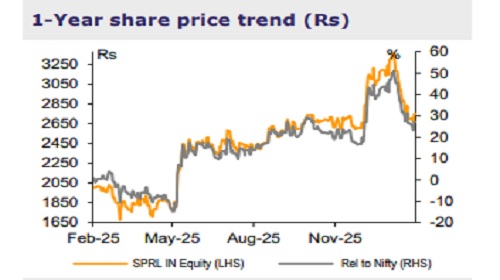

Buy Shriram Pistons & Rings Ltd for the Target Rs.4,650 by Emkay Global Financial Services Ltd

SPRL reported a largely in-line Q3, with consolidated revenue/EBITDA growth accelerating to ~20.7/20.6% YoY, coming in at Rs10.2bn/Rs2.1bn. EBITDAM was robust at 20.1%, outpacing the auto industry’s production growth of 16.3% YoY (PVs+2Ws+CVs) despite some impact from an unfavorable vehicle mix due to GST cutled transition. Standalone performance was also healthy, with 12.4%/9.5% YoY revenue/EBITDA growth and 20.6% EBITDAM. Subsidiaries (C-S) contributed to 15.5% of consol revenue (9.2/14.1% in Q3FY25/Q2FY26), with 17.3% EBITDAM contribution (9.8/16.9% in Q3FY25/Q2FY26). SPRL is seen rapidly scaling up via major businesses won across legacy and emerging products (EV, precision plastic injection molding) over the past 3 quarters; the management reiterated its confidence on sustaining industry-beating growth, led by a diversified portfolio across powertrains and higher focus on emerging ICE tech (including alternative fuels), exports (global piston capacities are being vacated on EV fears, creating supply gaps for SPRL to fill), non-auto (marine, industrial, snow mobiles, lawn mowers, etc), and aftermarket. We continue to favor SPRL within auto ancillaries, given its dominant positioning in core segments, even as it is transitioning into a multi-product player by diversifying into emerging/non-ICE parts (35% of revenue by FY27 vs nil/15% in FY23/25), via strategic acquisitions. We maintain BUY, with unchanged TP of Rs4,650, at 25x Dec27E PER. SPRL trades at 15x Dec-27E PER.

Growth accelerates to over 20% YoY across revenue/EBITDA/adjusted PAT Consolidated revenue grew 20.7% YoY to Rs10.2bn, with consol EBITDA up 20.6% YoY to Rs2.1bn and EBITDAM flattish at 20.1% (lower QoQ by 28bps). Consol adjusted PAT rose 23.6% YoY to Rs1.5bn. Standalone revenue also grew, at 12.4% YoY, with EBITDA up 9.5% YoY and EBITDAM lower by 54bps/35bps YoY/QoQ at 20.6%. SA adj PAT grew 15.2% YoY to Rs1.4bn

Earnings call KTAs 1) The mgmt expects ~12% YoY growth in the standalone business, implying a stronger ~15% growth in Q4FY26, supported by broad-based traction across the OEM, exports, and aftermarket segments. SPRL remains confident about the current demand momentum sustaining through to Q4 and beyond. 2) Several overseas legacy suppliers are vacating capacities, creating incremental opportunities for SPRL. The company intends to continue investing in the legacy portfolio. 3) The acquisition of SLS’s piston assets enhances SPRL’s product portfolio and customer access, thereby expanding the addressable market and strengthening its positioning in high-value applications. 4) The newly commissioned Motors & Controllers plant has commenced operations, with mgmt guidance for 5-7x revenue scale-up in FY26, backed by a healthy order book, new customer additions, and rising export enquiries. 5) Following the integration of piston assets and commissioning of the new Coimbatore facility, SPRL has adequate headroom to cater to incremental demand for 2 quarters at least. 6) The Plastics business (TGPEL and Takahata) is gaining traction, and the plastics and interiors portfolio (via Antolin) is scaling up, led by new customer additions and higher share of business from existing OEMs, supporting diversification beyond core powertrain components. Commodity costs are a pass-through (a one-quarter lag) which helps sustain margins.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354