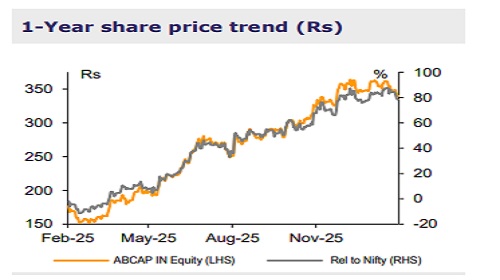

Buy AB Capital Ltd for the Target Rs.400 by Emkay Global Financial Services Ltd

Aditya Birla Capital (ABCAP) posted another strong quarter, with consistent execution across businesses and improving profitability. Lending remained the core driver as the NBFC saw healthy AUM growth of 24%, record disbursements, better asset quality, and gradual lift in margin, keeping it on track for achieving the medium-term RoA expansion target of 2.5%. Housing Finance continued to scale up rapidly, with best-in-class asset quality and rising operating leverage; the Rs27.5bn capital infusion from Advent International materially strengthens the franchise, extending the growth visibility and balance-sheet headroom for the next phase. Other businesses stayed supportive, with strong AMC profitability (Q3 PAT: +12% QoQ), robust growth, and margin expansion in Life Insurance driven by favorable product mix/strong growth, with improving Combined Ratio in Health Insurance. Overall, the quarter reinforces confidence on ABCAP’s diversified model, capital strength, and clearer path to sustained growth/returns, with the HFC deal emerging as a key strategic catalyst. We maintain BUY, with Dec-26E TP of Rs400 (valuing the SA NBFC at 2.5x FY27E P/B and subsidiaries at ~Rs145/sh, after applying 25% holdco discount).

Strong Q3 execution, with improving margins and asset quality ABCAP logged a resilient Q3 with strong growth and better profitability across businesses. Consol PAT rose 41% YoY to Rs9.83bn, on 30% YoY revenue growth. The NBFC business delivered healthy momentum with AUM up 24% YoY and 6% QoQ to Rs1.48trn, RoA improving to 2.25%, and asset quality strengthening as GS2+GS3 declined to 2.8% (down by 23bps QoQ), while credit cost was benign at ~1.23%. NIM improved marginally to 6.12%, though the mix shift toward higher-yielding Personal and Consumer loans and lower funding costs would support margin and RoA expansion ahead. The HFC business continued to outperform, with AUM growth of 58% YoY and 10% QoQ to Rs422.bn, RoA rising to 1.96%, and best-in-class asset quality with Stage 2+3 at 0.95%. This kept it firmly on track to achieving the ~2-2.2% RoA target in coming quarters, further strengthened by the Rs27.5bn capital infusion from Advent International. In Life Insurance, individual APE grew 19% YoY, with VNB margin expanding to ~14.6%, driven by a favorable product mix and rider attachment. Health Insurance saw strong GWP growth of 55% YoY in Q3, along with an improvement in the combined ratio to ~111% (9MFY26). AMC business was steady with PAT up 14% QoQ to Rs2.7bn, supported by 7% QoQ growth in revenue/healthy QAAUM growth. Overall, the quarter reflects consistent execution, strengthening balance sheets, and a clear trajectory toward higher returns.

Positive outlook with improving earnings visibility The outlook remains positive as ABCAP’s diversified platform, strong lending momentum, and improving asset quality support sustained the RoA expansion in the medium term. The HFC business is entering a stronger growth phase, aided by operating leverage and the recent Advent capital infusion, while Life and Health Insurance are scaling up with improving margin and unit economics. With earnings visibility improving and given strengthening of the balance sheet, we remain constructive on the stock. We reiterate BUY with Dec-26E TP of Rs400, valuing the NBFC at 2.5x FY27E P/B and subsidiaries at ~Rs145/sh after a 25% holdco discount

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354