Neutral Prudent Corporate Advisory Ltd For Target Rs.2,200 by Motilal Oswal Financial Services Ltd

Strong revenue growth in MF business

* Prudent reported operating revenue of INR2.9b, +36% YoY (in line) in 3QFY25, driven by 36% YoY growth in commission and fees income to INR2.8b. For 9MFY25, operating revenue rose 45% YoY to INR8.2b.

* EBITDA grew 32% YoY to INR659m (6% miss), with EBITDA margin of 23.1% (vs. 23.8% in 3QFY24 and 24.0% in 2QFY25). Operating expenses increased by 37% YoY to INR2.2b (in line), led by 49%/25% YoY growth in commission & fees expenses/ employee expenses.

* PAT rose 35% YoY to INR482m in 3QFY25 (8% miss). For 9MFY25, PAT increased 53% YoY to INR1.4b.

* Management guided for revenue growth of ~25% for the non-MF segments and 12-14% YoY growth in overall operating costs.

* We have cut our earnings estimates by 5%/10%/13% for FY25/26/27 due to a decline in blended yields and lower growth in the non-MF businesses. However, we expect Prudent to deliver a CAGR of 28%/29%/32% in revenue/EBITDA/PAT over FY24-27E, fueled by growing MF AUM and focus on increasing the share of non-MF business in the overall mix. The company is expected to maintain RoE of 30%+ for FY25/FY26/FY27. We reiterate our Neutral rating on the stock with a TP of INR2,200 (based on 33x EPS Sep’26E).

Revenue from Non-MF segments guided to grow 25% YoY

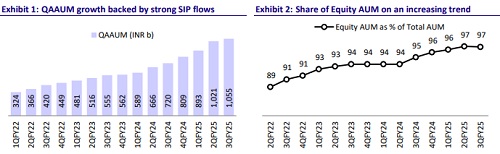

* QAAUM stood at INR1.1t, up 47% YoY. The monthly SIP flow grew to INR9.4b (from INR6.5b in 3QFY24) and management expects the flow to touch INR10b by Mar’25 on the back of a strong retail base.

* Total premium for the quarter came in at INR1.5b, of which life insurance premium stood at INR1.2b and general insurance premium stood at INR372m.

* Commission and fees income for the quarter rose 36% YoY to INR2.8b, of which INR2.4b and INR286m were contributed by the distribution of MF products and insurance products, respectively.

* Revenue from distribution of MF reported strong growth of 46% due to strong SIP inflows and active participation from MFDs.

* Revenue from the sale of insurance products dropped 4% YoY on account of a fall in the life insurance premium, led by the implementation of surrender charges regulations. Management expects a slowdown in the Life segment to continue and targets to build a strong health premium book.

* Revenue from the stock broking segment fell 20% YoY mainly due to reduced market activity amid weak sentiment. Management guides for the revenue contribution to remain stable at 3-4% and has recently introduced a margin trading facility to boost volumes.

* Revenue from other financial and non-financial products remained flat YoY due to the discontinuation of P2P product flows since Aug’24 (RBI regulations); however, it is expected to pick up on the back of healthy growth in the AIF/PMS/FD segments.

* Other income for 3QFY25/9MFY25 rose 46%/60% YoY to INR66m (6% miss)/INR214m.

* Fee and commission expenses grew 49% YoY to INR1.7b on account of an increase in the pay-out ratio to 64.6% from 63.4%. An additional provision of ~INR30m was included in 3Q expenses for higher net sales done by MFDs.

* While SIP market share on overall basis has been declining, its market share, excluding direct SIPs, has been rising. The company has guided for a stable improvement in market share within the regular category.

Key takeaways from the management commentary

* The blended yield in the insurance segment declined due to the impact of surrender charges, a fall in insurance premium and a shift in the product mix toward ULIPs (at 15%).

* AIF/PMS and FD segments witnessed strong growth, with average PMS/AIF in 9MFY25 doubling to INR10.6b from INR6.1b in FY24. This strong growth is expected to more than compensate for the decline in P2P.

* Management stated that any commission cuts done by the AMC will be passed on to distributors, and thus, it will not impact net margins of Prudent.

Valuation and view

* We expect the revenue growth momentum to be sustained in the medium to long term, primarily because of the following reasons: 1) increasing MF AUM mainly driven by improving SIP participation, and 2) focus on a one-stop-shop solution, which should result in an increase in distribution revenue from highermargin products such as insurance.

* We have cut our earnings estimates by 5%/10%/13% for FY25/26/27 due to a decline in blended yields and lower growth in the non-MF businesses. However, we expect Prudent to deliver a CAGR of 28%/29%/32% in revenue/EBITDA/PAT over FY24-27E, fueled by growing MF AUM and focus on increasing the share of non-MF business in the overall mix. The company is expected to maintain RoE of 30%+ for FY25/FY26/FY27. We reiterate our Neutral rating on the stock with a TP of INR2,200 (based on 33x EPS Sep’26E).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412