Buy JK Cement Ltd For Target Rs. 6,900 By Emkay Global Financial Services Ltd

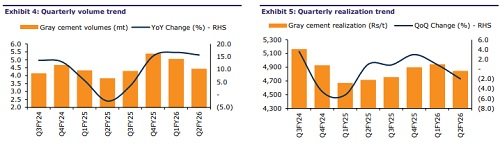

JK Cement (JKCE) reported standalone EBITDA of Rs4.4bn (up 63% YoY, albeit down 35% QoQ), missing our estimate by ~10% due to higher-than-expected operating costs. JKCE continues to improve its market share, as grey cement dispatches grew ~16% YoY (SRCM at ~4%), in the central India and Bihar markets. Lower trade sales, coupled with monsoon-led weak demand, resulted in ~2% sequential (1.4% lower than estimate) drop in grey cement realization. Inflation in unit (RM+P&F) costs and higher expenses on advertising and annual maintenance added to the margin pressure. Consequently, blended EBITDA/t slid to ~Rs900 from Rs1,230 (Emkay: Rs1,040) in Q1FY26. JKCE is on track to commission the 4mtpa Panna clinker line-2 by Dec-25 and Bihar GU (3mtpa) in Q4FY26. The work on Jaisalmer IU has begun and the company targets completion by H1FY28, taking the overall capacity to ~35mtpa.

Looking beyond the weak Q2 results, we continue to repose faith in JKCE’s ability to bounce back, and report profits akin to sector leaders led by best-inclass volume growth and presence in high-yielding markets. However, we take note of the higher costs in Q2 and cut FY26E/27E/28E EBITDA by 3-9%. We continue to value JKCE at 17x EV/EBITDA on Q2FY28E (rolled forward by one quarter), while we cut our TP by ~6% to Rs6,900 (from 7,300); maintain BUY.

Higher operational costs hurt margins

JKCE’s standalone EBITDA at Rs4.4bn was below our estimate (Rs4.9bn). Grey cement volumes were up ~16% YoY (down ~12% QoQ) despite extreme weather in JKCE’s core regions, implying continued market-share gains for the company. However, strong volume growth hurt realizations, as grey cement realization was down 2% QoQ. Meanwhile, standalone non-cement revenue rose 55% YoY (down 5% QoQ) to Rs1.85bn, indicating buoyancy in paint revenues. Blended unit RM + power & fuel costs were up ~6% QoQ, (Rs118/t) likely due to consumption of high-cost fuel (blended fuel consumption cost stood at Rs1.56/mn cal vs Rs1.53 QoQ). Other operating costs increased 11%/16% YoY/QoQ due to higher advertising and maintenance expenses in Q2FY26. Overall, total blended operating costs increased 8% QoQ, resulting in EBITDA/t sliding to Rs900/t from Rs1,230 QoQ levels (Q2FY25: Rs640). Assuming 17% margins in white cement, implied grey cement EBITDA/t stood at ~Rs800 vs Rs500 YoY and Rs1,175 QoQ. The difference between consolidated and standalone EBITDA narrowed to Rs68mn (vs Rs134mn YoY and Rs146mn QoQ), with EBITDA margin at ~4%.

On track to achieve 32/35mtpa by FY26/28, respectively

During Q2FY26, JKCE commissioned a 1mtpa GU at Prayagraj, taking the total installed capacity to >26mtpa. JKCE has started work on the Jaisalmer IU (4/3mtpa clinker/cement, respectively) and aims to commission the project in H1FY28. We estimate capex-spend of Rs50bn in FY26-28E; with healthy cashflow generation (Rs59bn over the same period), we see the balance sheet remaining in the pink (FY28E net debt/EBITDA: 0.7x vs 1.5x in FY25).

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354