Add Campus Activewear Ltd For Target Rs. 315 By JM Financial Services Ltd

Strong all-round performance

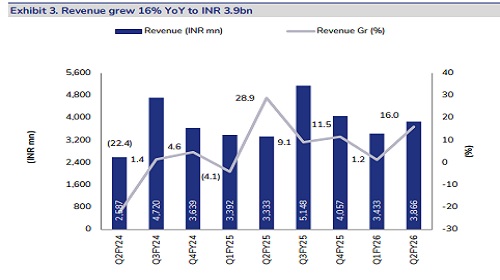

The company reported a healthy all-round performance, beating our estimates on all fronts, with revenue growing 16% YoY to INR 3.9bn (3% beat on our estimates), led by strong offline sales momentum with 20%/35% YoY growth in trade distribution and offline D2C sales. Growth was further supported by the addition of ~200 large format stores, along with contribution from exports and defence sales. EBITDA margin expanded by ~150bps YoY to 12.9% (JMFe: 12.1%), driven by ~100bps gross margin expansion to 53.3% (JMFe: 52.6%), as ASP improved on account of a higher share of premium products priced above INR 1,500 (57% vs. 45% in Q2FY25). The company is undertaking a capex of INR 2.3bn over the next 3 years to become self-sufficient in manufacturing premium sneakers, fully funded through internal accruals. Margins are expected to improve further as the share of these premium products and exports increases in the coming quarters. However, we cut our pre-IND AS EPS estimates by 3–4% to account for higher depreciation and lower other income, given the expected decline in cash balance. We maintain our ADD rating with a revised TP of INR 315 (from INR 310 earlier) as we roll forward to 45x Sep’27 EPS.

* Beat on all fronts: Net revenue increased 16% YoY to INR 3.9bn (3% above JMFe) led by 8% growth in ASP and 7% growth in volume. EBITDA increased 31% YoY to INR 499mn (10% above JMFe) as EBITDA margin expanded by ~145bps YoY to 14.9% (JMFe: 14.1%), driven by ~100bps gross margin expansion to 53.3% (JMFe: 52.6%) and a 55bps decline in other expenses, while employee cost was higher by ~7bps YoY. APAT increased 40% YoY to INR 201mn (8% above JMFe) as other income increased 50% YoY, partially offset by 39% and 25% YoY higher interest and depreciation expenses, respectively. Margins in 2Q are partially impacted by upfront investments towards advertising ahead of the festive season; adjusted for this, normalised EBITDA margin would have been higher by ~200bps.

* Strong offline momentum drives overall growth: Offline channels continued to drive overall growth, with D2C offline and trade distribution revenue rising 35% and 20% YoY, respectively, while D2C online revenue grew 8% YoY. Total volume increased 8% YoY to 5.8mn pairs, and ASP rose 7% YoY to INR 672, supported by the growing share of sneakers, which registered 100% YoY growth. The share of premium products (priced above INR 1,500) increased to 57% vs. 45% in 2QFY25, marking the highest-ever contribution for the company. Demand momentum has sustained in 3Q during the festive season and the management is aspiring to achieve double-digit revenue growth in FY26.

* Capex and supply chain integration: The company is undertaking a total capex of INR 2.3bn over 3 years to strengthen control over its premium footwear supply chain. The plan involves a three-phase factory expansion aimed at making the business self-sufficient in premium uppers and assembly. Of this, INR 0.9bn will be incurred in FY26. Upon completion, the expansion will add an incremental capacity of 6 lakh pairs per month. In addition, a maintenance capex of around INR 0.4bn will continue on an ongoing basis.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361