Buy Shriram Finance for the Target Rs.1,050 By Emkay Global Financial Services Ltd

The SHFL Board, on Friday, 19-Dec, approved the equity infusion by MUFG Bank. The capital infusion totals Rs396.2bn at Rs840.93/share and took place via the preferential allotment route; it translates into ~20% ownership of MUFG in SHFL, making it near-equal to that of the current promoter group. At present, MUFG is categorized as a Public Shareholder with the power to nominate 2 board members; however, we see this deal as a strategic investment by MUFG, with long-term plans, including increasing its shareholding and becoming the promoter. This large capital infusion (of Rs396bn) by MUFG provides a huge boost to SHFL’s balance sheet (as of Sep-25, networth of Rs604bn) by taking post-infusion networth and SHFL’s tier I capital extremely close to BAF’s and much above that of other non-PSU NBFCs. Pro forma Mar-26 tier 1 ratio for SHFL is likely to increase by ~14ppts to ~34%. The deal has potential to alter SHFL’s growth and profitability trajectory by: 1) a possible rating upgrade on the back of strong capital adequacy and the MUFG association narrowing the ~100bps CoF gap with AAA peers; 2) the improved CoF and stronger balance sheet allowing SHFL to venture into new product and customer segments, accelerating its growth outlook; 3) the MUFG association and stronger balance sheet also enabling it to hire top-level talent for driving new businesses; and 4) its possible transition into a bank, as the large balance sheet, high tier 1 capital, and MUFG association make it a suitable candidate. We have not built these optionalities into our estimates for now, and our FY27-28 estimate changes on account of the equity infusion leading to lower borrowing. We reiterate BUY on SHFL while hauling up our TP (now Dec-26E) by ~24% to Rs1,050 (from Sep26E TP of Rs850 previously), implying Dec-27E P/BV of 2.0x.

Balance sheet boost to prepare for the long-term profitable growth

The deal pushes up SHFL’s tier 1 capital adequacy by ~14% (pro forma Mar-26E basis), making a strong case for a rating upgrade which is also supported by MUFG’s association and commitment. While RoE is likely to drop in the near term due to over-capitalization, the multiple optionalities—including reduction in cost of borrowings, ability to attract toplevel talent, and a possible transition into a bank—catapult SHFL into the next orbit of profitable growth over the medium-to-long term. Such various benefits and optionalities accruing from the deal far outweigh the near-term moderation in RoE and reinforce our constructive view on the stock.

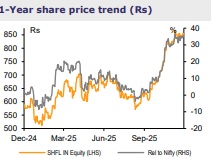

We reiterate BUY while revising up Dec-26E TP to Rs1,050 from Rs850

We are not building in the optionalities likely to play out for SHFL over the medium term, and our FY27-28 estimates are largely changing owing to the capital infusion driving down the interest cost. This leads to FY27E/FY28E BVPS increasing 24%/20%, respectively. We reiterate BUY on the stock, while raising our TP (now Dec-26E) by 23.5% to Rs1,050 (from Sep-26E TP of Rs850), implying Dec-27E P/B of 2.0x.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354