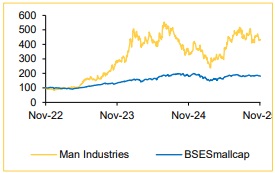

Buy Man Industries Ltd. For Target Rs. 600 By Choice Broking Ltd

Visibility of Profitability Improving as Growth Drivers Crystallise

We reiterate our BUY rating on Man Industries Ltd. (MAN) with a revised target price of INR 600/share (earlier INR 480/share). Our positive stance is underpinned by the following key drivers:

1) Capacity-led growth visibility: Ramp-up of the upcoming 20 KT stainless steel pipes facility in Jammu (project cost: INR 5.9Bn) and the 300 KT H-SAW pipes plant in Saudi Arabia (project cost: INR 6.3Bn) is expected to meaningfully augment revenues from FY27E.

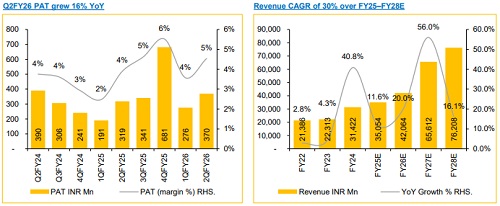

2) Strong earnings trajectory: We build in Revenue/EBITDA/PAT CAGR of 30/59/73% over FY25–28E, supported by an order book of INR 47.5Bn and a healthy bid pipeline of INR 150Bn, providing multi-year visibility.

3) Balance sheet upside from non-core asset monetisation: Monetisation of Navi Mumbai land parcel is likely to generate ~INR 7.5Bn in cash inflows over the next 5–6 years, equivalent to ~25% of the current market cap-strengthening liquidity and funding growth capex.

4) Margin expansion catalysts: We forecast ~728 bps EBITDA margin improvement over FY25–28E, driven by a higher mix of value-added products, scale benefits from increased capacity utilisation at existing and new plants and overall operating leverage gains.

Valuation: We arrive at a 1-year forward target price (TP) of INR 600/share for MAN. We now value MAN using our EV/CE (Enterprise Value / Capital Employed) framework, assigning an EV/CE multiple of 1.3x for FY27E/FY28E. We consider these multiples conservative given MAN’s strong ROCE trajectory, even under reasonable operating assumptions. Our valuation approach provides the flexibility to calibrate the multiple based on an objective and quantifiable assessment of the company’s forward financial performance. As a sanity check, we cross-validated our EV/CE-derived TP with implied trading multiple. At our TP of INR 600/share, the implied FY28E valuation translates to EVEBITDA/PB/PE 3.9/1.3/5.7x. This implied multiple reinforces the conservatism embedded in our valuation and support our positive view on MAN.

Risks: Potential slowdown in conversion of bid pipeline into order book and possibly slow ramp-up of upcoming capacities are risks to our BUY rating.

Recent Sebi order and subsequent SAT stay: SEBI issued a two-year market access ban (dated: 30th Sep'25) and monetary penalties on MAN and key executives linked to non-consolidation of a subsidiary. The company appealed the order before the Securities Appellate Tribunal (SAT). SAT on 10th Oct’25, granted an interim stay on SEBI’s directives, conditional on depositing 50% of the penalty. The matter is now under adjudication, with the SEBI order kept in abeyance until final disposal.

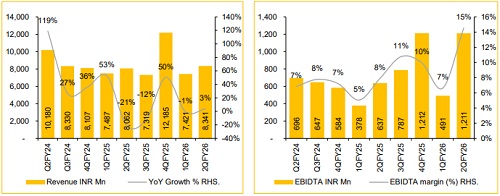

Q2FY26: Stronger-than-expected EBITDA Driven by Favourable Sales Mix

* Revenue: INR 8.34Bn, up 3.5/12.4% YoY/QoQ, below CIE est. INR 9.27Bn.

* EBITDA: INR 1,211Mn, up 90/146% YoY/QoQ, above CIE est. INR 738Mn; EBITDA margin expanded 661/790 bps YoY/QoQ to 14.5%.

* PAT: INR 370Mn, up 16.1/33.9% YoY/QoQ, versus CIE est. INR 454Mn; PAT margin stood at 4.4%, up 48/71 bps YoY/QoQ.

* Order Book: Robust at INR 47.5Bn.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131