Buy Yatharth Hospital & Trauma Care Ltd for the Target Rs. 850 by Choice Institutional Equities

Business Overview:

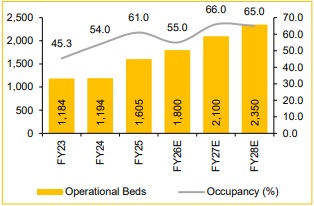

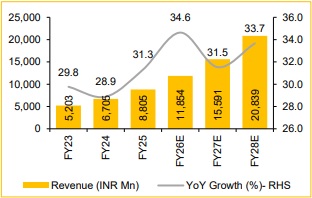

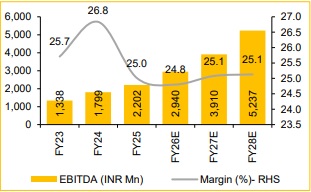

YATHARTH is a leading hospital chain in North India, operating 7 multi-specialty facilities with a strong footprint in the Delhi-NCR region. Since FY21, the company has more than doubled its bed capacity, from 1,100 to 2,300, in FY25, while maintaining a healthy occupancy rate of 65% and reporting an ARPOB of INR 32,395 in Q1FY26. Looking ahead, YATHARTH plans to scale up its capacity to around 3,000 beds by FY28E, largely within Delhi-NCR, targeting revenue growth of ~30% CAGR while sustaining its robust EBITDA Margin of 25%.

Is YATHARTH’s New Delhi and Faridabad Expansion Poised to Transform its Growth Trajectory?

With ~700 new beds across New Delhi and Faridabad, YATHARTH is set for accelerated growth from Q2FY26E. The New Delhi facility started operations in July 2025, while the Faridabad hospital will be inaugurated soon. Both centres are equipped with advanced robotic surgery and oncology infrastructure, alongside super-specialties. Given the fact that Greater Faridabad facility turned profitable within a year, the management expects a a similar ramp-up here. These hospitals will not only lift ARPOB (estimated INR 38,000 vs group average INR 32,395) but also strengthen YATHARTH’s clinical edge in oncology, cardiology and paediatric specialties.

Could YATHARTH Sustain EBITDA Margin amidst Rapid Expansion?

YATHARTH reported a healthy 25% EBITDA Margin in Q1FY26, marking 13 consecutive quarters of profitability growth. With two large hospitals being commissioned, the management expects a short-term drag of ~100 bps, but profitability should normalise by Q4FY26E as occupancy ramps up. Importantly, the turnaround of Greater Faridabad facility into EBITDA-positive status offsets some expansion costs. The company’s strong payer mix strategy further provides a cushion for CAPEX without stressing profitability.

Will Oncology Continue to Lead YATHARTH’s Specialty Growth?

Oncology has emerged as a key revenue driver, now contributing ~10% to the group’s topline, with a remarkable 50% YoY growth. At Noida Extension alone, oncology accounts for 17% of total revenues. With the addition of radiation oncology at both, Faridabad and New Delhi, facilities, the management expects oncology’s share to rise towards 15% over the next 2–3 years. This aligns with YATHARTH’s purposeful push into high-value super-specialties—oncology, neurosciences, cardiology and orthopaedics—backed by recruitment of top-tier consultants. Oncology cases not only enhance ARPOB but also attract international patients, supporting YATHARTH’s medical value travel strategy.

What is the Outlook for YATHARTH’s Brownfield Expansion?

With the Delhi and Faridabad projects nearing completion, YATHARTH is re-focusing on its Brownfield pipeline at Greater Noida and Noida Extension. These projects will add 450 beds (200 in Greater Noida and the remainder in Noida Extension). Construction at Greater Noida has reached the infrastructure stage, while map approvals are being finalised for Noida Extension. Together with Greenfield prospects in Ghaziabad and other NCR cities, YATHARTH plans a CAPEX outlay of INR 14–15 Bn over the next three years

Why Invest in YATHARTH?

YATHARTH is well-placed to capture India’s rising healthcare demand through strategic expansion and stable EBITDA Margin. ARPOB has grown 16% in two years to INR 32,395 in Q1FY26. However, it’s still below the industry’s INR 50,000–75,000 range, thus, offering strong growth potential as brand visibility improves. At 17x EV/EBITDA, the stock offers an attractive long-term play on structural healthcare growth in India.

Near-term Triggers: Operationalisation of two new facilities in July ’25: New Delhi (300+ beds) and Faridabad (400 beds).

Recommendation: We currently have a ‘BUY’ rating on the stock with a target price of INR 850.

Key Risks:

* Competition: The rise of new or well-established competitors in the healthcare sector could erode YATHARTH’s market share and reduce patient inflow, impacting the hospital’s growth and sustainability.

* Operational challenges: The planned expansion of bed capacity to 3,000 beds could pose operational challenges.

Operating beds to increase by 250-350 beds every year

Revenue expected to grow at ~33% CAGR (FY25-28E)

Despite expansion, EBITDA Margin to sustain at ~25%

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131