Buy Amber Enterprises India Ltd For Target Rs.8,269 by Prabhudas Liladhar Capital Ltd

Positioned for multi-segment growth

We interacted with the management of Amber Enterprises to understand its medium - to long-term outlook across Consumer Durables, Electronics and Railways. The RAC industry is likely to stay flattish in FY26, yet the company expects to maintain its 25–28% manufacturing share, aided by rising ODM contributions and growing domestic sourcing by Japanese brands. In Electronics, the acquisition of Shogini strengthens Amber’s PCB capabilities, broadens its customer base, and enhances the overall competitiveness of its PCB vertical, with the combined business this segment is expected to contribute 30–40% over next three years with double digit margin. In Railways, the Rs26bn order book provides visibility, with FY26 expected to be stable However expects to double the revenue in next two financial years.

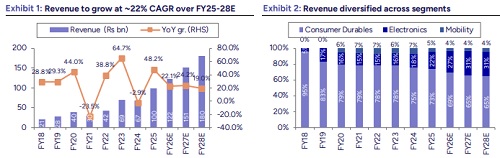

We cut our earnings estimate by 3.1%/3.5% for FY27/28E and Maintained ‘BUY’ rating and SOTP-based TP of Rs8,269 valuing its Consumer Durables segment at 23x EV/EBITDA FY28E, which implies 20x EV/EBITDA FY28E and 40x FY28E earnings on consolidated basis. We estimate revenue/EBITDA/PAT CAGR of 21.8%/26.5%/42.1% over FY25-28E with EBITDA margin expanding by ~90bps to reach 8.6% by FY28E.

Key Takeaways

Consumer Durable division: The RAC industry size in FY25 stood at 15mn units and is expected to remain broadly flattish in FY26, with the industry projected to reach up to 30–35mn units by FY30–31.

* In FY26, the RAC industry underwent three significant changes--energyrating revisions, a reduction in GST rates, and an increase in input prices. The higher energy-rating requirement led to price increases, while the GST cut provided a 1–2% benefit that partially cushioned the impact.

* Input costs have increased due to the energy-rate upgrade, higher compressor and controller prices, and currency depreciation with USD/INR trending above 90. In the inverter AC - Compressors account for 22% of the BOM, controllers comprise about 20-24%, and the remainder is made up of sheet metal, injection molding, copper, and coils.

* Demand saw a temporary dip due to unseasonal rains in October, but has since normalized, aiding improved liquidation of inventory. Despite seasonal fluctuations, industry growth remains supported by structurally low penetration levels of 10–11%.

* Inventory levels currently stand at around 3mn units, (nearly 60–70 days).

* AMBER continues to outperform the industry, driven by its diversified customer base, deeper penetration in both RAC and non-RAC categories, and its strategic shift from gas charging to OEM and subsequently to ODM. Additionally, Japanese brands increasingly adopting India as a manufacturing hub has strengthened the company’s customer pipeline as these brands migrate to locally produced products.

* AMBER to maintain its RAC manufacturing share of 25-28% in future.

Electronics Segment: Amber has acquired an 80% stake in Shogini Technoarts Pvt. Ltd. for Rs 5.1bn, strengthening its position in PCB manufacturing. Shogini operates a dedicated prototyping facility and produces a wide range of PCB types—single-sided, double-sided, multilayer, metal-clad, and flexible PCBs— while exporting to major markets including the USA, UK, Germany, Italy, Hungary, Singapore, and Sri Lanka. The company has a 25-acre land parcel, with only 15–16 acres developed, offering significant room for future expansion.

* Customer mix of Shogini more diversified compared to Ascent, which derives over 75% of its business from the automobile segment, whereas Shogini’s exposure to automotive is limited to 40–45%, with the remaining business spread across power electronics, electronics, telecom and IT, medical, defence, and industrial applications. The acquisition also reduces concentration risk for the PCB vertical, given Shogini’s broader end-market presence compared to Ascent’s heavy dependence on the auto sector.

* The combined scale of Ascent circuits and Shogini enhances procurement efficiencies, improves vendor pricing, and strengthens Amber’s capabilities in bare PCB manufacturing, which typically operates at asset turns of 1.25–1.3x.

* Amber expects its Electronics segment to contribute 30–40% in next three years, with double digit EBITDA margins, supported by scale-up and synergies from Ascent Circuits and Shogini. For FY26 Company guided for 8–9% of margins in electronic segment.

* In the PCB Segment, price of input cost impact the margins of electronic segment in Q2FY26 company will pass through the prices in coming quarters.

* The company has received High-Level Committee (central) approval for its HDI PCB project, while the state-level approval from the UP government is still pending and is expected by Dec–Jan.

* HDI PCB manufacturing qualifies for a 25% central capital subsidy, along with a turnover-linked incentive (TLI) of 23%, which will be disbursed over six years depending on the achievement of threshold revenues. Additionally, the project is eligible for a state government capital subsidy of around 42%, which will be spread over eight years. Subsidy disbursements will begin once commercial production commences and Trial production for HDI is expected in FY28 and for Multilayer phase 1trial production is expected in Q4FY27.

* Capex for Power One and Unitronics remain relatively small at Rs50-100mn each, though Unitronics offers strong growth potential; Amber has increased its stake by 1% and targets eventually reaching 50% via further purchase. Unitronics operates with 20–25% margins and is expected to return to growth after tariff issues last year, with new PLC products already introduced.

* Ascent’s total capex is structured in two phases within a Rs10bn plan—Rs 6.5bn initially, followed by the balance once commercial production ramps up. The HDI PCB project involves a Rs32bn capex over three phases, with Phase I of Rs12bn already planned. Phase II and III will be initiated only after demand visibility improves and customer approvals are secured. Shogini will require Rs200–300mn as a maintenance capex.

* All capex will be fully funded internally through cash generation, subsidies, and previously raised capital. The company has already received the entire Rs17.5bn raised thorough CCPS.

Railway segment:

* The railway business, which includes doors and gangways, has an order book of Rs 26bn as of H1FY26, supported by demand from both Indian Railways and metro projects.

* Amber expects FY26 to remain flattish, however by strong double-digit expansion over the next two years, with margins estimated in the 16–18% range. The segment is targeting a doubling of revenue within the next two years, aided by a meaningful increase in BOM content per trainset, with pantry systems, HVAC, doors, and gangways now part of the company’s offering.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271