains subdued. RMD is muted due to tariff impacts and should stabilize by Q1. 3) In SITL, Sonata continues to execute its three-pillar strategy: a) driving growth in the Microsoft SMC segment, b) expanding AI-led partnerships with other ISVs, and c) securing large SI deals. 4) Focus on large deals remains central to the company’s growth strategy, contributing ~40% of the pipeline, with 28 large deals (RMD:14, TMT:7, BFSI:5, HLS:2) in the pipeline in Q2. Steady progress on large deals helped Sonata negate the aforementioned headwinds. 5) The mgmt expects next phase of wage revisions for mid-senior talent in Q3, though it remains confident of sustaining IITS EBITDAM recovery in H2, supported by AIdriven efficiencies, utilization gains, and offshoring. It targets high-teen EBITDAM in the near term, with aspirations to scale toward the low-20s over the medium term. We retain BUY on Sonata and our TP of Rs400 at 18x Sep27E EPS.

Expanding deal pipeline to keep the recovery engine in motion The company is focusing on consistently securing large deals, expanding presence in BFSI and HLS, and deepening capabilities in cloud, data, AI, and modernization engineering, to accelerate the revenue growth trajectory once specific headwinds normalize. It is seeing strong traction in cloud, data, and AI offerings, as reflected in cloud and data forming 55% of the pipeline, AI-led deal pipeline of USD293mn, and AI order book of USD10.8mn (~10% of order book) in Q2. The company expects EBITDAM recovery to sustain in H2 despite a planned wage hike for mid-to-senior level employees.

Headwinds in domestic business expected to persist; partially cushioned by targeted initiatives Microsoft is phasing out the traditional Enterprise Agreement (EA) and pivoting toward the Microsoft Customer Agreement for Enterprise (MCA-E), signaling that it is now prioritizing direct sales to enterprise clients. While near-term volatility persists due to shift toward direct engagement in large accounts (expect impact from one large client in H2FY26 and another from H2FY27), the company is actively mitigating the impact by: a) expanding partnerships with AWS, IBM, Google, Oracle, OpenText, etc, beyond the Microsoft stack; b) accelerating growth through the Microsoft SMC (small and midsize customers) channel; and c) scaling SOC (security operations center) for clients and winning large integrated SIT deals that combine platform engineering and services. The management indicated that its strategy around mitigation is underway, but some impact is expected in the near-term (next 4-6 quarters) performance.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354