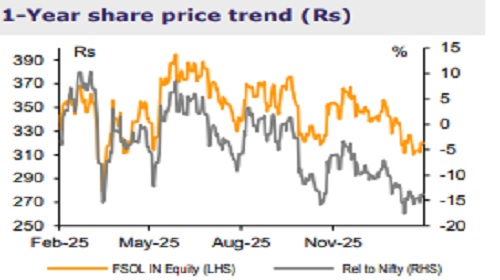

Add Firstsource Solutions Ltd for the Target Rs. 370 by Emkay Global Financial Services Ltd

Firstsource (FSOL)’s Q3 show was a mixed bag – Revenue grew 3.6% QoQ to USD274mn (4.6% CC), below our estimates; EBITM expanded by 40bps QoQ to 11.9%, marking the 5 th consecutive quarter of margin expansion, and slightly ahead of our estimated 11.8%. FSOL signed five large deals (each with ACV exceeding USD5mn) and added 9 new logos in Q3 (including five strategic logos), with 13 large deals signed on YTD basis vs 14 in FY25. The management has given guidance for FY26 CC revenue growth of 14.5-15.5%; 1.5% of this is contributed by PDC and TeleMedik and implies underlying organic growth range of 13-14% vs the earlier 13-15% band. This guidance implies Q4 sequential revenue growth of ~6-9% (with organic growth of ~4% at the lower end of the range). FSOL raised its FY26 EBITM guidance to 11.5-12% (vs 11.25-12%), while aspiring for 14-15% over the next 3-4 years. We cut FY26E EPS by ~9%, factoring in the Q3 performance, while we largely retain FY27/28 estimates. We maintain ADD, keeping our TP unchanged at Rs370, at 24x Dec-27E EPS

Results summary Revenue grew 3.6% QoQ to USD274mn (4.6% CC), below our estimate of USD279mn. The company added 9 new logos (of which 5 are strategic) and won 5 large deals in Q3. EBITM expanded by 40bps QoQ to 11.9%, slightly ahead of our estimate of 11.8%. Net profit came in at Rs1.2bn, below our estimates of Rs1.93bn on account of exceptional items, including i) one-time impact of the new labor code amounting to Rs913.5mn and provision for impairment of investment of Rs87.92mn in the associate. Headcount grew 1.9% QoQ to 36,689, with ~80% of gross hirings from offshore/nearshore. The company declared an interim dividend of Rs5.5/share. What we liked: EBITM beat; healthy deal intake/pipeline, and strong cash conversion (~86% OCF/EBITDA for 9MFY26). What we did not like: Softness in BFS and Healthcare.

Diverse Industries and EMEA lead the pack, assisted by contribution from PDC Revenue growth was driven by diverse industries (37% CC QoQ) and CMT (2%), while growth in BFS and Healthcare was flattish. Among geographies, North America and EMEA grew 1% and 14% QoQ, in CC terms.

M&As aiding growth; PDC integrated in Q3 and TeleMedik to come in Q4 FSOL fully integrated the PDC acquisition in Q3, adding >300 employees, strengthening its UK utilities portfolio with several new and large logos, and contributing ~2pps to the YoY CC revenue growth. The acquisition enhances scale and capability, while supporting the momentum in the Diversified vertical. The TeleMedik acquisition (to be integrated in Q4) in Puerto Rico strengthens the company’s clinical and utilization management capabilities and expands its presence in the US Medicaid market, thus benefiting from Puerto Rico’s structural cost advantage. Collectively, PDC and TeleMedik broaden FSOL’s client footprint and support diversified, acquisition-led growth engines across UK utilities and US healthcare. FSOL revised its FY26 CC revenue growth guidance to 14.5-15.5% (organic likely to be closer to double digits; rest from M&As—Ascensos, PDC, TeleMedik).

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354