Buy VRL Logistics Ltd for the Target Rs. 350 by Motilal Oswal Financial Services Ltd

Focus to remain on profitable growth; recent reduction in GST to support volumes

We hosted VRL Logistics (VRLL) for a Non-Deal Roadshow (NDR). Following are the key highlights:

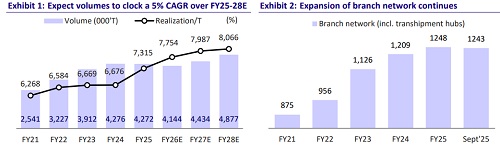

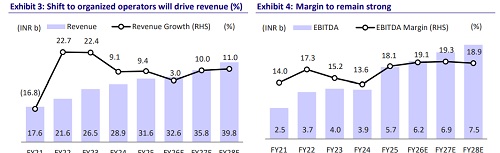

* VRLL continues to perform well, with management guiding for revenue growth of ~4-5% in FY26, driven by disciplined pricing and a sustained focus on profitability, despite lower volumes following its strategic exit from lowmargin contracts.

* VRLL expects EBITDA margins to normalize to ~19%, reflecting higher administrative expenses (including professional and legal fees) and salary revisions effective from Aug’25. Margin stability is expected to be supported by improving tonnage growth.

* In 1HFY26, volumes declined by an average of ~12%, while realization per ton improved by ~14%, supporting profitability over pure volume growth. Moreover, volumes have started to recover, growing 4% QoQ in 2QFY26, supported by a strong festive season and GST rate cut. Management expects further growth, driven by increasing tonnage from existing customers and the onboarding of additional clients.

* Industry growth is expected to remain strong, with E-way bill generation and FASTag collections rising ~17% and ~13%, respectively, in Oct–Nov’25.

* Moreover, VRLL continues to benefit from a net reduction of two branches in 2Q (nine opened, seven closed), part of its strategy to shut underperforming or low-utilization locations. While the company continues to explore expansion in the eastern and northeastern regions, branch rollout remains cautious and linked to business stability.

* VRLL will remain focused on sustaining high margins, aided by disciplined cost control, improved fuel procurement practices, and lower reliance on hired vehicles, while maintaining its focus on volume growth. Recent GST reductions across key commodities are expected to support consumption recovery and drive an improved volume trajectory going forward. We expect VRLL to clock a 5% volume growth and a revenue/EBITDA/PAT CAGR of 8%/9%/16% over FY25-28E. Reiterate BUY with a TP of INR350 (based on 22x FY28E EPS).

Volume recovery focus; strong festive spillover and GST reduction to support volumes

* VRLL will focus on accelerating volume growth by undertaking massmarketing initiatives across both existing and newly opened branches, while simultaneously identifying and securing profitable freight contracts to drive sustainable and profitable expansion.

* VRLL witnessed an improvement in volumes, driven by a strong festive season and consumption uplift following the GST rate cut, with some spillover reflected in Oct’25.

* The GST on logistics services provided by VRLL is expected to remain unchanged, as the company is already availing 5% GST with no input tax credit.

Prudent branch optimization strategy continues

* A net reduction of two branches was recorded in 2Q (nine opened, seven closed) as part of its strategy to shut underperforming or low-utilization locations.

* While VRLL continues to explore expansion in the eastern and northeastern regions, branch rollout remains cautious and linked to business stability.

* Further, the company acquired property in Bengaluru worth INR2.3b, funded by INR1.9b in debt. This acquisition is expected to reduce rental costs by ~INR150m and generate third-party rental income of INR15m annually.

Superior cash flow discipline supported by streamlined fleet management

* VRLL maintains one of the lowest customer concentration risks in the industry, with minimal dependence on large accounts (top 10 contribute 3% and the top 3 just 1%). Its disciplined collection mechanism ensures strong cash flows, with ~70% freight realized at delivery, ~15% at booking, and limited credit exposure to select contractual clients. This supports industry-leading metrics, such as 12 days of receivables and 0.02% bad-debt provision, underscoring VRLL’s strong efficiency and risk management.

* VRLL is currently one of the largest fleet owners of commercial vehicles in the country (with 5,782 trucks having a total capacity of 77,284 tons as of Sept’25). Net vehicles declined by 376 YoY, reflecting improved asset utilization and selective scrapping of high-maintenance vehicles.

* Further, the company has an in-house fleet maintenance facility with a tie-up for spare parts and an in-house scrapyard for disposing of the old fleet, which helps in controlling overhead costs.

Valuation and view

* VRLL is well-positioned for long-term growth, supported by its strategic focus on volume, profitable contracts, operational efficiency, and strong service reliability.

* While near-term headwinds persist, VRLL’s approach to scaling volumes, supported by the GST reduction and a stable pricing strategy, positions it to benefit from structural growth in India’s organized surface logistics sector. We expect VRLL to clock 5% volume growth and a revenue/EBITDA/PAT CAGR of 8%/9%/16% over FY25-28. Reiterate BUY with a TP of INR350 (based on 22x FY28E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)