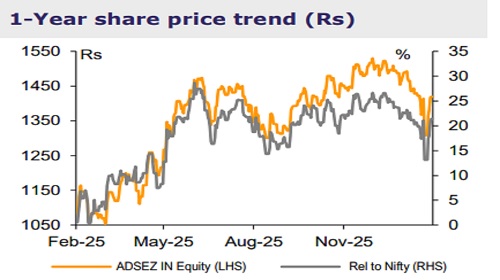

Buy Adani Ports Ltd for the Target Rs.1,900 by Emkay Global Financial Services Ltd

APSEZ delivered an impressive quarter, with sales/EBITDA/PAT growing 22%/20%/21% YoY. Buoyed by this performance and acquisition of the NQXT port asset, the management raised its FY26 EBITDA guidance to Rs228bn, while affirming the upper end of its previous revenue guidance. Accelerating growth momentum across non ports segments (logistics/marine grew 91/62% YoY) underpin APSEZ’s execution prowess. Profitability across segments was largely maintained, with international ports seeing strong expansion (+900bps YoY). On the back of capacity expansion projects planned at domestic ports, we expect the segment to clock 13% revenue CAGR over FY25-28E. In line with our investment thesis, the improving trajectory of the marine and logistics segments bodes well for APSEZ’s transition from a port operator to an integrated logistics and global infrastructure platform, thereby structurally reducing the cyclicality linked to trade volumes. With inclusion of the NQXT asset, we expect APSEZ to solidify its international presence and replicate its domestic success on the global stage. Factoring in the Q3 beat and the NQXT acquisition, we raise FY27E/28E EBITDA by 6%/7%, respectively, and retain BUY with unchanged Dec-26E TP of Rs1,900 (based on SoTP methodology).

Strong quarter; the non-ports ramp-up continues Overall revenue in Q3 grew 22% YoY to Rs97bn, with growth seen in the ports (+14% YoY) and non-ports (+72% YoY) segments. Logistics revenue grew 62% YoY, as the trucking/IFN business grew 3.5x/15x YoY, while marine revenue grew 91% YoY. Overall EBITDA grew 20% YoY to Rs 58bn and, with strong growth in the low-margin non-ports business, EBITDA margin contracted by 68bps YoY to 59.6%. In the ports business, domestic ports revenue grew 15% YoY, with volume/realization growing 6/9% YoY. Domestic container volumes grew 11% YoY, with the container market share expanding to 45.8% (Q3FY25: 45.4%). Adj PAT grew 23% YoY to Rs33bn.

Outlook and risks With OCF-to-EBITDA consistently above 85% and the inorganic investment phase now behind, APSEZ offers strong cash flow predictability over the next 4-5 years. Expansion in allied businesses like the logistics and marine segments is likely to gradually diversify earnings, reducing cyclicity linked to port volumes, and thus supporting multiple reratings, as outlined in our initiation note. A stable return profile and strong OCF generation should enable further deleveraging (from the existing net debt-to-EBITDA of 1.8x). With visible earnings traction, improving leverage (FY28E net debt-to-EBITDA: 1.3x), and strong return ratios (FY28E RoCE: 17%), we expect revenue/EBITDA/PAT CAGR of 20/20/18% over FY25-28E, and view APSEZ as a core structural compounder in India’s infrastructure/logistics space. Key risks: An adverse event at the group level (leverage, regulatory scrutiny), trade uncertainties triggered by evolving geopolitical risks, rising competitive intensity in the logistics business.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354